Air Canada (TSX:AC) has been one of the most popular stocks in Canada since the pandemic began. Trading at roughly $50 a share, the stock plummeted when the pandemic impacted operations by over 80%.

Initially, the stock fell as low as $10, which was a significant discount. Some investors who happened to buy that low have made money. However, for investors who have been hoping for a recovery, that’s never quite materialized.

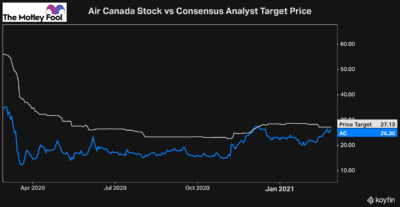

Today, the stock trades at $26, roughly 50% down from its pre-pandemic price of $50. And while many investors are hoping for the stock to recover to that price, it looks like it could be years before that becomes a reality.

Today, that consensus analyst target price is just over $27. So, with the stock trading at $26, Air Canada stock is close to its fair value. The analyst target price could always increase. At the moment, though, the situation isn’t getting any better.

With new government restrictions on traveling and a halt on all planes flying to the Caribbean, Air Canada’s business could be impacted for even longer. Plus, a delay in Canada’s vaccination schedule compared to the U.S. and other European countries could hurt the business even further.

The stock will have to rebound at some time. The question is, when and how much value will shareholders lose until then? That’s what makes investing in Air Canada today so tricky.

However, at a certain price, it has to offer value. So, what price makes Air Canada stock a buy?

What price makes Air Canada stock a buy?

When looking at an investment in Air Canada, the price is not the most important consideration. Instead, you have to decide how much risk you’re comfortable taking on.

The less risk you feel comfortable with, the lower the ultimate price Air Canada stock will be worth a buy for you. That’s because in the current environment, and with all the uncertainty, it’s challenging to put a target on the stock.

With analysts’ estimates of below $30 fair value today, investors should want a significant discount before considering the stock.

Looking at the last three months, there seems to be support at $20. This means unless some major negative developments materialize, the stock likely won’t fall below $20. Investors see value at this price, which is why there is strong support at these price levels.

One caveat is that if the situation worsens and analysts downgrade the stock, it will obviously get cheaper. So, this price will no longer be as attractive and could end up being the new fair-value price.

So, with less than a $30 target price, buying Air Canada stock at $20 is taking on quite a bit of risk for that potential return. While investors expect a recovery from here, what you may want to do is wait for more certainty.

At that point, it might become more clear what Air Canada’s path back to a $50 share price will be. For now, though, with minimal upside, it’s not worth an investment unless it falls below $20 a share.

Bottom line

There’s no doubt that investors in Air Canada have a tonne of potential to make money. What’s less clear is when this may materialize and exactly how much potential Air Canada investors have.

With several significant risks and no clear path back to $50 a share, Air Canada is not a terrible stock. However, several Canadian stocks are much better investments today.