It’s not often we’re told to be lazy. But in the case of investing on the TSX today, laziness can be quite the virtue. Yet it’s this fight against laziness that’s actually costing investors a lot of returns. So, let’s dig into why you don’t want to make this investing mistake.

The investment mistake of trading on the TSX today

There are a number of costs associated with investing. That’s true even if you’re investing in something like a Tax-Free Savings Account (TFSA). The first point to consider to prevent an investing mistake on the TSX today is regarding commission fees.

Every time you trade, you are charged a fee. If you were to buy up an equity, you’re likely charged about $10 as a commission fee. That’s fine if you’re trading once a year or even a couple times. But let’s say you’re trading on a weekly or monthly basis. Suddenly, that really adds up.

You may have made $100 in returns, but that’s all gone when you’ve spent $120 on commission by trading once a month! And that goes for both buying and selling. So, say you buy once and sell once per month — that doubles to $240!

I have suggested in the past that you make automated contributions towards a TFSA. I’m not suggesting to stop doing this. Instead, to save on commission fees, wait until there is a dip on one of the equities on your watchlist. Then you’re likely to see a quick turnaround that makes up for that commission fee. And it also means you’re more likely to trade once a year when you’ve built a bulk of cash, rather than on a bi-weekly or monthly basis.

Buying back in

Then there’s the negative impact of not just leaving your investments well enough alone. If you’re investing in strong companies and not looking for a get-rich-quick scheme, then every investor should just being buying and holding until they have to sell.

Let’s take Algonquin Power & Utilities (TSX:AQN)(NYSE:AQN) as an example. The company is a strong utility and renewable energy provider — the perfect choice for any portfolio. Its stable income from utilities means it can create a lot of revenue and acquire more businesses. Meanwhile, its renewable energy assets mean that as the world shifts to clean energy, there should be a boost in returns. It’s a great choice.

For example…

Let’s say you bought Algonquin because it’s doing well on the TSX today from the clean energy boom. You bought it in January and saw it doing well by the end of the month, so you sold it after making about 8% in returns. Fine, you made a couple bucks and sold “high.”

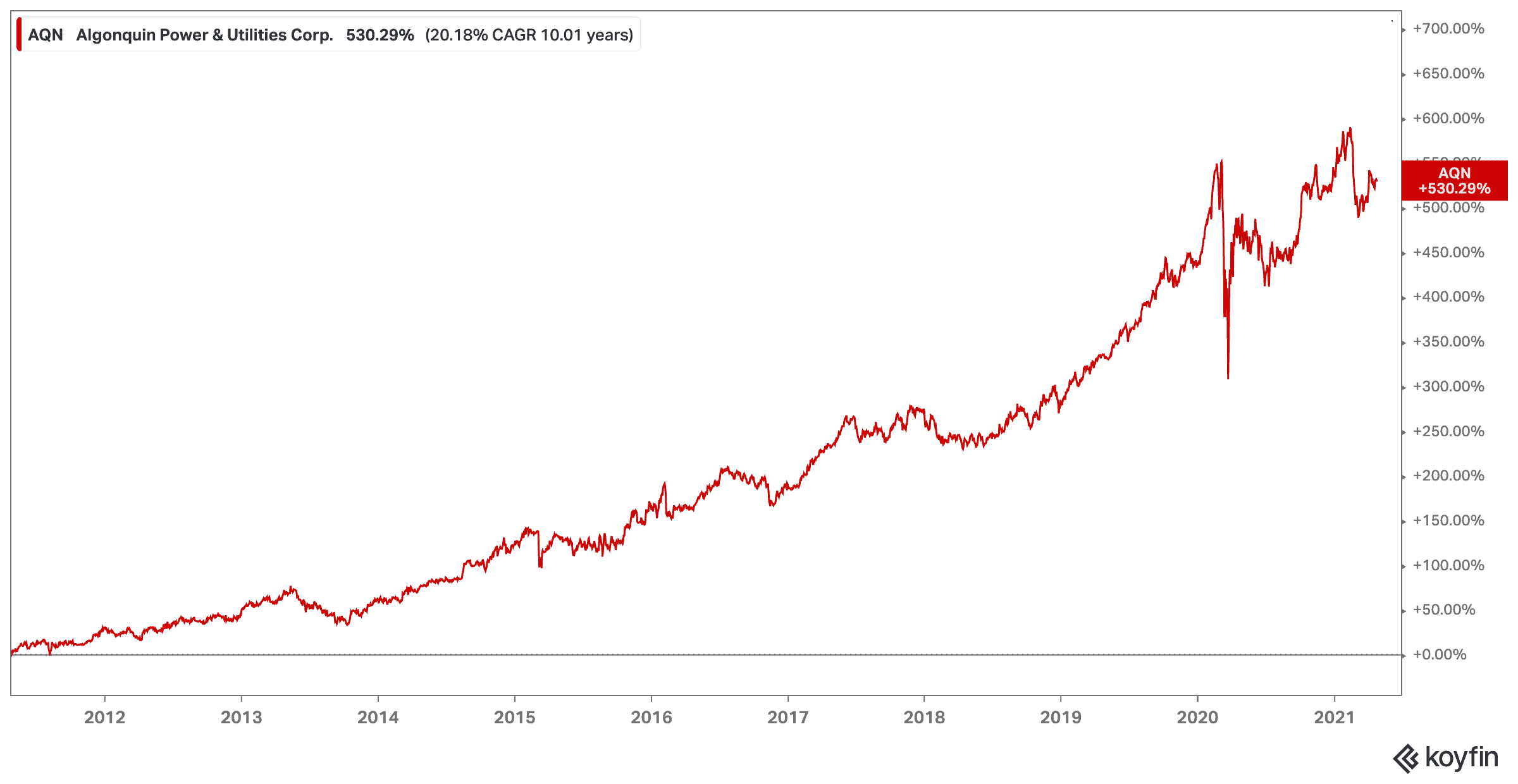

However, there are two investing mistakes you’ve made. As you’ll see, Algonquin stock fell a bit, then climbed some more. It has since fallen back with the pullback in clean energy. But dig in deeper, and you’ll see why you want to hold onto this stock.

This latest movement is based on market movement and not company performance itself. Algonquin shares grew 530% in the last decade for a compound annual growth rate (CAGR) of 20%! It also provides a 3.8% dividend yield that’s grown at a whopping 28% CAGR during that time! So, by holding on to this stock for even just a year, you’ve already missed out on at least 10% already by selling early. You’ve also missed out on guaranteed cash dividends!

Bottom line

To put this investing mistake in perspective, let’s say you invested $10,000 in January and sold in February. That 8% made you $800 but no dividends. Now, let’s say you hold for a decade and see similar growth to the last decade and reinvest dividends. Without adding anything else, your investment would be worth $107,305. Suddenly, that $800 looks like pure garbage.

So, be lazy, and be Foolish. Stick to long-term investing, buying in on market dips on the TSX today. You’ll see returns you never thought were possible.