Historically, stocks have been known to provide lacklustre returns during the summer months between May and October. Hence, traders coined the old adage “Sell in May and go away,” which urges investors to exit the stock market in May and come back in November. This strategy could have worked well for some time, but should Canadian stock investors follow it right now?

How has the “sell in May” strategy performed on TSX stocks recently?

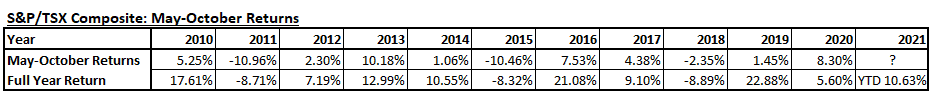

This strategy is said to have produced positive results from the 1950s until the early 2000s on selected U.S. and European indices like the Dow Jones, but the “sell in May and go away” strategy has produced mixed results on the S&P/TSX Composite Index over the last decade.

In 2011, you could have avoided a 10.9% loss and a similar drawdown in 2015. However, investors who sold in May also lost an opportunity to gain 10.18% in 2013, and 7.3% in 2016. More than 78% of stock market investment returns in 2013 were earned between May and October. Again, nearly half of the 9.1% total return on the TSX for 2017 was earned between May and October.

Most noteworthy, if you sold TSX stocks in May of 2020 and came back to the market in November, chances are high that you lost money last year. You probably bought high in November of 2019 and sold low during the market crash for a near 10% loss.

That said, buying TSX stocks in November of 2020 and holding till the beginning of May this year could have produced a nice 24% return during the six-month period. However, this had more to do with the ongoing COVID-19 recovery and nothing to do with annual seasonality.

Should Canadian investors sell TSX stocks in May and go away?

There are a number of considerations Canadian investors have to make regarding selling TSX stocks in May and going away in 2021.

Firstly, the TSX is still in a recovery mode post the 2020 pandemic shock. Strong recoveries in the energy sector, REITs, and many other impacted areas could continue to propel capital gains over the next six months. Opportunities for positive returns might be lost if one sells in May and buys back into the market in November.

Secondly, selling in May could mean the immediate realization of capital gains. The TSX has rallied by 10.63% so far this year, and one may understandably be tempted to book the gains and go away. However, if one trades in a taxable account, capital gains taxes will hurt the portfolio. I would aim to delay taxes in taxable accounts as much as possible.

Perhaps one may decide to book the gains in a Tax-Free Savings Account (TFSA). That’s an option, but it comes with the risk of overtrading in a TFSA. If you hold many positions, you risk being heavily taxed by the Canada Revenue Agency (CRA). The taxman may deem your capital gains as trading income and tax you accordingly.

Lastly, past performance is not a perfect predictor of future returns. Selling in May of the 1950s and going away may not work in a 2021 world where home-based retail traders on brokers like Robinhood combine with high-frequency trading algorithms push trades through the exchanges every second, even during extended market hours for TSX stocks listed on U.S. exchanges. Times may have changed, and that old market anomaly may not be a rewarding strategy now.

Foolish takeaway

The recent performance for the “sell in May and go away” stock trading strategy on TSX stocks hasn’t been convincing during the past decade. Perhaps the regime has changed, and the market anomaly is no longer present.

Unlike short-term traders, long-term investors like investing legend Warren Buffett take advantage of their time in the market which usually rewards them better than timing the market.

Foolish investors are better off staying invested in the market for the long term, even during market crashes. Investors who took hid of this advice during the 2020 market crash did well. The strategy is simple: buy and hold high-conviction stocks, hang on to equities all year round, year after year, and stay invested, unless the stock’s fundamentals have changed. There won’t be any room left for the May trade.