Choosing the stocks you buy for your Tax-Free Savings Account (TFSA) carefully is crucial because you want to maximize the tax-free nature of the account. However, you don’t want to lose money and, therefore, contribution room on high-risk and highly volatile stocks. This makes it difficult to decide which are the best stocks to buy now.

Plus, on top of picking the right stocks, you’re going to want to have the discipline to invest for the long-term and stay patient. Avoiding easy-to-make mistakes is also crucial to maximizing your investing performance.

So as long as you can stay disciplined, do the research to find high-quality stocks, and invest for the long-term, you’re setting yourself up for success. Here are three of the best stocks to buy for your TFSA now.

One of the best Canadian tech stocks to buy now

Over the past month, tech stocks have been some of the worst performers creating new buying opportunities for investors.

There are several high-quality Canadian tech stocks to choose from. One of the very best, though, offering incredible growth potential is AcuityAds Holdings Inc (TSX:AT).

AcuityAds is in the AdTech space. The company works with marketers to increase the effectiveness of digital advertising. AcuityAds has two platforms. One is a self-serve platform. The other platform has automated capabilities driven by artificial intelligence.

AdTech stocks offer a tonne of long-term growth potential. Marketers are continuously looking for better ways to reach their target audiences, and AcuityAds aims to provide the services to do that. This is why it’s one of the best stocks to buy now.

The stock has natural potential to grow its revenue as the AdTech industry gains in popularity. However, there’s also potential for AcuityAds when more advertising dollars come back after the pandemic.

The stock could also see a big gain when it eventually lists on U.S markets too. These tech stocks can be volatile, though, so it’s important to take a long-term position.

If that’s what you’re looking for, though, a high-potential tech stock to buy and hold for the long-term, then AcuityAds is certainly one of the best stocks to buy now.

A rapidly growing Canadian REIT

Real estate is always a great industry to invest in. There are several different subsectors of the real estate industry to consider, though.

There is potential to find value in some of the hardest-hit retail REITs today. In my view, though, the best stock to buy now is in one of the top growth stocks in the industry, Granite REIT (TSX:GRT.UN).

Granite is an industrial REIT that owns industrial, warehouse, and logistics properties. Demand for warehouse spaces has skyrocketed over the last year as the e-commerce industry has exploded. That’s why it’s such a great growth stock.

Companies that are closing their shops and moving online need a central storage hub, resulting in skyrocketing demand for warehouses. So while the retail industry is struggling, companies like Granite are reaping the rewards.

So if you’re looking for a top real estate stock to buy for growth, Granite is one of the best stocks to buy now.

A top Canadian retail stock

Although, as I just mentioned, the retail industry has been struggling over the last year, one Canadian stock that’s been completely unfazed by the pandemic and actually used the opportunity to grow is Canadian Tire Corporation Ltd. (TSX:CTC.A).

Canadian Tire is one of the top retail companies in Canadian history and continues to be one of the best stocks to buy now.

Not only have many of its products been in hot demand over the last year, but Canadian tire has also had a strong e-commerce presence even before the pandemic began. This has been crucial to its performance the last year.

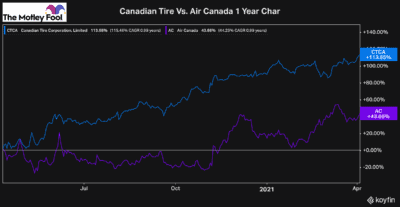

I recommended Canadian Tire to investors almost exactly one year ago as a much better investment than Air Canada. Sure enough, over that time, Canadian Tire has more than doubled the return of Air Canada.

Despite this growth, Canadian Tire is still one of the best stocks to buy now for long-term investors. The stock still trades more than 10% below its target price. Plus, it pays a rapidly growing dividend which currently yields 2.5% and has more than doubled since 2016.