BlackBerry (TSX:BB)(NYSE:BB) reported fourth-quarter and full-fiscal-year 2021 results on Tuesday evening. Is the stock a buy after earnings? Let’s look at BlackBerry’s financial results and stock in more detail.

The tech company reports US$315 million loss in fourth quarter

The cybersecurity technology and automotive software company reported a loss of US$315 million and disappointing fourth-quarter revenue. BlackBerry missed Wall Street estimates for fourth-quarter revenue, as the pandemic-induced global economic crisis hit demand for its QNX car software.

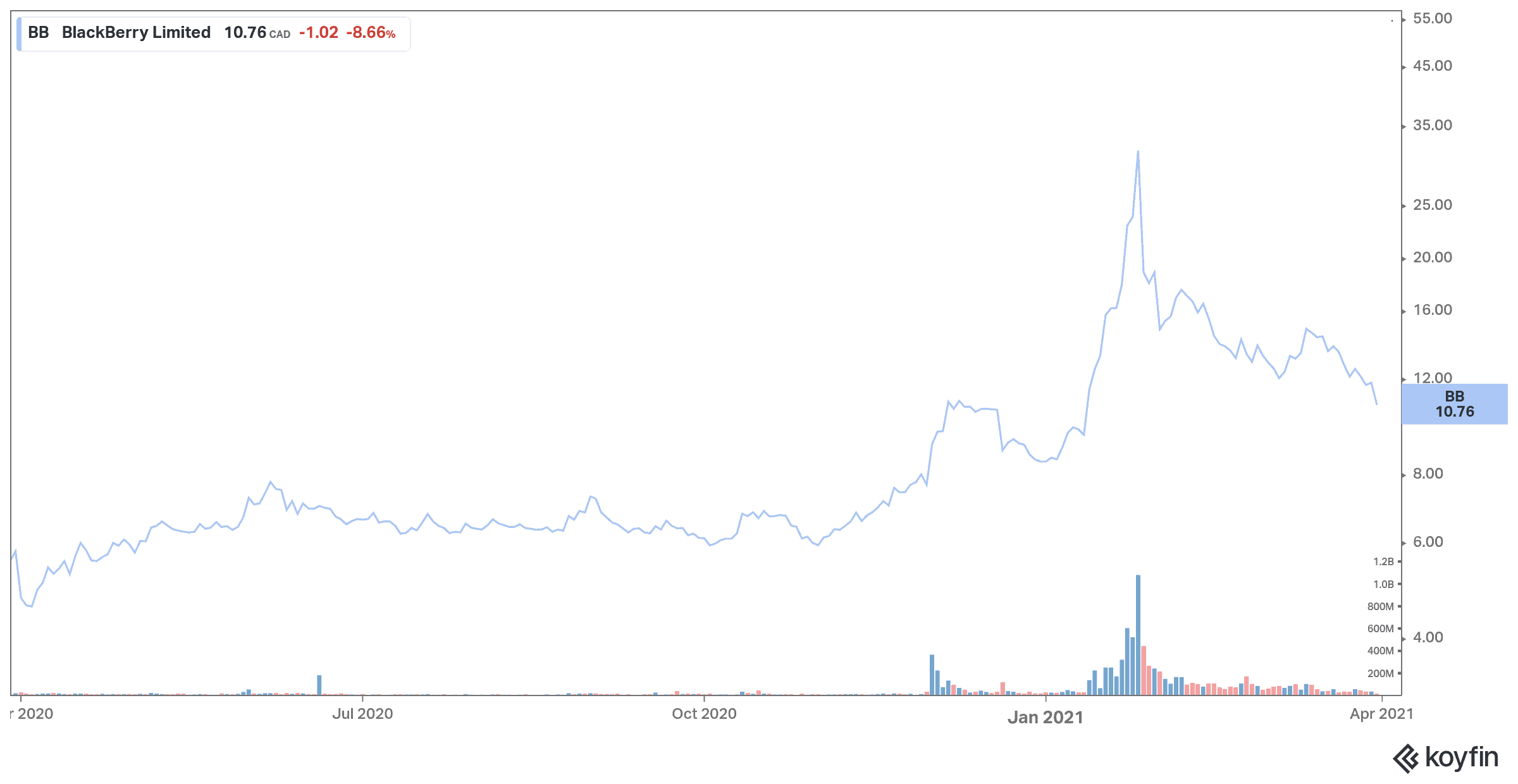

BlackBerry stocks fell more than 10% shortly after the opening bell on Wednesday.

Shares had recently experienced a noticeable outbreak with the movement of the new social traders of WallStreetBets.

A slow recovery in the U.S. auto industry due to a global semiconductor shortage and pandemic-related weakness has hurt demand for BlackBerry’s QNX car software used by automakers such as Volkswagen and Ford.

Quarterly revenue for the tech company was US$210 million, up from US$282 million a year earlier. BlackBerry also reported adjusted revenue of US$215 million, up from US$291 million a year earlier.

BlackBerry said it suffered a net loss equal to a loss of US$0.56 per share compared to a loss of US$41 million, or US$0.07 per share, a year earlier.

On an adjusted basis, BlackBerry reported earnings of US$0.03 per share.

Analysts had estimated US$0.03 per share in adjusted earnings with revenue of US$248.14 million for the three months ended February 28, according to financial data firm Refinitiv.

John Chen, BlackBerry’s executive chairman & CEO, sees tangible signs that the group’s efforts are starting to pay off. He mentions a strong sequential increase in invoicing for software & services activities.

He said: “This has been an exceptional year to navigate, however we are pleased with QNX’s continued recovery, despite new challenges from the global chip shortage. QNX now has design wins with 23 of the world’s top 25 electric vehicle OEMs and remains on course to return to a normal revenue run rate by mid-fiscal 2022. BlackBerry IVY also made encouraging progress, with positive engagement from a number of leading automakers and the launch of our BlackBerry IVY Innovation Fund. We are seeing tangible signs that our efforts and improvements in go-to-market are starting to pay off and have a positive impact. This quarter we generated strong sequential billings growth for our Software and Services business, including significant improvements for both Spark and QNX. Total billings are back to pre-pandemic levels.”

He told analysts in a conference call Tuesday afternoon that BlackBerry was continuing to negotiate a previously announced possible sale of part of its patent portfolio, but there was no definitive deal.

Should you buy BlackBerry stock?

While revenue is expected to increase by 11.3% for fiscal 2022, profit is expected to fell by 16.7%. With a forward P/E of 116.75 and a five-year PEG of -3.28, the stock is overvalued. The PEG is negative, because the company’s earnings are expected to decrease in the future. In other words, it will lose more money. I would stay away from BlackBerry stock until earnings are back on the growth path.