The two top Canadian railroad stocks are locked in a battle to acquire the clutch railway business of Kansas City Southern (NYSE:KSU). Frankly, in a world where railroads are as hard to build as pipelines, it is understandable why the battle has turned tooth and nail.

The KSU network could be a game changer for these stocks

That is why the KSU network is so key. Whoever gets KSU gets to exclusively connect three industrial-leading countries together. It’s a toll-road arrangement every railroader dreams about. Not only is there the geographic advantages, but there are also significant operational synergies that can be unlocked over time.

In an industry where results are largely based on volumes, efficiency, and the overall economy, the opportunity to buy an entire railroad is literally “once in a lifetime.” With that in mind, I guess you can understand why this deal is so important. Given this, I guess the question needs to be asked: which of these value stocks is better to own today?

Canadian National is one of the biggest

Canadian National Railway (TSX:CNR)(NYSE:CNI) is, by far, the larger of the two Canadian railways. It has a market capitalization of $94 billion and is the fifth-largest Class 1 railroad in the United States. CN is known as Canada’s north-south rail line, because it spans all the way from Yellowknife to New Orleans. It has approximately 20,000 miles of track in its network.

Despite its expansive network, its stock has lagged over the past few years. In fact, year to date, the stock is down 4.5%. In the first quarter of 2021, year-over-year revenues were stagnant (and have not improved since 2019) and its adjusted operating ratio of 66% actually got worse. Regardless, the company is still very profitable, but perhaps not as profitable as it could be.

Certainly, CN has the balance sheet to complete its $33 billion takeover offer of KSU. However, there are many questions as to whether regulators will allow it. It would make it a behemoth in the U.S., and fair competition/pricing could be compromised. Given the collapse in the share price, it appears many shareholders are not loving the deal. The good news is this could present an attractive buying point for new investors.

Canadian Pacific is the best operator

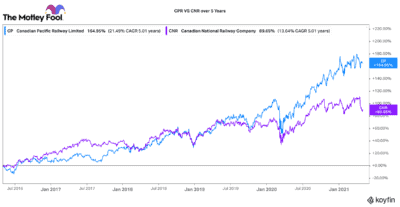

Canadian Pacific Railway (TSX:CP)(NYSE:CP) is almost half the size of CN. It has a market capitalization of $49 billion. CP is the smallest Class 1 railroad in the United States. It operates 13,000 miles of track across Canada and the northern United States. Over the past five years, and particularly the last year, CP stock has outperformed CN’s. In fact, it has doubled CN’s returns.

This is largely because CEO Keith Creel has relentlessly pursued operational efficiencies and organic growth initiatives. While revenues declined 4% in the first quarter, the company still improved its adjusted operating ratio 70 basis points to 58.5%. That’s industry leading! Despite the pandemic, CP broke records for transporting grain, automobiles, and intermodal.

All in all, I like this stock for the fact that it makes much with little. The lower its operating ratio, the more profitable it is. Given a singular connection in Kansas City, I believe the KSU acquisition is a great fit. Regulators could smile more favourably on a smaller railroad merging with an equal. However, the deal comes down to price. Should CP match CN’s bid, I would start to get very concerned about its balance sheet. Its current offer is already a substantial bid for a railway.

Which stock should you buy?

So, which stock should you own? To be honest, both are great businesses that are well managed and well capitalized. Certainly, CN’s recent stock dip could be an attractive long-term buying opportunity. Likewise, it has a lot more room for operational improvement and better margins.

However, CP is undoubtedly one of the best operators in North America. It has a top management team that can make just about any asset profitable. If it can succeed through the bidding war (and subsequent regulatory hurdles), the KSU merger could propel exceptional returns going forward.

Considering this, my bet today is on CP. Given the increasing drama unfolding, however, that wager could change quickly.