Suncor Energy (TSX:SU)(NYSE:SU) is one of Canada’s leading oil and gas companies. Yet Suncor stock has been in the dumps the last few years. So has the whole oil and gas sector. There were just too many issues dragging it down. For example, volatile oil prices made the sector too risky. Also, environmental concerns just scared investors away. But today, we’re seeing the tide turning.

Here’s why Suncor stock is a stock to buy now.

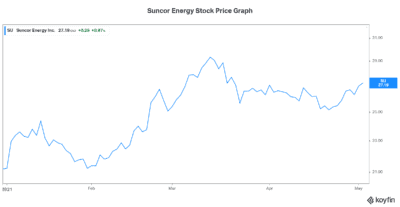

Suncor’s stock price rises from the ashes as oil prices rally

In the last year, the price of oil has skyrocketed. It’s up almost 150% since May 2020, and the momentum continues to build. This is due to a perfect storm of sorts. During the pandemic, uncertainty was high. Oil prices came crashing down. This resulted in much lower production as oil and gas companies held onto cash. In other words, supply was hit.

Today, we are close to the end of the pandemic. The market is now starting to price in a surge in demand as COVID-19 restrictions are slowly being lifted. Large spikes in demand are very bullish for oil and gas prices. The demand side is looking increasingly stronger.

As a result of this changing backdrop, Suncor’s stock price has soared almost 30% in 2021.

So, the fundamental supply/demand balance has shifted. With supply having fallen and demand now rising, we have an extremely bullish scenario for oil and gas companies. Suncor reported its first-quarter earnings result this morning. And consistent with what we would expect in this environment, the quarter was strong.

Suncor delivers strong cash flows … and ambitious cash flow plans

Cash flow generation has always been one of Suncor’s strengths. In the latest quarter, Suncor’s cash flows doubled — yes, doubled to $2 billion compared to the $1 billion in Q1 of 2020. This is attributed to rising commodity prices. But it was also helped by Suncor’s relentless focus on cost reductions. For example, Suncor is restructuring its staffing. It’s making use of autonomous trucks, which is driving down costs. And lastly, Suncor is streamlining its supply chain and its corporate functions.

At the end of the day, these efforts will drive Suncor stock higher by bringing significant cost savings. Suncor is targeting incremental cash flow of $1 billion by 2023 and $2 billion of incremental cash flows by 2025. Suncor breaks even at $35 oil. Oil is currently at $65. This translates into massive cash flows for 2021 and beyond assuming oil prices hold firm. This makes Suncor a top stock to buy today.

Suncor stock will continue to rally as the company cleans up its act

Suncor’s stated greenhouse gas emissions goal is to “harness technology and innovation to reduce our emission intensity by 30% by 2030.” This is to be achieved by using more co-generation facilities, which is a highly efficient technology that reduces waste by investing in technology to change the way the company extracts and processes the oil sands, and by conducting research into carbon capture and conversion technologies.

Finally, the company’s initiative also includes investing in lower carbon forms of energy, even including renewable energy such as wind and biofuels. This signals this $65 billion company’s intention to be around for the long term.

Motley Fool: The bottom line

Suncor stock remains a stock to buy today and for the long term. Strong cash flows translate to strong shareholder value creation. And this translates to happy shareholders.