Bitcoin’s price hit a new all-time high of USD 61,556.59 over the weekend. However, the cryptocurrency traded 5% lower on Monday, but Bitcoin mining stocks had a positive start to the week. Hive Blockchain (TSXV:HIVE) stock opened 1.5% higher while its Canadian peer Hut 8 Mining (TSX:HUT) traded nearly 7% up on Monday morning.

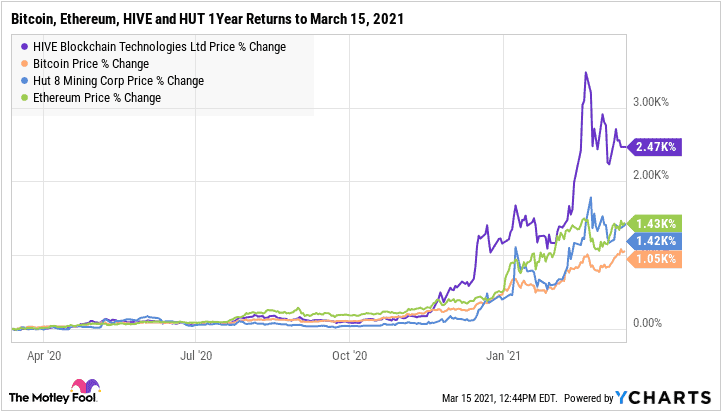

Although the crypto asset’s price has soared over 1,050% in the past twelve months, investors in Bitcoin mining stocks have enjoyed higher and more awesome returns during the same period.

The two Bitcoin mining stocks outperformed the super coin over the past year. Perhaps they could offer more upside if the cryptocurrency surges, but which among them could provide better upside in 2021?

Let’s take a quick look.

A Bitcoin miner with diversified crypto exposure

Hive Blockchain is one of the early Bitcoin mining stocks to grace the TSXV. Once affiliated with a technical partner, the company self manages its operations now. Hive owns and operates three data centres located in Sweden, Iceland, and Quebec.

One important factor to consider before buying Hive Blockchain stock is its mining focus. The company’s facilities in Sweden and Iceland both produce Ethereum. Only the recently acquired 226 Peta Hash per second (PH/s) data center in Canada is dedicated to Bitcoin mining. Moreover, a quarter of the Quebec facility’s capacity is leased to an institutional client.

Hive Blockchain’s stock price outperformed peers in 2020 mostly as a result of its Ethereum assets. Ethereum performed better during the past year. However, if you are more bullish on Bitcoin long-term, or desire pure exposure to Bitcoin mining assets, then HIVE may not be the ideal Bitcoin mining stock to add to your portfolio right now.

That said, should Ethereum prove to be more stable and resilient than Bitcoin in the future, for any reason, Hive’s diversification may become handy and absorb valuation shocks and volatility. Further, management is investigating artificial intelligence and graphic rendering as well as private blockchain computing at its two foreign-dased data centres. More diversification is coming.

More capacity and highly focused

Hut 8 Mining is a Toronto-headquartered Bitcoin mining firm that has risen to become a leading industry powerhouse as it recently surpassed the One Quintillion hashes per second (1 Exa Hash per second) mining capacity this year, giving it over four-times HIVE’s bitcoin mining capacity. The company is laser-focused on mining Bitcoins only and had 3,012 Bitcoins in its wallets by February 21 this year.

Hut 8 recently reported that it is hashing (mining) at a rate of 6.8 bitcoins per day. At the current bitcoin price of US$56,667 (at CoinDesk exchange), that would amount to over US$385,300 per day, or nearly US$35 million (C$43.8 million) in gross revenue per quarter.

Of course, I am not expecting the HUT to report that much revenue this quarter as returns fluctuate daily. Given that it generated just C$5.75 million in revenue for the third quarter of 2020, the potential revenue surge is huge. No wonder the Bitcoin mining stock is currently outperforming HIVE daily these days.

Hut 8 will release its earnings results for the last quarter of 2020 on March 25. Analysts expect fourth-quarter revenue to rise 58% sequentially to $9.1 million before hitting $23 million for this quarter. That’s serious growth, much of which is already priced into the stock.

Which is the better Bitcoin mining stock?

As far as valuation is concerned, shares in HUT trade at a trailing 12-month enterprise value to revenue (EV/Rev) multiple of 29 today. The company’s December 2020 numbers aren’t in yet. Hive Blockchain’s comparable multiple is more expensive at 37. This includes better numbers for December 2020. Hut 8 stock looks cheaper.

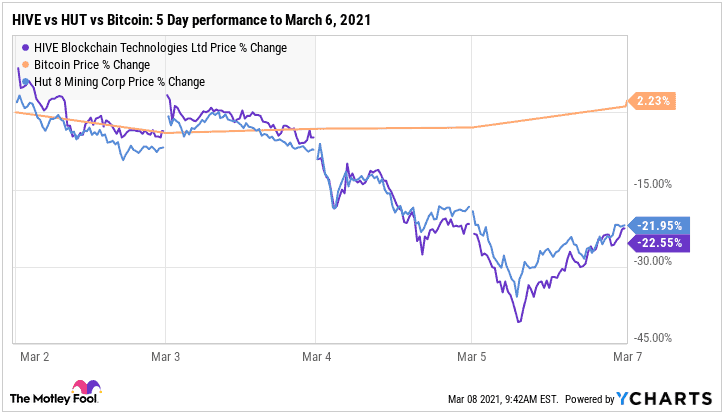

While Hut 8 is a pure Bitcoin mining stock, Hive adds some diversification into Ethereum economics, and the results were awesome in 2020. However, both stocks sometimes trade in similar fashion, as was witnessed in the first week of March. There were no diversification benefits at that time.

Foolish bottom line

Bitcoin is a finite asset, and miners with the most hashing capacity right now have the upper hand. As it stands, Hut 8 is king in Canada, yet its valuation looks cheaper. However, bullish investors may still buy both bitcoin mining stocks and improve on potential diversification benefits.