In a market update provided on Monday, cryptocurrency miner Hive Blockchain Technologies (TSXV:HIVE) reported that its Bitcoin and Ethereum portfolio value has reached US$109 million. This implies a staggering 81.7% increase in the portfolio’s value in just over a month. However, Hive stock fell 5% on Monday. Investors could have viewed the latest growth rate as too slow.

Hive Blockchain’s coin inventory surges by 82%

Hive’s coin inventory stood at 20,030 Ethereum (ETH) coins and 320 Bitcoins (BTC) on March 31 this year. The portfolio was valued at US$60 million at the time. Since then, management revalued it to US$75 million on April 16 before reporting a US$109 million valuation yesterday.

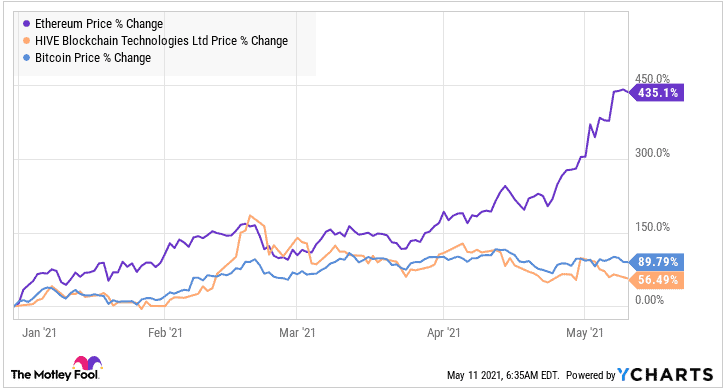

The company’s portfolio value is increasing due to two main components: increasing cryptocurrency prices, especially for Ethereum, and new mining production. Ethereum has continued to skyrocket in 2021, while the company acquired a 50 megawatt Bitcoin mining data centre recently.

New ETH and BTC production is being “banked” in cold wallets. However, it appears like rising coin prices contributed more to wallet inventory value growth rates than new production during the past month. The company could have done better.

Why do Hive stock investors expect higher growth rates?

Hive’s latest portfolio revaluation was computed at Ethereum and Bitcoin prices of US$3,900 and US$59,000, respectively. Revaluing the company’s portfolio at March 31st inventory quantities produces a new value of US$97 million. This implies that new mining production since April has only contributed US$12 million to inventory. This is a concerningly low number.

The company changed its coin sales policy for the calendar year 2021. The company is no longer selling its mined ETH and BTC coins to fund operating costs and capital expenditures like it used to do. Management is banking new mining proceeds in cold wallets with a goal to create value for shareholders and improve balance sheet liquidity.

HIVE produced 21,500 Ethereum coins and 165 Bitcoin during the final three months of 2020. This implied a monthly average production of about 55 Bitcoin and over 7,000 Ethereum coins. Assuming prior productivity rates persisted into 2021, investors would expect the company to have added more than US$32 million to its coin inventory during April.

Given the US$12 million worth of new production, Hive probably produced “too few” ETH and BTC coins last month versus past run rates.

What slowed ETH and BTC production rates?

I suspect the diversion of some computing power towards a third, smaller yet highly profitable coin stalled Hive’s coin inventory growth in April.

Lured by a substantial increase in Ethereum Classic’s price during the past few months, management diverted some mining capacity towards ETH Classic in April. However, Ethereum Classic coins produced are generally being sold on the market to help fund electricity costs and other basic general and administrative expenses.

Further, the company was upgrading memory chips at its Ethereum mining facilities. Moreover, components were slow to arrive from China due to ongoing chip shortages.

Is this a bad thing?

The truth is, the company can’t have its apple and still eat it at the same time. The company still needs to generate daily cash flows to finance its operations. It’s either Hive sells some coins regularly for regular liquidity, or it banks all its mining production in cold wallets, then repeatedly approaches capital markets for new financing.

I would prefer that the company strikes a balance between growing the balance sheet while also self-financing some operating costs. This strategy seems to be working well, with cash balances rebounding from about US$30 million on April 16 to US$33 million on Monday.

Investor takeaway

Hive stock investors expect the company to produce more coins and higher cash flows in the future. The company’s productivity rate is a significant factor to check now and then. Wallet inventory growth rates potentially slowed in April. However, management is striking an intelligent balance between operational liquidity and balance sheet growth. There’s still value in that strategy — it minimizes shareholder dilution.

Most noteworthy, as the company rides on the decentralized finance (DeFi) transactions growth and rallies in cryptocurrencies, the company is considering distributing its shares as a dividend this fiscal year. Investors could reap significant returns on Hive stock again this year.

Claim Membership Credit

Claim Membership Credit