Market corrections are difficult for everyone. They’re simply very stressful. But we can’t let that stress get the better of us. That’s why I would like to talk about the importance of a well-devised strategy in case of a market correction. We need to know what the best stocks to buy now are to protect ourselves. It can ensure that we make good financial decisions through the chaos.

Some of us believe that the risk of a market correction is high at this time. The S&P/TSX Composite Index is at all-time highs. Yet the economic hit of the pandemic is real. So, it seems that the market has shrugged it off. Why? Well, fiscal and monetary stimulus has made this possible. But what are the long-term ramifications of this? Well, for starters is inflation, to be followed by higher interest rates. In fact, these would be very damaging to economic growth. And the risk of them rearing their ugly heads is real.

Without further ado, here are three stocks to buy to protect ourselves from the possibility of a market correction.

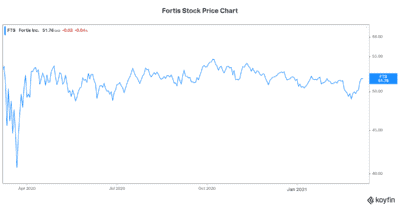

Fortis stock: The ultimate protection in a market correction

Fortis (TSX:FTS)(NYSE:FTS) is a leader in the regulated gas and electric utility industry in North America. This is a business that is highly defensive. This means that cash flows are highly predictable and highly resilient.

Fortis stock offers true protection in a market correction. Its defensiveness will limit its downside. Furthermore, its dividend yield of 5% will ensure a steady stream of income to shareholders. Fortis has a history of 47 consecutive years of dividend growth. Looking ahead, Fortis has committed to grow dividends by 6% annually through 2025. This is as good as it gets.

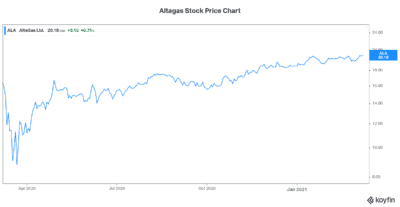

AltaGas stock: The defensive growth stock

Defensiveness plus growth seems contradictory, but the reality is that two characteristics can exist together. In fact, this is the case with AltaGas (TSX:ALA) stock. AltaGas is a diversified energy infrastructure company. 60% of the company’s EBITDA is derived from its highly defensive utilities business. And the rest of it is from its midstream business.

Today, AltaGas stock is soaring and is up almost 30% versus last year.

But the important point here is that this momentum has only just begun. AltaGas is clearly doing many things right. This will shelter it from a market correction. Also, this is resulting in huge amounts of shareholder value creation. For example, AltaGas’s utilities segment is benefitting from rate base growth and lower operating costs. Also, AltaGas is benefitting from its midstream assets. These assets are located in some of the fastest-growing markets in North America, including the Montney and Marcellus/Utica basins. And lastly, AltaGas’s propane export facility is posting +20% growth in volumes, as Asian propane demand is soaring.

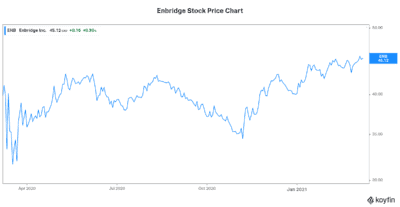

Enbridge stock: The value stock to survive a market crash

Enbridge (TSX:ENB)(NYSE:ENB) stock has been down and out for a while now. It’s been struggling under a dark cloud of political and environmental group opposition. However, the company remains as essential today as it always was. It remains as profitable as well, if not more. This has resulted in a truly undervalued stock that’s looking good today.

Enbridge stock has a 7.4% dividend yield. This is matched only by its long history of reliable and growing dividends. In the last five years, Enbridge’s dividend has grown at a compound annual growth rate of 8.85%. Let me remind you, this was a period when the price of oil was extremely volatile. But Enbridge continued to chug along, happily growing its cash flow and increasing its dividend, and keeping shareholders happy.

Motley Fool: The bottom line

Whether a market correction is coming or not, there are certain stocks that you can’t go wrong with. Fortis stock, Enbridge stock, and AltaGas stock are all top stocks. They’ll protect your money in a market correction. And they’ll provide a consistent and generous stream of income.

Act Fast: 75 Only!

Act Fast: 75 Only!