BCE (TSX:BCE)(NYSE:BCE) stock has long been a pillar of strength. Current pandemic times have created massive economic uncertainty. Therefore, BCE’s strength has rarely been more useful or desirable. BCE will be reporting its quarterly earnings result next week. I thought it was a good time to review what to expect.

It’s also a good time to review why BCE stock is a top stock to buy today.

BCE stock offers investors the full package

The reasons for adding BCE stock to your portfolio are many. With BCE, you get predictability. You get dominance. And you get growth, as the telecom giant expands its offering and its services. Lastly, you get a reliable and growing dividend. What’s not to like?

The tech and telecom sectors, including BCE, are outperforming as they lead us into the future. They’ve been instrumental in this pandemic. They’ve brought us out into the virtual world — for shopping, working, appointments, and more. Also, BCE stock is currently yielding a healthy 6%. Consider this for a moment. BCE is one of the most cash flow-rich, steady companies out there. And it’s yielding 6%. Investors should pounce at the chance to get this yield.

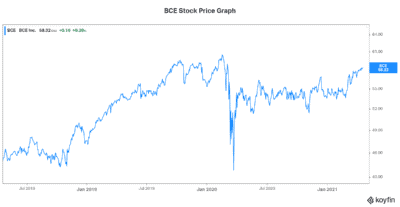

BCE’s stock price is undervalued: Q1 earnings will most likely not disappoint

In three of the last four quarters, BCE managed to beat market expectations by a lot. The only time the company missed was when the pandemic first hit in Q2 2020. This is a testament to the predictability and resiliency of BCE’s business. Last year, BCE delivered 96% of 2019 EBITDA. This is remarkable considering the chaotic economic environment we were in. But it’s not surprising. We know that BCE is defensive, essential, and predictable. In the first quarter of 2021, earnings will be lower year over year. But they will start off a year that will see strong earnings growth off of BCE’s many investments that it has made.

The telecom industry is rapidly changing. New advances such as fibre optics and 5G are changing the landscape. And BCE is committed to keeping up with these changes. BCE will be spending $1 billion to $1.2 billion in the next two years on network improvements and enhancements. This capital expenditure plan has been accelerated to meet the needs of its customers. BCE will be investing in upgrading its core network. This will lay the foundation for 5G growth. It will also connect more Canadians in rural areas. And lastly, it will speed the rollout BCE’s fibre optic network. This fibre optic delivery brings the fastest speeds and a better overall experience.

Is competition coming for BCE?

It takes billions of dollars to build telecommunications networks. And the Big Three telecom giants have made these crucial investments over the years. They currently control the market, with 90% market share in terms of both subscribers and revenue. So, what will happen now that the CRTC has mandated that they help smaller competitors in order to keep cellphone bills down?

Well, not much, according to Moody’s Rating Agency. For one, rates are not being mandated. Rather, they will be commercially negotiated. Also, smaller competitors will only be able to gain access to networks in areas where they own spectrum — that is, radio frequencies. It seems that smaller potential competitors were not really given the ruling they had hoped for. The Big Three will maintain their leading positions. Barriers to entry remain extremely high.

So, this leads us back to the all the reasons why BCE stock is a stock to own today.

Motley Fool: The bottom line

BCE stock is a top stock to buy today in large part for its 6% yield. Its resiliency and its top spot in the telecom industry will serve shareholders well for years to come. BCE stock price will stand the test of time.