As equity markets remain volatile, investors should look to buy quality stocks that are trading at a lower valuation. Several companies in the technology and cannabis sectors have lost momentum in the last month, as market participants are worried about rising interest rates and high valuation metrics of these high-growth companies.

We’ll look at three such stocks that can regain lost ground and outpace broader market returns.

Docebo

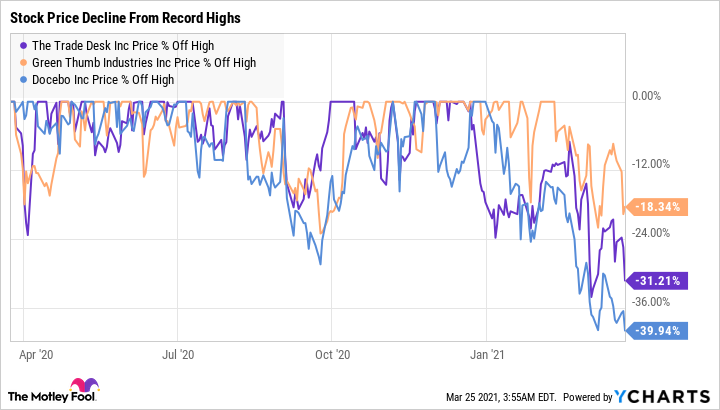

The first stock on the list is Docebo (TSX:DCBO)(NYSE:DCBO), an enterprise-facing e-learning company. Shares of Docebo are trading 40% below its record high. Docebo provides a cloud-based learning management system and helps clients centralize learning materials from peer enterprises into a single system.

In the fourth quarter of 2020, Docebo increased sales by 53% year over year to US$18.8 million. Its subscription sales stood at US$16.7 million, accounting for 89% of total sales. Gross margin rose by 300 basis points to 84%, allowing the company to report an EBITDA of US$0.5 million in Q4.

Analysts tracking Docebo expect the company to increase sales by 48% to US$93.2 million in 2021 and by 35.6% to US$126.4 million in 2022.

Bay Street also has a 12-month average target price of $63.3 on DCBO stock. This indicates Docebo is trading at a discount of 27.4% to average analyst estimates.

The Trade Desk

Shares of programmatic advertising company The Trade Desk (NASDAQ:TTD) are trading at US$668, which is 31% below its record high. Due to a sluggish macro-environment, TTD’s sales were up 26% year over year compared to 39% in 2019 and 55% in 2018. Between 2015 and 2020, TTD has increased sales at an annual rate of 49%.

This decline was offset by the company’s stellar performance in the rapidly expanding CTV (connect TV) vertical. The company expects revenue growth to rebound in 2021 and forecasts top line to expand between 33% and 35% in Q1. Comparatively, its EBITDA is estimated to grow by at least 41% year over year.

TTD operates the world’s largest DSP (demand-side platform), which suggests the company does not partner with any content network. It also means The Trade Desk “isn’t incentivized to steer ad buyers toward any particular ad inventory.”

The digital ad-market is forecast to touch US$526 billion in 2024, up from US$333 billion in 2020, according to market research company eMarketer, giving TTD enough room to grow its business.

Green Thumb Industries

The final stock on the list is Green Thumb Industries (CNSX:GTII). Shares of this pot stock were up 150% in 2020 and are now trading 18% below its record high. The company announced its Q4 results last week and did not disappoint investors.

In the December quarter, Green Thumb sales were up 134% year over year at US$177.2 million compared with sales of US$75.8 million in the prior-year period. Wall Street forecast the company to report sales of US$167.2 million.

The marijuana giant also managed to report a GAAP profit for the second consecutive quarter. In Q4, its net income stood at US$22.5 million, or US$0.11 per share, compared with a net loss of US$14.1 million, or US$0.07 per share, in the prior-year period.

Its EBITDA soared by a stellar 374% to US$65.4 million in Q4 as well. Further, the company also reported a fourth consecutive quarter of positive operating cash flow.