Aphria is no more!

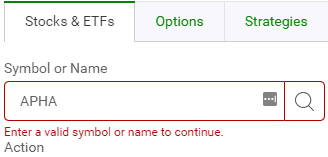

As a publicly traded company, it stopped existing earlier this month. If you try to trade the “APHA” ticker, your broker will give you a message like the one shown below:

It’s all the result of the Aphria/Tilray (NASDAQ:TLRY)(TSX:TLRY) merger, which turned both companies into one company operating under the name “Tilray.” It was one of the most anticipated M&A deals of 2021, and this month, it finally closed.

We’ll have to wait a few months to see how the new combined company is doing. Tilray released its first-quarter earnings on Monday, but they didn’t include any earnings from Aphria. In the next quarterly report, we’ll get to see how the two together are doing. Until then, we can only speculate based on Aphria and Tilray’s individual earnings in their most recent periods.

Details of the merger

The Aphria-Tilray merger was basically a “reverse acquisition,” meaning the company that was bought was the one that survived. Technically speaking, it was Tilray that acquired Aphria. But the terms of the merger gave 62% ownership in the new entity to Aphria shareholders.

Going by revenue, the new Aphria/Tilray entity is the largest cannabis company in the world. Canopy Growth (TSX:WEED)(NYSE:CGC) still has it beaten on market cap, by more than a 2:1 ratio. But thanks to the merger, Aphria/Tilray now sells more cannabis than any other entity on earth. That could provide the potential for it to catch up with Canopy’s valuation eventually.

What about Canopy?

Speaking of Canopy…

It is not only not the biggest cannabis company in the world; it’s not even the biggest in Canada anymore.

Tilray is headquartered in Toronto now, as was Aphria before the merger. Thanks to the merger, Tilray is now the market-leading Canadian cannabis firm.

That’s bad news for Canopy shareholders.

For a long time, the thesis on investing in Canopy was based on its market position. After receiving a $5 billion cash injection from Constellation Brands, Canopy was seen as having the potential to remain the dominant player in the global cannabis industry forever.

That seems unlikely to happen now. Canopy has been experiencing significant revenue growth deceleration in recent years. In its most recent quarter, Canopy’s revenue was up 25%, which is a solid growth rate, but nothing compared to what it used to post. Also, Canopy ran a whopping $829 million net loss on its $169 million in revenue. Not only is it losing money, but it’s losing multiples more money than it’s taking in. In the third quarter, Canopy took $400 million in impairment charges, stemming from investments it made that weren’t worth the price paid. In the lead up to legalization, the company spent enormous sums of money buying up competitors, but most of the investments didn’t pan out. Now, the company’s cash pile from Constellation Brands is dwindling, and it doesn’t have much to show for it.

Foolish takeaway

Cannabis stocks haven’t been as hot in 2021 as they were in 2018, and for good reason. Since legalization, their earnings results have mostly disappointed. Perhaps the Aphria/Tilray merger will change the game. But for now, the cannabis space looks like a loser.