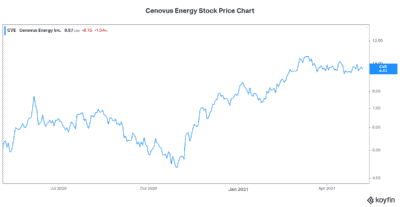

Energy stocks have been rallying lately, as the price of oil has come alive again. Within this group, Cenovus Energy (TSX:CVE)(NYSE:CVE) stock is a very bright spot.

The backdrop is clear and bullish. Oil has rallied 34% in 2021. Also, the North American population is quickly being vaccinated. Things will be opening up again soon. Within the oil and gas sector, Cenovus Energy is the stock to buy now. Here are the catalysts that should drive the stock higher.

Cenovus Energy stock should rise, as its debt-reduction plan is implemented

First-quarter results at Cenovus highlight the cash flow-generation power of this company. Driven by the sharp rise in oil prices, cash flow from operations increased more than 80%. But when we adjust for one-time items, cash flow was even stronger at $1.1 billion. Free cash flows are also soaring at $600 million this quarter. This places Cenovus in a very bright spot. And this energy stock has already started rising as a result.

The company’s stated priority is to reduce its debt. The acquisition of Husky Energy, while extremely well timed, drove debt levels to uncomfortably high levels. But today’s environment is the perfect one for Cenovus to work this down. The company expects the $13 billion of debt to be $10 billion by the end of the year. This would open the door to other forms of capital allocation. Maybe we’ll see a return of capital to shareholders from this energy stock at this time.

Ultimately, management’s goal is to maintain a net debt level of at or below $8 billion. Deleveraging is top priority for Cenovus. Given today’s commodity prices, there’s a good possibility that the company will meet debt target levels sooner than the stated targets.

Cenovus’s Husky acquisition: Synergies will be higher than $1.2 billion

At the time of the Husky acquisition, Cenovus laid out its plans and expectations. The company told investors that it expected $1.2 billion in synergies. But today, we have gotten further colour. The reality is that this $1.2 billion is the low bar of what Cenovus expects in synergies. It includes the low-hanging fruit like staff reductions.

Now, the company is getting to work on the upside. Cenovus is a leader in operational processes and efficiencies. It’s getting to work on using its operational know-how on Husky’s assets. From longer wells to better completions, Cenovus is making changes. And this is driving efficiencies. These efficiencies and productivity gains translate to more synergies on the Husky deal. This energy stock is just getting started.

Cenovus Energy stock to benefit from strong oil prices as economies reopen

So, we have seen how Cenovus Energy stock is already benefitting from rising oil and gas prices. But what’s to come is even better. Vaccinations are making their way to North American populations. The end of the pandemic is in sight — at least the end of disruptions due to the pandemic. We will soon be able to go about our lives in a more “normal” fashion.

According to Cenovus’s CEO, Alex Pourbaix, there are clear signs that a demand recovery will happen in refining this year, especially in the United States. With this, we can extrapolate the first quarter’s strong results to the rest of the year. In fact, momentum is building — Cenovus Energy stock remains undervalued.

Motley Fool: The bottom line

Cenovus Energy stock has many upcoming catalysts. This makes it an energy stock to buy now. The macro backdrop is improving significantly, which is driving all energy stocks higher. Cenovus has this, plus its company-specific catalysts, which work together. In my view, this makes Cenovus Energy stock the best energy stock to buy now.