The COVID-19 pandemic will end, probably sooner than we think. Therefore, the best stocks to buy right now are stocks that will benefit most from an economic recovery, like Canadian National Railway (TSX:CNR)(NYSE:CNI) stock. Yes, I know; an economic recovery might feel like a dream. After all, we’re in the third wave of the COVID-19 pandemic, and all seems dark and hopeless.

But is this the beginning of the end of the darkness? I think we can now see the light at the end of the tunnel. The vaccine is spurring hopes of getting back to “normal.” And with that, an economic recovery is taking shape.

Best stock to buy right now: Canadian National Railway ups its guidance

Canadian National Railway reported its first-quarter earnings yesterday. The result was pretty much as expected. A 3.7% drop in net income followed a quarter that continued to be impacted by the pandemic. But there were signs of hope that came from management’s comments.

Areas of strength for Canada’s railroad included grain, which continued to hit record volumes for the 13th consecutive quarter. Also, the consumer-driven business was booming. In fact, CN’s intermodal business posted a 19% growth in volumes.

CN Rail stock: A play on a post-COVID-19 pandemic recovery

The bottom line here is clear. CN Rail is projecting growth and economic improvement. The company is therefore adding more railcars to its fleet. And the company has raised its EPS outlook. We can now expect EPS to increase in the double-digit range. That’s up from the previously forecasted high single-digit increase.

Lastly, Canadian National has upped its bid for Kansas City Southern. This move was made to position the railroad for the post pandemic recovery. It will position CN to compete with the high-growth long-haul-trucking industry. It’ll connect CN to Mexico, give the auto industry a second line, and allow Canadian aluminum producers to more directly access customers. It will bring more choice and more competition, with a focus on growth.

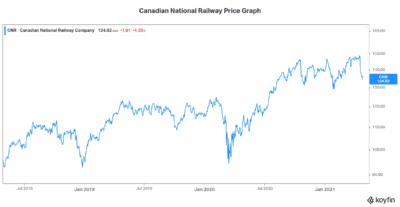

The Canadian railways transport more than $250 billion of goods annually from a diversified list of sectors. Natural resources, crude oil, manufactured products, and consumer goods all find their way to our homes through railways. So, Canadian National Railway is the backbone of our economy. When the economy recovers, Canadian National stock will go right along with it. The graph below illustrates CN Rail stock’s resiliency.

Cineplex stock: Will consumers return to the movies post the COVID-19 pandemic?

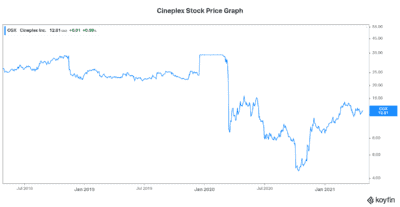

Cineplex (TSX:CGX) stock in another way expose your portfolio to the coming economic recovery. It’s obviously less diversified and more risky than CN Rail. But it is, nonetheless, a stock that has big upside in a post-pandemic world. Cineplex stock has been very volatile since the pandemic hit (mostly on the downside). But this year, it has rallied almost 40%. There’s clear value there once the economy opens up again.

Once the population is fully vaccinated against COVID-19, Cineplex can reopen. The question becomes, will people actually return to the movie theatres and amusement complexes? I guess the answer to this is a matter of opinion. Personally, I believe they will. I can speak from my own personal experience on this matter. My daughters and their friends are so excited to go back to all of it. After so many months of being cooped up at home, there’s nothing that seems more attractive to them right now. I’m guessing that’s a universal feeling.

So, Cineplex has survived with government help as well as tenant-relief programs. It’s also survived by focusing more on its online offering, and its digital and food businesses.

Motley Fool: The bottom line

Canadian National Railway’s business is directly tied to many aspects of the economy. If they say they are seeing the beginning of a post-pandemic recovery, I would believe it. CN Rail stock and Cineplex stock are two of the best stocks to buy right now in preparation for it.