Cryptocurrency miner Hive Blockchain Technologies (TSXV:HIVE) saw its stock price surge over 3,600% at one point over the past 12 months. Rising prices for Bitcoin and Ethereum powered Hive stock price surge last year. However, thanks to the company’s significant exposure to Ethereum, Hive’s stock price growth could be sustained by the rapid growth in decentralized finance (DeFi) applications this year.

Hive stock investors to enjoy DeFi diversification benefits

Hive Blockchain prides itself as the only publicly traded Ethereum mining stock for a good reason. It has invested in a blockchain platform that is gaining wider institutional business adoption at a faster rate than Bitcoin.

The company has two large data centers in Sweden and Iceland that are 100% focused on Ethereum mining operations. Only one data center (the Canadian one) is mining for Bitcoin.

Ethereum has a platform for “smart contracts” which has gained wide adoption in the financial transactions revolution and the industrial applications space. The platform is the go-to home for a growing DeFi ecosystem of blockchain-based applications that seek to replace traditional financial intermediaries in the global payments ecosystem today.

Hive Blockchain and peers in Ethereum mining are enjoying growing earnings from increasing transaction fees as the DeFi ecosystem gains momentum.

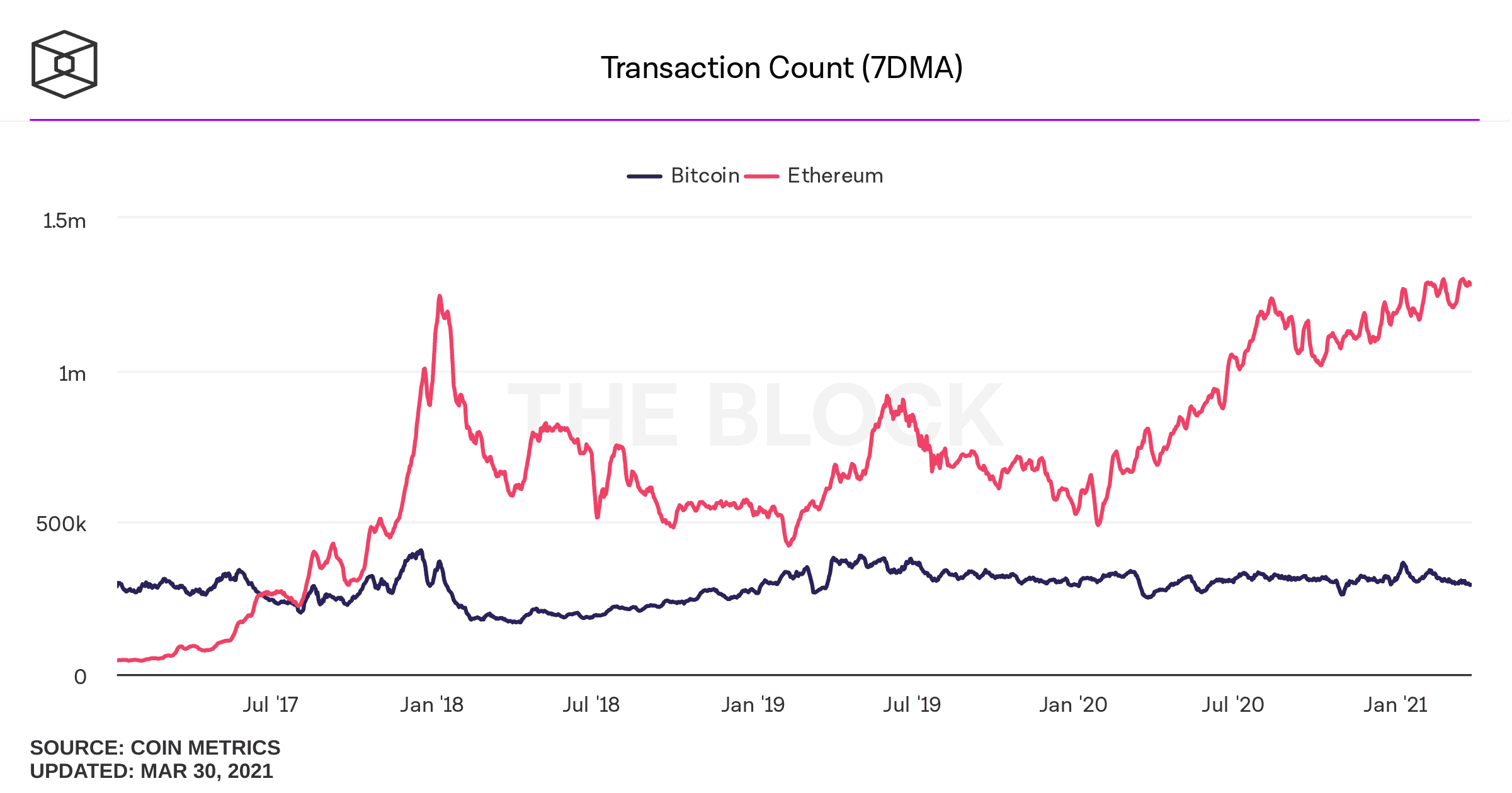

Actually, DeFi ecosystem growth is already underway. The decentralized finance applications ecosystem increased 23 fold from a $3 Billion market size to an over $71 Billion market within the last twelve months. We have witnessed the average number of transactions per week grow exponentially on Ethereum while Bitcoin transaction volumes have remained flat over the past year.

Ethereum transaction volumes growing exponentially while Bitcoin transactions remain flat. Source: The Block.

I believe the surge in DeFi applications is fueling the increase in business volumes on the Ethereum platform. Hive Blockchain is reaping diversification benefits into mining the second-largest cryptocurrency coin..

Fees growing with volume

Even better, transaction fees have been growing with surging volumes too. Hive Blockchain should enjoy more recurring business from this emerging trend. As transaction fees grow and volumes surge, the Ethereum coin’s price could have a diluted impact on total revenue for the firm. We could see a smoothening of the firm’s quarterly revenues and dampened cash flow volatility over time.

In other words, Hive stock could be derisked going forward as the DeFi ecosystem generates recurring business for the Ethereum mining firm.

Hive Blockchain in share-swap deal with DeFi Technologies

Interestingly, management at Hive Blockchain isn’t dragging its feet. The team recently closed a share swap with a leading player in the emerging decentralized finance ecosystem. The company will receive 10,000,000 shares (7% stake) in DeFi Technologies Inc. in exchange for 4,000,000 Hive common shares (representing 1% of the company’s total issued shares).

The two firms intend to partner in growing the decentralized finance ecosystem. If successful, the partnership could increase Hive’s share of the emerging ecosystem’s growing fees and subsidy payouts.

Already, the majority of earnings on the Ethereum platform are coming from DeFi activities right now. Visa‘s recent acceptance of the USDC, a digital coin version of the United States Dollar, gives positive momentum to the new finance ecosystem’s growth trajectory.

USDC is based on Ethereum.

Foolish bottom line

Decentralized finance is gaining momentum. Hive stock investors are well positioned to enjoy the benefits as the company rides on Ethereum to greatness.

As revealed on March 25, the company is considering giving its shareholders a stock dividend “over the next year.”

The future returns outlook is promising for Hive stock investors today.