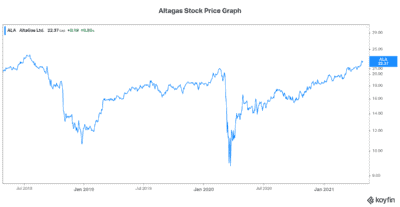

Top dividend stocks like AltaGas (TSX:ALA) stock weren’t always perceived as such. In fact, in 2018, AltaGas was the opposite of a top dividend stock. It slashed its dividend. The stock price came crashing down. And debt levels were high. All of this was covered extensively by Motley Fool writers like me. But let’s fast forward.

Today, AltaGas stands as one of the best comeback stories that places it back into its top dividend stock standing. And this time, all indications are that this advantage will be maintained for the long term.

Exceptional earnings growth makes AltaGas a top dividend stock

AltaGas stock is up almost 90% since it crashed in December 2018 after its 56% dividend cut. It was a move that was necessitated by the company’s debt-laden balance sheet. And its debt-riddled balance sheet was the result of AltaGas’s $8.4 billion acquisition of WGL Holdings Inc., a U.S. utility company.

It was a move that made sense. But the financial risk behind this debt-fueled acquisition did not always seem so clear to the market. Today, AltaGas continues to prove the benefits of this acquisition to the delight of shareholders like me.

AltaGas released its first-quarter earnings result today. EPS rose more than 60%, blowing past expectations. Along with this, AltaGas raised its 2021 earnings expectations. At the mid-range of its expected 2021 earnings guidance, AltaGas will achieve a 22% increase in EPS. This demonstrates the power of the company’s strategy and transformation. I mean, AltaGas is an energy infrastructure and a utility company. How can it grow so quickly?

AltaGas’s midstream segment provides the growth

I’ve written many Motley Fool articles on this company, because I’ve believed in its value proposition. AltaGas’s midstream business is located in Western Canada. It includes processing and export facilities. These assets are located in some of the fastest-growing markets in North America. They include the Montney and Marcellus/Utica basins.

These are extremely liquids-rich formations. They hold an estimated 449 trillion cubic feet of natural gas, a substantial amount of natural gas liquids, and a significant amount of oil. They’re also low-cost basins that are very competitive.

All the basin needs is a build-out of infrastructure to take the gas out to different markets, including the U.S. and Asia. This is not a simple task as we have seen in recent years. But now, stronger natural gas prices are changing things. Progress is happening.

AltaGas’s Ridley Island Propane Export Facility was completed in May 2019. It will provide Canadian natural gas producers with the ability to export their propane to markets in Asia. This facility, along with the Ferndale facility, will deliver lower carbon-intensive fuels to Asia for years to come.

AltaGas’s utility segment provides stability and predictability

AltaGas has once again reduced its debt burden with the sale of certain U.S. storage and transportation assets. This, mixed with AltaGas’s utility segment, will ensure a level of stability for the company. The utility segment accounts for 56% of total EBITDA. The remaining EBIITDA comes from the midstream segment. So, as we can see, AltaGas is a nice mix of stability and growth.

Motley Fool: The bottom line

AltaGas stock is a top dividend stock today. This is because of its current 4.5% dividend yield. It’s also because of the its strong growth prospects, which are leading AltaGas into a very lucrative future.