What are the best stocks to buy right now? This is a common question that investors have. Well, you’re in luck. At Motley Fool, one of our greatest pleasures is to help investors come up with good money-making stock ideas. This article will tackle just that. The best stocks to buy right now have a few things in common. They are quality companies. Also, they have a strong long-term growth trajectory.

April is a time of renewal. Spring flowers and warmer weather bring new hope. This year, spring’s natural optimistic effect will be accentuated by the coronavirus vaccine.

Best stocks to buy right now reflect a new world

There’s no question: Canada has ramped up its vaccine rollout. In fact, it’s administering more than 100,000 doses per day. But as of early this week, only 10% of Canadians were vaccinated. And at this pace, it would take 11 months before everyone is vaccinated.

And then there’s talk that the coronavirus could become endemic. This means that it will be a virus that we will have to learn to live with. We’ll need to keep our guard up. Therefore, we don’t know how long we will need to implement the current adjustments to society, or some version thereof.

Many stocks are benefitting from this new world. In fact, we have covered this extensively at Motley Fool Canada. These are stocks that will continue to benefit. Without further ado, let’s take a look at the best stocks to buy. These are stocks that are not only benefitting from the pandemic. They’re also benefitting from that mega growth trend of technological digitization — all for the betterment of industry.

Well Health Technologies stock is one best stock to buy right now

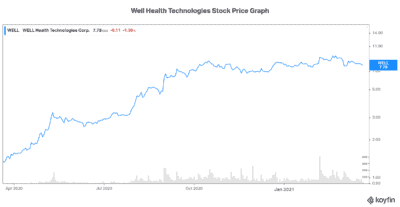

Well Health Technologies (TSX:WELL) is an omni-channel digital health company. Revenue at the company has grown to over $50 million in 2020 from almost nothing in 2016. This highlights the value that Well Health is providing to the medical industry. Digitizing the medical experience has numerous benefits for both doctors and patients.

But the point here is that this growth is only just beginning. Let’s just look at how Well Health closed 2020 for proof. Revenue rose 75% in the fourth quarter. And acquisitions plus organic growth are setting it up for a $300 million revenue run rate in the years ahead.

The primary healthcare system is one of the last big industries that has yet to digitize. According to Well Health reports, the Canadian primary care industry is a $250 billion industry. Physician spending accounts for approximately 15.4%. The industry is plagued by underinvestment, fragmentation, and a lack of technology.

Well Health Technologies stock is one of the best stocks to buy for all of these reasons. This is a revolution, and Well Health is at the forefront.

BlackBerry stock is another “best stock” to buy right now

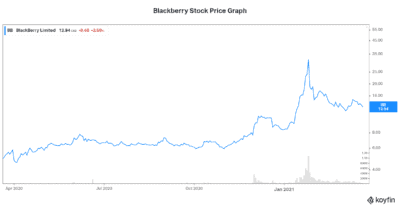

BlackBerry (TSX:BB)(NYSE:BB) stock has been in the news a lot lately, but not for the reasons it should be in the news. Clearly, I think BlackBerry has not been given due credit for its technological leadership. In fact, BlackBerry has won many industry awards for its technologies. Its cybersecurity software is top of the line. And its machine-to-machine connectivity technology is becoming the standard for connected cars.

Despite all of this, BlackBerry has kept its skeptics. But I think BlackBerry stock is one of the best stocks to buy now. It’s destined for rapid growth as its industries expand and grow. Its cybersecurity business is benefitting from the increased risk of systems break-ins. It’s also benefitting from the rapidly increasing work-from-home trend.

Finally, BlackBerry’s involvement in the connected car industry is huge. In this industry, many are estimating a 24% CGAR in the next five years. The big news in this segment is the BlackBerry IVY partnership. BlackBerry and Google Web Services have partnered to provide a top-tier vehicle software solution.

Motley Fool: The bottom line

Two of the best stocks to buy right now are Well Health Technologies stock and BlackBerry stock. These companies are paving the path to a new world — a world in which the benefits of technology take us to the next level. With or without the disruptions of a pandemic, this is good business.