Air Canada (TSX:AC) stock is falling down. Yes, five straight days of falling have pulled the stock down 10% from its new high of $29.8 on March 15. A 10% decline is only a correction for a highly volatile stock like AC. It is currently trading at $26.7 and is likely to fall another 10% to $24 this week.

What led to the unexpected rally of Air Canada stock?

You will be surprised to know that Air Canada stock has more than doubled from its pandemic low of less than $13. And what led to this double or nothing rally is investors’ sentiments. You will agree that the stock market has been behaving unexpectedly since the pandemic.

Billionaire investor George Soros calls it a stock market bubble inflated by the stimulus checks people received. This time, there are Robinhood investors that are leveraging zero-commission trading to make short-term gains. AC is a perfect play for these Robinhood investors, and that explains its 2.55 beta volatility.

The fundamentals are not driving the rally, because there has been nothing but losses for the airline. AC recorded a $4.65 billion net loss in 2020. I know the new age investor gives more weightage to revenue growth instead of profits. But that applies only to less capital-intensive tech companies that can fund their losses. For a capital-intensive industry like the airline, the profit and cash flow metric still hold true.

If it is not fundamentals, is it the news that is driving the rally? That got me interested in studying the pattern of AC’s stock price movement.

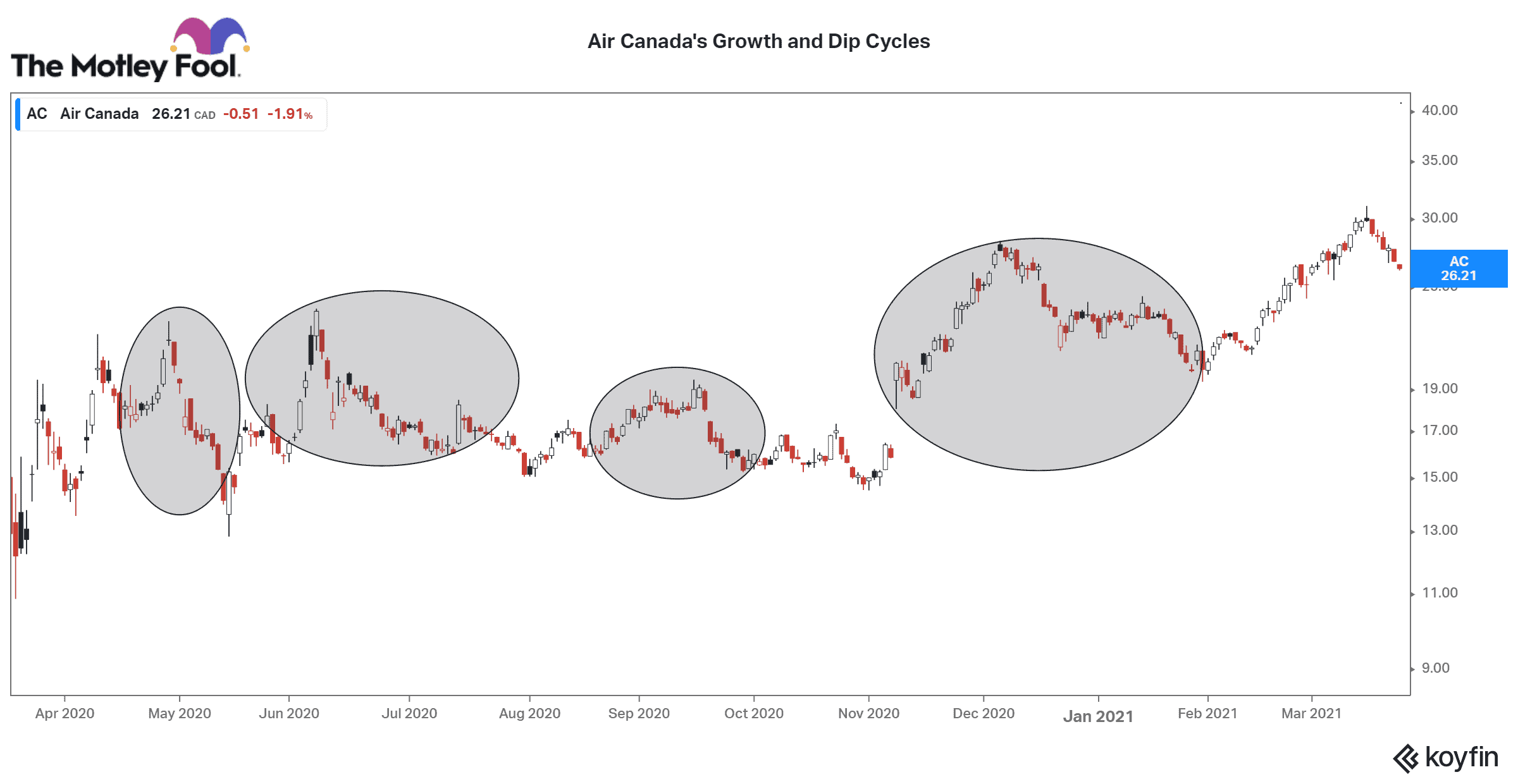

Air Canada’s growth and dip cycles

If you look at AC’s stock price movement in the last 12 months, there were four down cycles, and each cycle saw a 22-35% dip. All dip cycles lasted 40 days, except for the first cycle (May 2020) that lasted 15 days. In three out of the four dips, the stock jumped back with more strength and made a new high every time.

For instance, in the June 2020 growth cycle, AC stock surged 46% in less than 10 days as there was a hint of a vaccine. But the first trial failed, sending the share down 32% in 40 days. In the November 2020 growth cycle, AC stock jumped 83% in 30 days as Pfizer announced 90% vaccine effectiveness. But the second wave of the pandemic came and sent AC stock down 25% in 50 days.

The above trend shows that a dip cycle is longer than the growth cycle. Moreover, the dip acts as a catapult and pushes the stock even higher.

How to make the most of these cycles

Now, it is impossible to time the market. You can’t buy AC stock at its bottom and sell it at its peak with accuracy. But what you can do is buy the stock near its dip and sell it near its peak. If you study the stock carefully, its cycles are range-bound. And every cycle has a phased growth.

Before November 2020, AC stock was trading in the $14-$20 range. After the vaccine news, the stock increased its range to $20-$27. It is in the fifth cycle, the bailout. And in this cycle, it has a range of $24-$32. AC stock will continue to decline for another week or two and fall below $24. That is the time to buy the stock because bailout news will push the stock above its pandemic high of $29.8 to a new high of $31 or $32. A $24-$32 gap represents a 33% upside.

I don’t recommend such short-term trading as it has a high risk of a downside. But you can minimize your risk by buying the stock at a dip of $24. That is the price it has maintained in the last 50 days. Even if you don’t gain anything, you won’t lose much value if you buy at the dip. But if you buy the stock above the $24 price, your downside risk is higher.