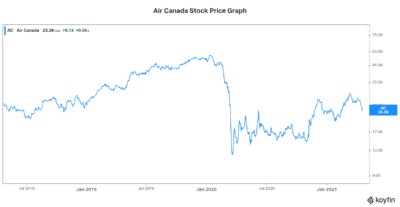

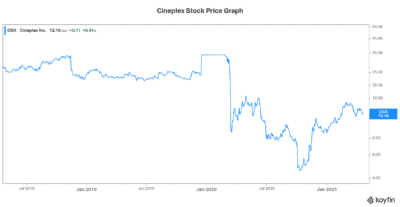

Air Canada (TSX:AC) and Cineplex Inc. (TSX:CGX) are being hit hard in this pandemic. In fact, they are among the hardest hit. Air Canada’s stock price has been shattered down to below $25. And Cineplex’s stock price has been hit down to below $13. The company’s business relies on people coming together. Yet, lockdowns and shutdowns have been the norm in the last year or so.

So how can these companies even survive? And shape are they in today? And which stock has the best chance for the most dramatic comeback?

The government finally steps in for Air Canada’s ailing business

After a long time waiting, the government has finally agreed to a $5.9 billion bailout package for Air Canada. It’s one that comes with many conditions. And it’s one that includes an equity investment by the government, i.e. you can me, the taxpayers.

There are two points I’d like to make. The first is that it’s obviously great the Air Canada has received this help. But the second is that there will be dilution. $500 million was raised through an equity issue that was priced at $23.1793. This life-saving package was necessary. But Air Canada’s problems won’t magically disappear.

The airliner is still bleeding through tens of millions of dollars per day. Yet, it must make good on certain purchase orders. And it must re-establish certain regional flights, which may operate at a loss for some time to come. The pandemic is not over. The hope is that it will be over soon. But questions remain. Will passenger traffic ramp back up to what it was pre-COVID-19 or will it be forever diminished? Whatever happens, we’re not sure how long it will take before we can get a sense of where this will all settle.

In the meantime, Air Canada has been thrown a necessary lifeline. Air Canada stock trades at just under $23.50 currently. It has been flying close to $30 in March, but then the third wave hit. And then the bailout package hit with the possibility of dilution spooking investors. So it’s still a long road with much uncertainty.

Cineplex stock continues to hang in there

Cineplex, on the other hand, doesn’t seem as precarious to me. It’s a very different business with more opportunity to diversify its revenue base. And this is exactly what it has done. Even before the pandemic, Cineplex was diversifying its business away from the movie exhibition business.

From digital media to its online offering of movies and games to its food service offering, Cineplex has more to shelter it from the COVID-19 storm. In 2020, Cineplex continued to be hit hard by the pandemic. Revenue declined significantly and earnings plummeted. Cineplex issued a significant amount of debt and benefitted from government and tenant relief support. Today, Cineplex is in dire straits with a big debt-load, but the end is nearing as vaccinations make their way through to Canadians!

Will vaccinations come on time for Air Canada’s stock price and Cineplex’ stock price?

So the big question is, will vaccinations be quick enough to save these companies from even more prolonged pain? I mean, they will already be feeling the aftershocks of this for years to come. Essentially, I think that Cineplex has a quicker rebound time than Air Canada. It’s just a much simpler proposition with a much lower perceived risk profile. People may need more time to get over the pandemic. They may be hesitant to get back to normal due to their fears. Air travel will probably be harder to recover than a simple night at the movie theatre.

The bottom line

Both Air Canada stock and Cineplex stock have the potential for strong returns once things go back to “normal”. In my view, the risk profile in Cineplex stock is lower that Air Canada stock. The road back from the brink is a lot easier and simpler for Cineplex. But at the end of the day, both of these stocks are risky. So proceed with caution!