If you’re an investor who likes to buy value stocks, it’s important to keep up to date with market developments to know what the top TSX stocks to buy right now are.

The market generally moves in cycles, and stocks from the same industry often rally together. So, although you should still make long-term investments and not try to time the market and move in and out of stocks, it’s important to know and recognize which stocks are rallying.

Investors can weigh their portfolio to these types of stocks or industries while they have the most potential.

For example, many of the stocks that first recovered from the coronavirus pandemic have been growth stocks. Now, though, value stocks have been consistently outperforming the rest of the market.

Investors with solid diversification will have exposure to both these types of stocks. However, if you noticed, for example, that your tech stocks had been rallying excessively and thought energy stocks were becoming attractive, you could’ve taken some profits and gone overweight energy.

Here are two of the top TSX stocks to buy right now if you want to take advantage of the rally in value stocks today.

A top TSX real estate stock to buy right now

Real estate is an industry that is offering a tonne of potential over the next few years. Plus, some retail real estate stocks that have been struggling offer even more value for investors today.

That’s why First Capital REIT (TSX:FCR.UN) is one of the top TSX value stocks to buy right now.

The company owns an impressive portfolio of mixed-use real estate. This is important, because the diversification has been key for First Capital over the last year.

The stock has certainly seen an impact from the pandemic, especially its retail assets. However, it has handled the pandemic a lot better than many of its peers due to its diversification and high-quality assets.

First Capital owns assets in some of the best locations plus, these locations are almost always anchored with high-traffic businesses such as grocery stores, pharmacies, and banks.

This makes the units a lot more appealing to potential tenants and is part of why First Capital has been so robust compared to its peers.

So, with the stock trading at a significant discount today, First Capital is one of the top TSX value stocks to buy now.

A top Canadian media stock

Another high-potential opportunity for investors today is Corus Entertainment (TSX:CJR.B).

Corus is a stock that’s been cheap for a while, and although the stock has recovered tremendously over the last six months, it’s still significantly undervalued, making it one of the top TSX stocks to buy now.

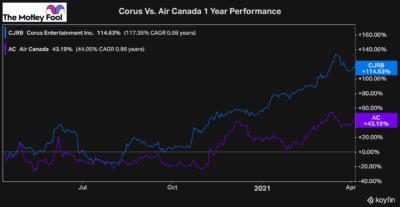

I first recommended Corus to investors almost a year ago as a much better investment than Air Canada.

Over those 12 months, Corus has more than doubled Air Canada’s performance. And even today, I’m still more bullish on Corus.

The stock is not only recovering rapidly and improving its long-term growth potential, but it’s also still remarkably cheap.

As of Wednesday’s closing price of $5.84, Corus has a roughly $1.2 billion market cap. That’s a significant bargain. The stock is currently trading at a forward price-to-earnings ratio of just seven times. Furthermore, it’s trading at only roughly four times its fiscal 2020 free cash flow.

This goes to show just how incredibly cheap Corus is. So, when you consider it also pays a 4% dividend, it’s easily one of the top TSX stocks to buy today.