Suncor Energy (TSX:SU)(NYSE:SU) and Air Canada (TSX:AC) are two of the most popular stocks in Canada. They also happen to be two of the most impacted businesses by the pandemic.

Air travel has been decimated and is easily one of the most impacted industries there is. Energy, though, has also been impacted significantly, which is unsurprising given travel and other mobility is down substantially, as countries all over the world have been trying to stop the spread.

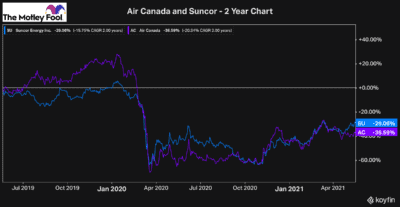

Looking at a two-year chart of both stocks, it appears they are both significantly undervalued.

As you can see, both stocks are down by roughly 30% or more over the last two years.

However, just because stocks used to be high and are now low doesn’t mean they will recover. When it comes to some of the best businesses in their industry, though, there is certainly a lot more potential for recovery, and a rapid one at that.

So, it’s understandable that Suncor and Air Canada continue to be some of the most popular stocks in Canada.

Here’s what to consider before making an investment and which is the better buy of the two.

Air Canada stock

Many consider Air Canada to be trading at a discount because the stock is a lot less than it was before the pandemic. However, you have to remember that Air Canada has lost a tonne of value over the last year.

There are some stocks like Suncor that have lost some value over the course of the pandemic — but nowhere near the cash Air Canada was losing.

So, its current price is actually a lot closer to its true value than many think. A few weeks ago, I explained how even if the stock recovered to full capacity overnight, it likely wouldn’t be worth any more than $32 to $36 a share.

And considering Air Canada is extremely unlikely to return to full capacity anytime in the near future, the stock’s potential is likely even less than that. Analyst estimates are right on the money, in my view, with an average target price of roughly $30.

That doesn’t leave very much upside potential for investors, considering Air Canada trades at $25 today. And when you consider there still so many risks with an investment in an airline stock, less than 20% upside over the course of the next year may not be worth it for many investors.

Why Suncor is the better stock to buy now

Suncor stock is in a slightly similar position to Air Canada. However, it is much better positioned for a recovery. In fact, Suncor and the entire energy industry have already been recovering rapidly.

Don’t get me wrong; an investment in energy is not without risks either. However, it’s nowhere near as risky as Air Canada stock is today. Furthermore, Suncor is one of the best and most resilient stocks you can buy in the rapidly recovering energy industry.

Oil prices are up roughly 35% year to date, which is why the entire sector has been rallying. Plus, Suncor’s recent earnings report shows promise of a strong recovery, and the company reaffirmed its guidance for 2021.

This has the average target price among analysts at roughly $35, just under 20% upside from Wednesday’s closing price.

The stock offers similar upside potential to Air Canada stock. However, it also pays a 3% dividend and, as I mentioned before, it’s a lot less risky.

So, considering Suncor stock is one of the top Canadian stocks in the energy industry, it’s a stock I’d be looking to buy over Air Canada today.