Canada’s leading supply chain management and concurrent planning software maker Kinaxis (TSX:KXS) reported its first-quarter results for 2021 after markets closed on Tuesday, and its stock price fell more than 5% on Wednesday. Q1 revenue increased 9.4% year on year to US$57.7 million, while earnings dipped 130% to a US$0.06 loss per share. Kinaxis stock is down nearly 33% over the past six months, but there’s still a strong chance that shares could recover from the decline suffered so far this year.

Canadian investors paid hefty premiums on companies like Kinaxis whose revenues and cash flows were largely unimpacted by the COVID-19 pandemic last year. Tech stocks were top gainers during the 2020 crisis. However, we have seen valuation multiples generally contract, as international vaccine rollouts gathered pace in 2021.

Why has Kinaxis stock fallen so far in 2021?

It’s not just the above-noted multiples contraction that’s to blame for an 18% decline in Kinaxis’s stock price so far this year.

The company acquired Rubikloud to add AI and machine-learning capabilities to its platform in 2020. Combined with an earlier acquisition, quarterly cost of sales and operating expense run-rates increased more than revenue grew. Higher costs plunged the company into quarterly operating losses by December last year.

Moreover, in March, management issued a slower-than-usual revenue-growth outlook for 2021. On Tuesday, the company reiterated its prior revenue guidance for an 8-10% year-on-year growth to US$242-US$247 million for 2021. Investor interest in the high-priced tech growth stock has dipped further.

That said, even as valuation multiples contract, Kinaxis is one high-quality tech stock that has become cheaper for long-term-oriented investors to buy right now.

What could drive Kinaxis’s stock price going forward?

Three things usually drive a stock’s return for investors. The company can grow its revenue or earnings (or any other item upon which a valuation multiple is derived — for example, its cash flow per share or its adjusted EBITDA). It can also pay or increase its dividend per share, or the market could become more bullish about its future growth prospects and pay a higher premium on its stock, thereby expanding its valuation multiple.

Kinaxis hasn’t paid a dividend yet, and I don’t expect it to initiate a dividend in the near term. The company is still investing in growth projects. However, revenue, earnings, and cash flow growth could potentially surprise to the upside and command a return to multiple expansions later in 2021.

Analysts still expect the company to grow total revenue by 9.8% in 2021. They see growth accelerating to 28.2% by 2022.

However, a review of the company’s earnings call on Wednesday gave the impression that Kinaxis is seeing an accelerated customer uptake of its RapidResponse platform right now. The company is now deliberately targeting mid-sized firms and has shortened the time it takes for a customer to deploy the product and realize quick returns on investment.

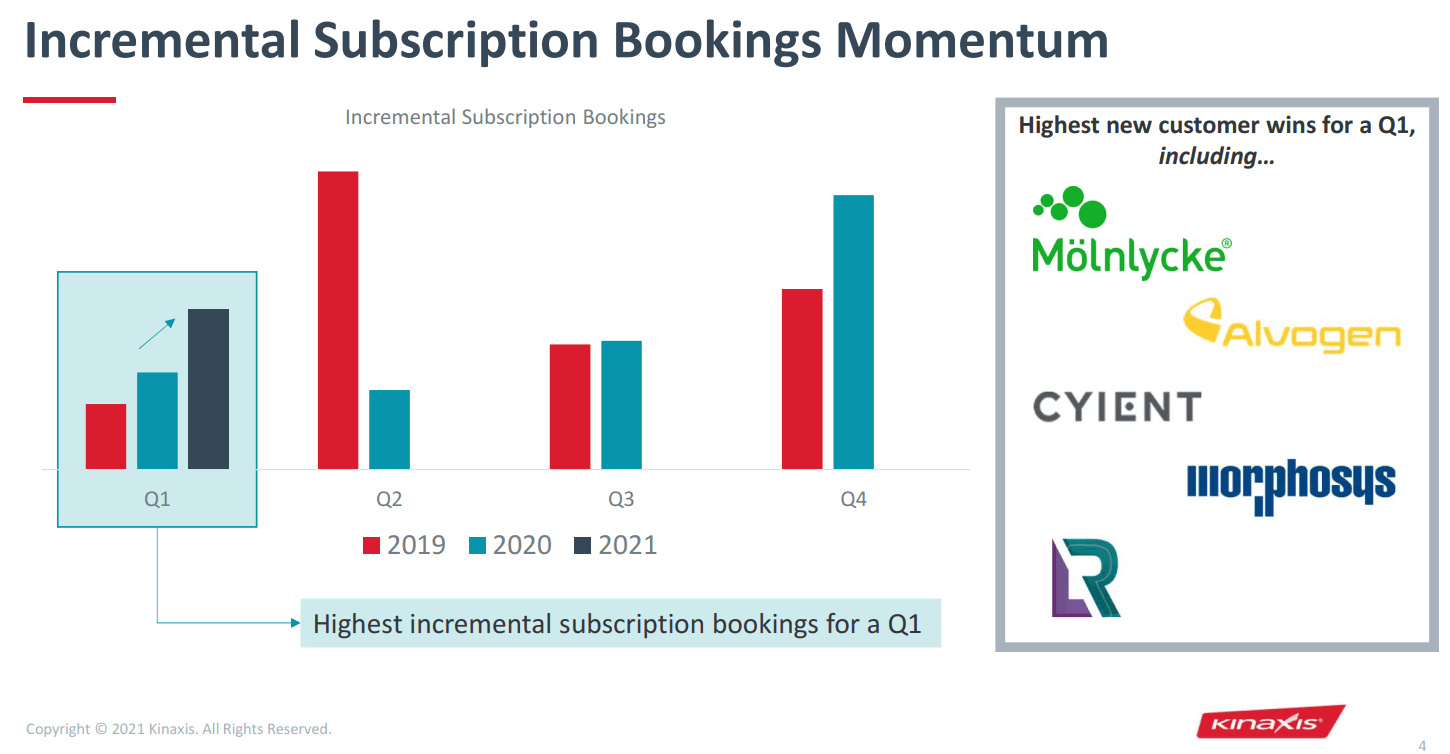

The company’s incremental bookings during the first quarter of 2021 were a record. This trend seems to persist from the last quarter of 2020, labeled Q4 in the graphic below.

The company is now capable of onboarding a new customer in just 12 weeks. I would expect its land-and-expand strategy to generate massive organic growth for many years. The company has a strong +100% revenue-retention rate and its customer backlog continues to increase at double-digit annual growth rates. Most noteworthy, its most recurring Software-as-a-Service (Saas) revenue backlog increased by 16% during Q1. I expect SaaS revenue to return to its historical 23-25% annual growth rate by next year.

Interestingly, management reiterated its subscription term licence revenue guidance for 2021 at US$3-US$5 million for 2021, despite booking US$2.1 million (over 50%) on the line item during the first quarter. It’s highly likely that the company is being too conservative and setting the stage for a significant revenue beat for 2021.

Investor takeaway

Investor enthusiasm could soon return to Kinaxis — a high-quality TSX growth stock that has no debt on its balance sheet. Valuation multiples could expand again before year-end if management increases its earnings guidance in upcoming earnings releases.

Kinaxis stock could recover from earlier losses suffered in 2021.