It may not seem so obvious, but Canadian energy giants are likely to enjoy a piece of the cake if the United States President Joe Biden’s grand US$2 trillion plan to significantly overhaul American infrastructure goes operational. The plan includes the massive rebuilding of roads, bridges, transportation networks, water supply systems, and advanced manufacturing infrastructure. Ironically, the plan seeks to promote clean energy projects but it could generate new demand for Canada’s oil sand produce.

Bitumen and asphalt remain key construction inputs for road surfacing and roof waterproofing. The majority of all bitumen produced globally is used as a binder in asphalt roads, parking lots, and footpaths. The latest trading data shows that the United States consumed almost all of Canada’s exports of bituminous mixtures in 2020. According to the TrendEconomy database (free access), about 94% of Canadian bituminous mixtures exports last year were destined for the U.S.

It’s true that the plan still requires congressional approval, and some of its provisions may still be altered. However, I would bet that many Republican lawmakers would back the rebuilding of bridges, roads, and airports.

About US$621 billion, the largest chunk of Biden’s bill, is earmarked for infrastructure projects. I believe this part of the bill could easily see the light of day. The money would fund the modernization of 20,000 miles of highways, roads, and main streets. It will fix 10 economically significant bridges and fund the repair of 10,000 smaller bridges. These capital projects could significantly increase the demand for bitumen and asphalt in America. And Canadian oil sands producers of the product are ready to supply.

Here’s one of the best-positioned TSX energy stocks to benefit from the Biden infrastructure bill.

Imperial Oil stock to enjoy a boost from Biden

One of the largest integrated oil majors in Canada, Imperial Oil (TSX:IMO)(NYSE:IMO) is a world-renowned asphalt producer. The company boasts being Canada’s largest asphalt producer controlling the country’s largest market share exit 2020. Integrated with its high-quality Cold-Lake crude oil asset, Imperial Oil’s asphalt operations at its Strathcona and Nanticoke refineries are significantly more profitable than heavy oil production.

The company is a founding member of the Asphalt Institute, an international trade association of petroleum asphalt producers, manufacturers, and affiliated businesses. The North American industry has recognized Imperial’s active engagement and participation in the research institute for the last 100 years. It’s easy for the company’s asphalt to find its way onto the new U.S. road surfaces due to its ExxonMobil association and existing relationships with contractors.

Of course, investors aren’t buying Imperial Oil stock today just for the asphalt trade. IMO is generating massive free cash flow right now.

Imperial Oil can fund its operating cash needs, sustaining capital expenditures, and cover its current dividend at Western Texas Intermediate (WTI) oil prices of US$36 per barrel. With the WTI averaging US$60 a barrel since March this year, investors in Imperial oil stock should be in high spirits right now. The company is making boatloads of cash. Shares are a must-hold in a TFSA account.

Watch the growing dividend!

Most noteworthy, dividend income investors should check out Imperial stock today. The company has paid dividends every year for over a century and has been increasing its annual dividend payouts every year for 26 consecutive years and counting. The current dividend yields 2.9% annually.

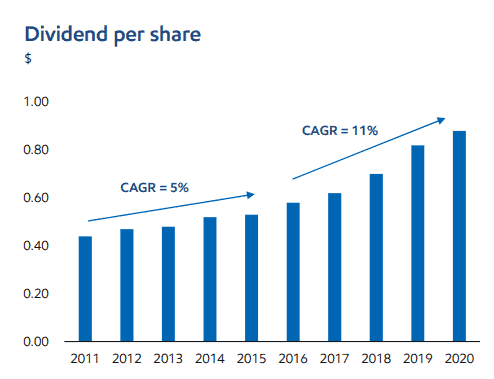

Imperial increased its dividend at an 11% compound annual rate over the past five years. The company had the best credit rating among the top five Canadian oil companies in 2020. Its AA credit rating from the S&P Global was higher than peers’ BBB ratings range from the same rating agency. It has more room to effect further dividend increases without damaging its balance sheet.

Foolish bottom line

The Biden infrastructure bill may pull North American asphalt prices up. Imperial Oil is well positioned to profit from such a development. That said, the company is already enjoying near-term cash flow growth, which helps it further strengthen its balance sheet, buy back more shares and fund its growing dividends. Imperial Oil’s stock has nearly doubled over the past six months. An asphalt boost could be a nice topping for capital gains this year.