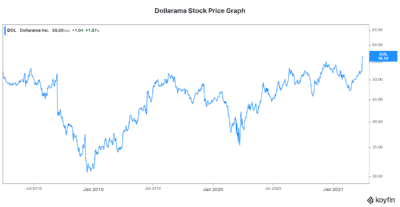

Dollarama (TSX:DOL) stock continues to rise. After the company reported another impressive quarter, it’s clear why. In fact, it was the type of quarter that investors have gotten used to from Dollarama. But as the pandemic lingers, what should we expect from Dollarama going forward? Is there trouble brewing ahead as cost inflation heats up?

Without further ado, let’s take a look at Dollarama stock. Is this pandemic going to get the better of it? Or is it still blue skies ahead?

Dollarama stock has not missed a beat through this pandemic

As an “essential” retailer, Dollarama has escaped the dismal fate of so many other retailers. It has actually thrived. In the latest year, fiscal 2021, Dollarama posted a 3.2% increase in comparable store sales. This is an impressive result — especially considering that this number includes stores that were temporarily shut down due to the virus. It speaks to the strength of the business model. It also speaks to the demand from consumers.

As an indication of this, we investors can look to Dollarama’s dividend. A growing dividend is something we always like to see. This return of capital to shareholders is one of the key attributes that can attract us to Dollarama stock. In fact, a 6.8% dividend increase was instituted in December. And this was followed by the recent additional 7% dividend increase. Dollarama stock’s dividend now stands at $0.20, for a 0.33% dividend yield. It’s not a yield to get excited about. But the dividend-growth rate is something to get excited about. At this rate, Dollarama is growing to be a legend in the Canadian retail landscape. And shareholders will continue to be rewarded.

Dollarama: There seems to be no stopping this retailer

So, Dollarama posted sales of $1.1 billion for the full year. And this growth shows no signs of stopping. In fact, Dollarama’s target is to have 2,000 stores in Canada by 2031. There are currently 1,291 stores. This plan is supported by the continued strong performance of Dollarama stores across Canada.

Current trends can give us a glimpse of the momentum that is driving this growth. Before the lockdowns and store closures in December, things were booming at Dollarama. Early in the fourth quarter, comparable store sales were up a full 7%.

Inflation could put a damper on Dollarama stock

In all of this good news, there is, unfortunately, something a little concerning on the horizon. We have already seen that the pandemic has not put much of a damper on consumer demand for Dollarama. But there are other consequences of the pandemic that will cut a little deeper.

Supply chain pressures are escalating. The fact that the pandemic has introduced new costs to all levels of the chain is not surprising. For example, new safety protocols and more intense cleaning are the new norms. So, cost inflation is steepening. This means that Dollarama has to absorb these significant increases. Thankfully, the company has been able to absorb and offset some of this through greater efficiencies. This has ensured stable margins without price increases. But going forward, this cost inflation will escalate. This will likely be a problem for Dollarama.

What should we, as investors, make of this? Well, this is certainly a roadblock.

Motley Fool: The bottom line

Dollarama stock certainly remains an investor favourite. It’s been a retail stock like no other. It grows in the good times and is resilient in times of trouble. Today, Dollarama continues to roll along impressively. But Dollarama stock is approaching all-time highs. And it’s trading at very lofty valuations. It’s priced for perfection, you might say. And there are upcoming cost pressures to worry about. Therefore, it may be a good idea to wait before establishing a position in Dollarama stock.