Goodfood Market (TSX:FOOD) announced on Wednesday strong financial results for the second quarter ended February 28, 2021. Canada’s leading online grocery store announced quarterly revenue over $100 million for the first time. The company’s shares soared by more than 6% shortly after the opening bell.

Goodfood reports record quarterly revenue

Revenue reached $100.7 million in the second quarter of fiscal 2021, an increase of $41.9 million, or 71% year over year.

The gross margin was 30.4% for the quarter, an improvement of 0.1 percentage point, and gross profit was a record $30.6 million, an increase of $12.8 million, or 72%.

Goodfood reported a net loss of $4 million, an increase of $0.7 million from the same period last year, resulting in a loss per share of $0.06.

Goodfood posted positive EBITDA, with a margin of 0.5% in the second quarter, representing an increase of 5.5 percentage points year over year.

Quarterly cash flow from operating activities were $5.4 million in the quarter, an increase of $9.3 million from the same period last year. Goodfood reported a record cash balance of $163 million.

As of February 28, 2021, there were 319,000 active subscribers, an increase of 73,000 subscribers, or 30%, compared to February 29, 2020.

Those strong results demonstrate Goodfood’s ability to generate growth and superior margins in the fast-growing online grocery and meal solutions market.

Jonathan Ferrari, CEO of the company, said, “The uptake of Goodfood’s grocery products also reached new heights with over 1.1 million grocery products sold in this quarter alone and we now have more than 750 products available to our members. The continued strength of our members’ interactions with our offering has led to increased basket sizes and order frequencies, and that, combined with our strong balance sheet, positions us ideally to further penetrate the online grocery market that is still in the early days of its digitization.”

The online grocery industry is one of the fastest-growing industries in the world. As a result, there are significant opportunities for Goodfood to rapidly increase its subscriber base and basket size by investing in highly targeted marketing campaigns, expanding production capacity across the board through new installations and investments related to automation, increasing its product lines, and continuing the expansion of its national platform.

Goodfood’s strategy involves partially deferring short-term profitability in order to invest in creating long-term value for its shareholders, as well as continuing to improve its cost structure to meet its long-term profit margin and profitability targets.

This food stock is a good buy on the dip

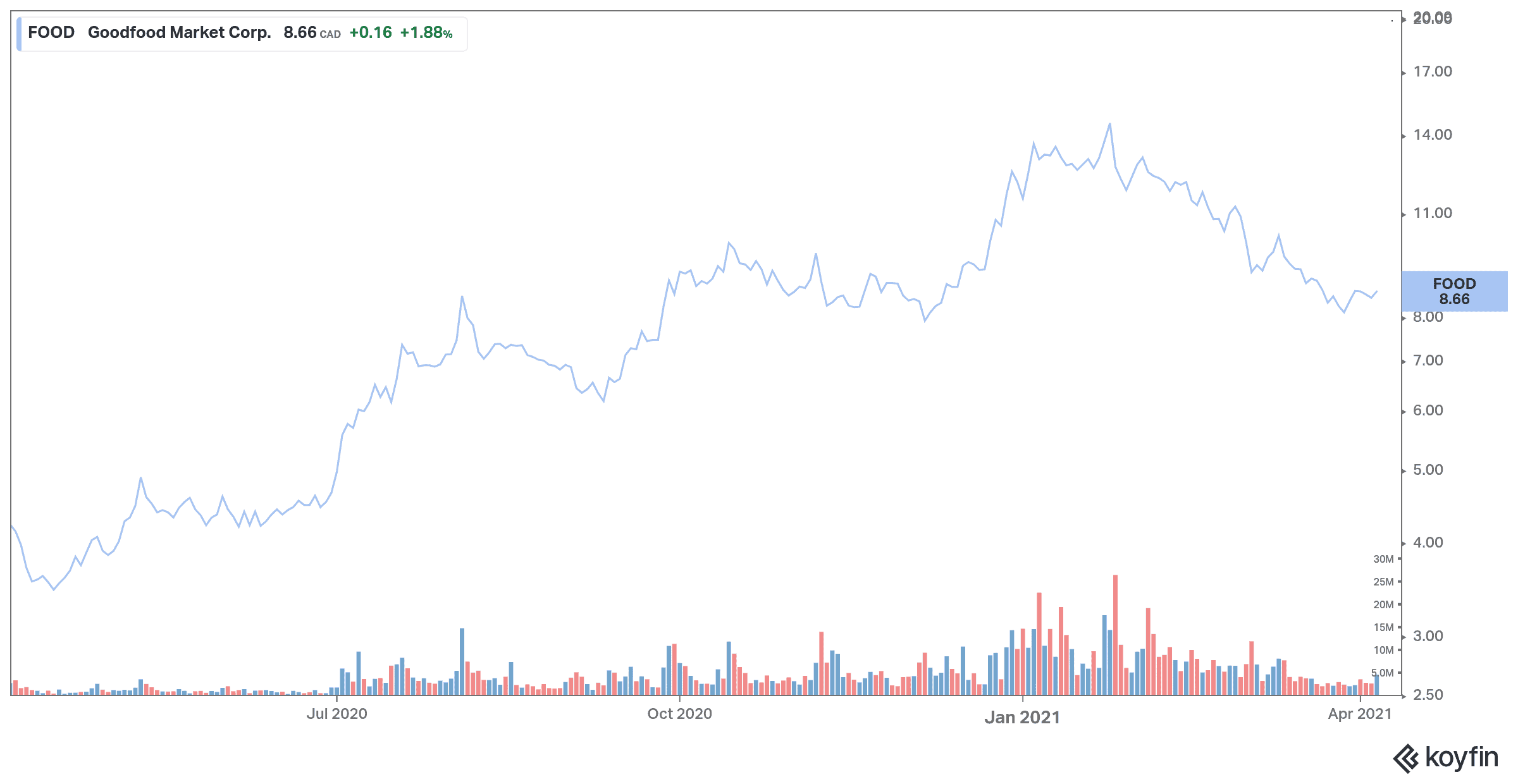

Goodfood stock has corrected by more than 30% year to date, providing a solid buying opportunity for long-term investors.

Goodfood is well positioned to deliver strong returns in the future thanks to the growing demand for online grocery services. The company continues to see increased adoption of its online grocery and dining solutions offerings, as evidenced by the explosive growth of its active subscriber base.

Goodfood is well positioned to deliver strong returns in the future thanks to the growing demand for online grocery services. The company continues to see increased adoption of its online grocery and dining solutions offerings, as evidenced by the explosive growth of its active subscriber base.

The increased delivery speed, the launch of same-day delivery services, cross-selling efforts, promotions, targeted marketing, as well as the expansion of product offerings bode well for Goodfood’s future growth and position it to take advantage of favourable industry trends. Goodfood’s stock price could easily pop 50% or more in 2021.