According to market data from Coinbase, Ethereum hit a new all-time high of $5,172.12 (US$4,172.10) per coin during the early hours of Monday. The cryptocurrency remains a star of the moment, as Dogecoin corrects back to US$0.51 from a record of US$0.74 seen on Saturday, May 08. Cryptocurrency miner Hive Blockchain’s (TSXV:HIVE) stock could continue to enjoy massive benefits from the latest cryptocurrency market development.

Why is Ethereum rising?

While speculative buying and selling continue to increase transaction volumes for cryptocurrencies in 2021, as it did back in 2018, there could be some changes to underlying demand drivers for Ethereum in 2021.

Ethereum monthly transactions hit a new record of 41.76 million transactions for April. This was after recording another record high of 39.24 million for March. The previous all-time monthly transactions record was 36.68 million transactions in one month set in August 2018.

Unlike Bitcoin, which is mainly seen as a store of value and whose valuation rides on popularity due to first-mover advantage, Ethereum is an open-source blockchain technology platform that is open for institutions to develop real-world applications. A surge in Decentralised Finance (DeFi) applications and transactions has done great for Ethereum adoption. Ethereum transaction volumes and associated transaction fees have been hitting new records so far this year.

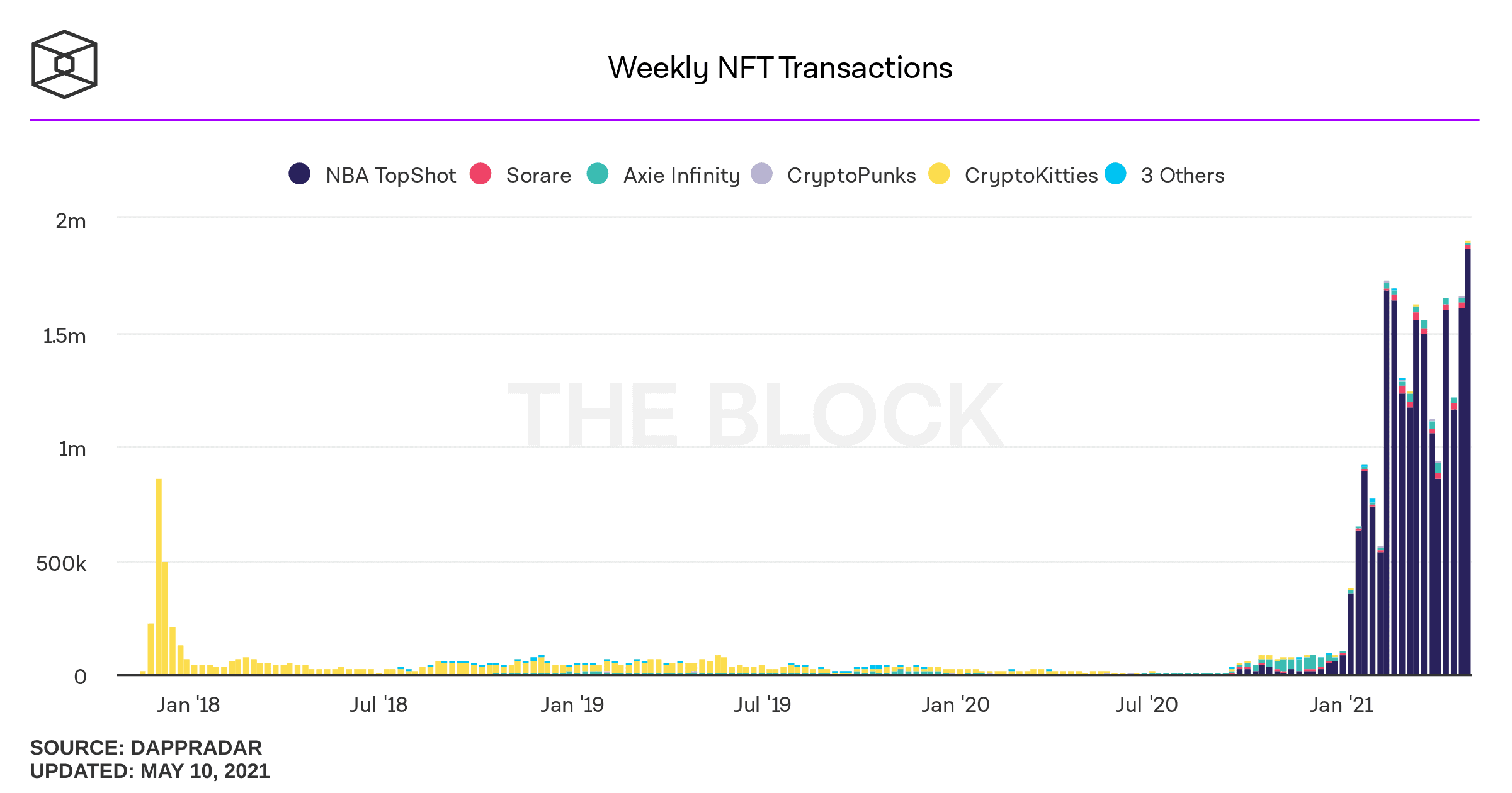

Moreover, the recent hype on Non-Fungible Token (NFT) transactions has been a significant tailwind for Ether. NFTs are mostly being created on Ether, and transaction settlements are done on Ethereum. Ethereum transactions should continue to surge, as daily average NFT transaction settlement requests increase.

Most noteworthy, if the rumours of a new Ether-based social network become any fruitful, the coin’s ecosystem could be even more vibrant going forward. It appears that Ethereum has been more successful in bringing more blockchain functionality and usability to humanity than Bitcoin, at least for now.

How does Hive stock benefit?

Hive Blockchain is one rare publicly trading cryptocurrency miner with exposures to both Bitcoin and Ethereum economics. Not only does the company’s crypto coins portfolio value benefit from the recent surge in Ethereum and recovery in Bitcoin, but the miner is also enjoying good revenue growth and growing profits from rising Ether transaction volumes and associated transaction fees.

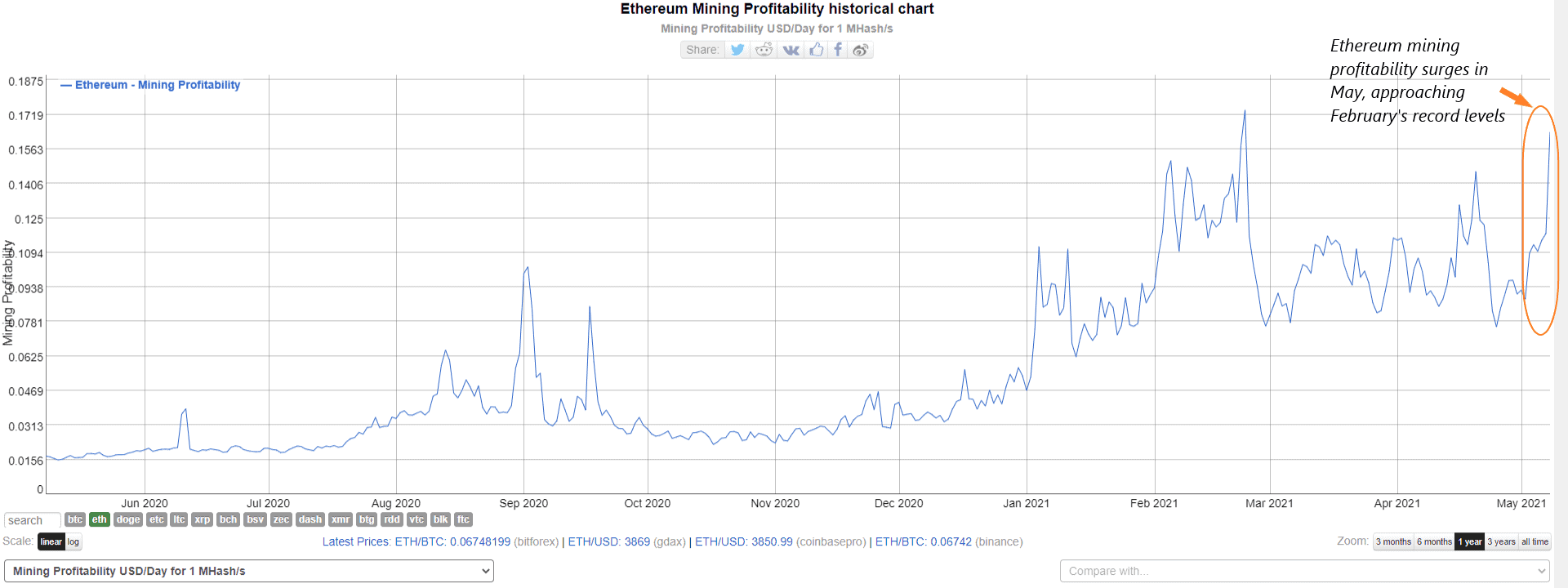

Ethereum transaction fees remain elevated, and miners get to cherry-pick on transactions offering the best fees. Miners will give first preference to orders offering higher fees. Transactions offering lower fees get to wait for a bit. Resultantly, total Ethereum miner revenue has been surging so far this year, and it hit a record at US$1.65 billion for the month of April.

You may have guessed it, but mining profitability is very high on the Ether blockchain right now.

Miners have seen demand for transaction validation services increase with more uses for Ethereum.

Hive’s stock price could return to growth after a recent consolidation, as mining business conditions consistently improve. Increasing revenue should allow the cryptocurrency miner to grow into its valuation. Hive stock could rise if the market maintains its high valuation multiples on the ticker constant. The last 12-month enterprise value-to-sales multiple on the miner’s shares stands at 31.6 today.