Last week, the TSX Venture exchange released its TSX Venture 50 ranking for 2021. The TSX Venture 50 is a yearly ranking compiled by the exchange highlighting the top 50 Canadian stocks of the past year.

Since the TSX venture is an exchange for up-and-coming businesses, investors can often find some of the highest-potential growth stocks. So, every year, when the TSX Venture releases its top 50 ranking, it’s like a shortcut to some of the best up-and-coming Canadian stocks.

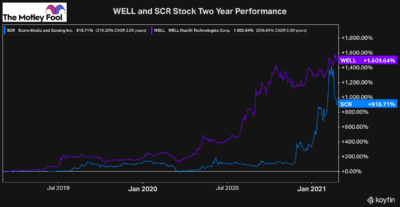

Last year, some of the stocks that appeared on the list are now well known among Canadian investors. Stocks like WELL Health Technologies and Score Media And Gaming have been on the list in the past.

These stocks have since graduated to the TSX and, in just the last two years, have grown in value by over 1,500% and 900%, respectively.

The growth these stocks are capable of us is incredible. Often, as you can see from the charts, the stocks take off with little notice. That’s why it’s key, when you find a high-quality business you’re confident in for the long run, that you take a position. You never know when the stock could return you upwards of 1,000%.

With that in mind, here are three of the top Canadian stocks that made the 2021 TSX Venture 50 list.

A top Canadian EV stock

The first high-potential Canadian growth stock to consider is GreenPower Motor Company (TSXV:GPV). GreenPower is a Canadian electric bus maker. The company was founded in 2010 to improve the technology in battery-powered busses and trucks to make them more efficient and more affordable.

This is a massive industry with huge potential, so it’s no wonder why GPV is one of the best-performing Canadian stocks over the past 12 months.

The stock is up just shy of 1,200% over the last year and continues to see more momentum as it signs new deals. Just recently, GPV made a deal to supply a subsidiary of Warren Buffett.

The future looks bright for GPV, especially considering it has so much potential, yet it is only worth roughly $650 million. So, if you’re looking for a top long-term Canadian growth stock to buy today, GPV is among the best of the best.

A Canadian Bitcoin miner

In addition to GPV stock, another incredible Canadian growth stock over the last year has been BitFarms (TSXV:BITF).

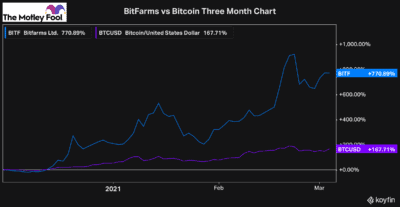

BitFarms is a rapidly growing Bitcoin miner that’s seen major growth recently. As most investors know by now, the price of Bitcoin has skyrocketed over the last six months. This has led many companies in the Bitcoin space to see major rallies in their share prices.

BitFarms is highly leveraged to the price of Bitcoin. While the cryptocurrency is up 164% over the last three months, BitFarms is up 770%.

This significant leverage works the other way, too, though. If Bitcoin were to selloff consistently, BitFarms would surely tank much more than the coin itself.

There’s another risk to Bitcoin mining, and that’s the fact that it is a highly competitive business. Miners continuously have to improve their computing power to stay competitive, making it an extremely high-risk business.

So, although these Canadian stocks offer a lot of potential, they can be quite dangerous. This makes it crucial that investors take a long-term approach and stay up to date with any developments in BitFarms’s operations.

Canadian green energy stock

Lastly is one of the top green energy stocks you can buy today, which just recently graduated from the Venture exchange after an incredible run. Xebec Adsorption (TSX:XBC) is a rapidly growing clean technology company.

The business makes industrial products it sells to customers to help manage carbon emissions. Its equipment can trap naturally occurring raw gasses and transform them into renewable natural gas or hydrogen. This is a rapidly growing industry, and Xebec’s technology is some of the best.

In addition to the natural growth, Xebec has also been acquiring plenty of businesses that it sees natural synergies with. This should help improve its technology and grow its sales, making Xebec a top Canadian stock to own for decades.

The business has an incredible run in 2020 but has since sold off rather significantly. Today, it’s once again offering investors an incredible opportunity to gain exposure.

Don't Miss AI's Third Wave

Don't Miss AI's Third Wave