Natural gas prices like oil prices are soaring. The reasons behind the strength in natural gas are similar to those behind the strength in oil. For example, years of reduced capital investment has reduced supply. Also, the worse days of the coronavirus pandemic are behind us. This means demand is starting to rise. So in this environment, natural gas stocks are finally seeing some strength. Peyto Exploration and Development Corp. (TSX:PEY) and Birchcliff Energy Ltd. (TSX:BIR) are two prime examples.

Since the summer of 2020, natural gas prices have risen approximately 50%. There’s a long-term bullish story for natural gas. In fact, the market is beginning to price this in. Natural gas will be the transition fuel in our quest for clean energy. This is because it’s still the cheapest and most abundant fuel source. And it’s not as dirty as many alternatives. Simply put, it’ll be needed for decades to come. There seems to be a growing realization of these facts.

Without further ado, here are the two natural gas stocks to buy now for big gains.

A natural gas stock for growth

Birchcliff Energy is a natural gas producer based in prolific basins in Western Canada. Its production is heavily weighted toward natural gas, at an almost 80% weighting, leaving Birchcliff with significant exposure to these rapidly rising natural gas prices.

Birchcliff is a relatively small exploration company with a market capitalization of almost $800 million. Its size and its focus mean that it doesn’t benefit from diversification across areas or commodities, which makes the stock more volatile than an energy stocks like Suncor. When energy stocks are falling that’s a bad thing. But when the tide is up, this is a really good thing. The price of natural gas is rising. These are the good times.

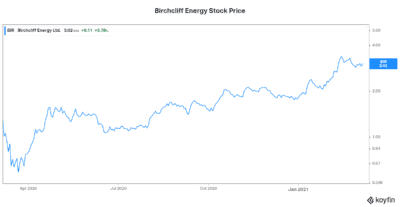

To illustrate this, let’s look at Birchcliff Energy stock’s performance in the last year. Birchcliff’s stock price has soared over 60% in 2021. And it’s skyrocketed almost 400% versus one year ago. This is the torque that you can get with this type of stock. While it’s not for the faint of heart, it definitely has a time and place in today’s bullish oil and gas environment.

A top tier natural gas stock

Peyto Exploration and Development Corp. is one the lowest cost natural gas producers in Canada. In a time of rising natural gas prices, this means more money flowing to the bottom line. In fact, Peyto’s history of strong capital efficiencies will ensure that it benefits fully from this rise in prices. Also, it has always been a shining example of capital discipline in an industry that too often lacks it.

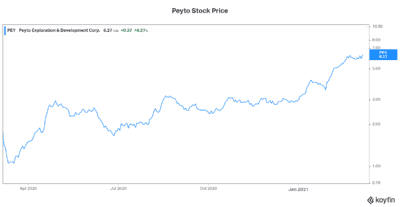

With a market capitalization of almost $1 billion, Peyto is another high torque natural gas stock. It fell hard in the last few years. Nevertheless, I’m interested in the flip side. Now that the tide is turning, Peyto stock is rising fast. It has more than doubled so far in 2021. And it’s up more than 300% in the last year.

Peyto’s fourth quarter 2020 results are a glimpse of what 2021 may hold. Falling costs and rapidly rising earnings and cash flows are set to continue. Peyto’s stock price will benefit from this as natural gas prices should continue to rise.

The bottom line

Natural gas prices have risen dramatically in the last year. With this, natural gas stocks have finally begun to show life again. Birchcliff Energy stock and Peyto stock are both heavily weighted to natural gas. They are smaller energy companies that have big sensitivity to rising natural gas prices. Consider buying them today for some added torque in your investment portfolio.