This past weekend Warren Buffett released his letter to shareholders along with his fourth-quarter earnings. Whenever Warren Buffett reports earnings, and especially when he writes his letters to shareholders, investors listen.

Often investors are looking to see which stocks he bought and which he sold in the quarter. It’s also crucial to read his commentary on the current market environment.

This helps investors get a good idea of how Buffett sees the markets, which stocks he likes that he’s buying, and which he doesn’t that he’s selling.

However, it’s also a good idea to look at the size of his cash pile and what he intends to do with it.

Warren Buffett’s cash pile has been growing for years. The Oracle of Omaha has let it build up in the past, except he’s usually had the opportunity to spend it by now.

This time around, he continues to build it up as he sees no real acquisition potential, mostly due to lofty valuations in markets. It’s been years since Buffett made a major acquisition, and he continues to remain patient.

However, the one thing he has signaled is more share buybacks of his own stock Berkshire Hathaway.

In the past, when Buffett was hoarding cash, investors would take this as a warning sign. However, these days, while markets are certainly at lofty valuations, it’s not that surprising to see.

So we shouldn’t ignore that he doesn’t see value. It’s definitely worthwhile to keep in the back of your mind.

What does Warren Buffett’s lack of acquisitions say about markets today?

Buffett going this long without making a major acquisition is notable. However, it’s not a major risk. It just means that he and his company can’t find value today.

Surprisingly, retail investors have a lot more options than Buffett because the sheer size of his firm makes investments in small and medium-sized businesses effectively pointless.

So just because Warren Buffett has a hard time finding a large enough company to buy that he sees value in doesn’t mean there aren’t a tonne of stocks offering retail investors incredible opportunities. Here’s a top Canadian stock perfect for long-term investors today.

A top Canadian stock to buy in this environment

One of the best stocks for investors to buy today is Corus Entertainment Inc (TSX:CJR.B). Corus has been a top value stock worth a buy since last summer.

The stock was in turnaround mode when the coronavirus pandemic hit. Yet, throughout the last year, the stock’s operations have been robust, and it’s increased its financial position considerably.

Despite everything going on with the pandemic, Corus continues to execute and turn its business around, creating major value for shareholders. This makes it the perfect stock for retail investors, even though it’s too small of a company for Warren Buffett to own.

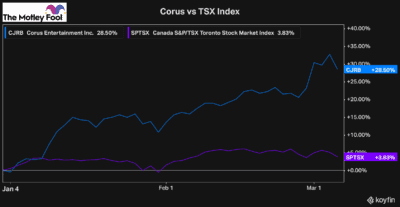

The stock has been rallying consistently as investors continue to see value in Corus.

As you can see, the stock has had an incredible start to the year, despite volatility from the broader market. This makes Corus the perfect stock to buy today, especially considering it’s still well undervalued.

Bottom line

It’s still helpful to watch what Warren Buffett is doing and listening to his commentary on the current market environment. However, just because he isn’t making any major acquisitions doesn’t mean there isn’t a tonne of stocks offering incredible value for investors today.