Lightspeed POS (TSX:LSPD)(NYSE:LSPD) is one of the fastest-growing TSX tech stocks that could have a momentous 2021. Soon after closing an upsized equity offering last month, and just as speculated earlier, LSPD has already announced its first point-of-sale software industry competitor acquisition for this year. The company is wasting no time consolidating a fragmented global industry.

Meet Lightspeed’s first acquisition in 2021

Late on Thursday last week, Lightspeed announced the acquisition of one of its largest competitors in the retail point-of-sale software space, Vend Limited (Vend) for US$350 million.

Vend is a cloud-based retail management software company based in New Zealand. It boasts of over 20,000 customer locations across the world, and the transaction doubles LSPD’s customer base in Asia. Vend generated revenue of about US$34 million in 2020, and processed over US$7 billion in gross transaction volume (GTV) on its platform.

Another cash-plus-LSPD-stock deal

As has become the norm in recent acquisitions, Lightspeed will pay Vend investors in both cash and stock. About US$192.5 million will change hands in the Vend acquisition deal, and the balance on the US$350 million deal will be settled in the company’s stock worth US$157.5 million.

Too much cash?

Investors in Lightspeed’s stock will note that the company is paying a lot more cash in the latest transaction than it did in a similar transaction a few months ago.

The company acquired U.S.-based ShopKeep, another POS systems vendor with over 20,000 customer locations and over US$7 billion in GTV (identical metrics with Vend) for US$440 million late last year. In that deal, Lightspeed paid US$145.2 million or a third (33%) of the consideration in cash.

In another deal in December, the company paid cash amounting to US$123 million (28.6% of the deal) in a US$430 million acquisition of Upserve.

This time around, the company will pay more than half of the consideration (55% of the deal) in cash, then settle the balance in stock.

Moreover, it appears that the Vend team had a better bargaining position. ShopKeep investors were paid 8.8 times their company’s last 12-month revenue of US$50 million. In comparison, Vend principals demanded 10.3 times their company’s trailing twelve months sales of US$34 million.

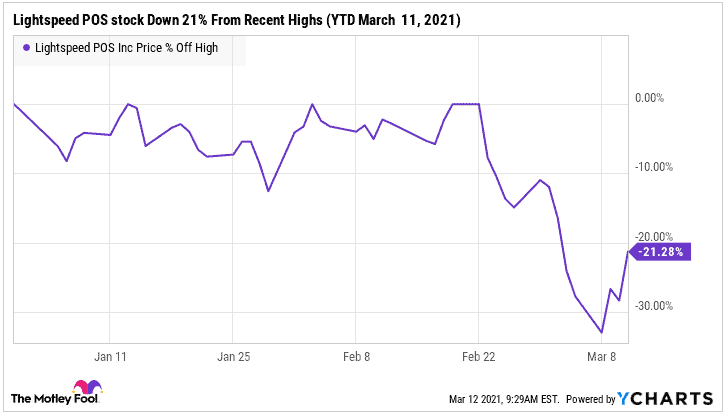

Although Lightspeed is paying less total consideration for the same customer base and GTV, the higher cash component could mean a more skeptical Vend negotiating team that is concerned about potential near-term weakness in LSPD’s stock price, which traded at 21% lower from recent high on Wednesday.

Investor takeaway

Lightspeed’s founder and CEO, Dax Dasilva is going full-speed in consolidating a fragment global point-of-sale services market. The latest acquisition grows LSPD’s customer locations by 17% to 135,000 and could increase the company’s GTV to over US$40 billion this year. However, targets could potentially demand more cash upfront in 2021 acquisition deals if volatility in the company’s stock price remains elevated.

Most noteworthy, the deal offers the company new cross-selling opportunities for its payments, eCommerce offerings to a larger customer base, and recruits more prospects for its youthful supplier network. The transaction could be accretive to growth. It’s being concluded at around 10 times sales, using cash and stock valued at over 33 historical annual sales. The dilution for current stock investors seems reasonable.

Parties expect the Vend deal to close by the end of next month.