The best stocks to buy right now are in the energy sector. It’s a sector that has a rough many years. It’s also a sector that is in the midst of a rebound — a rebound that was a long time coming and that has a big runway ahead. Suncor Energy (TSX:SU)(NYSE:SU) stock is only one of the top stocks I will discuss here.

Improving oil and gas fundamentals: The best Canadian stocks to buy are in the energy sector

Natural gas supply fell 4% in 2020 due to the pandemic. Similarly, COVID-19 also had an impact on oil supply. In fact, OPEC agreed to cut production by 10% during the pandemic. Furthermore, production in North America also fell dramatically. So, here we are today with lower production (supply) combined with growing demand. Demand is growing because we’re heading out of this pandemic and because long-term demand continues to be supported by growing population at home and rising standard of living abroad.

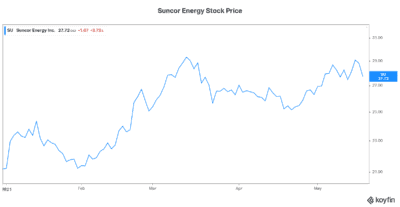

Suncor Energy: A dividend stock with integrated oil and gas exposure

Suncor Energy is Canada’s leading integrated energy company. It is an operational leader in oil sands, exploration, and refining and marketing. It’s this integrated businesses model that makes Suncor stock so interesting. It means that Suncor will benefit from rising oil and gas prices while being sheltered from price swings. This makes it a reliable dividend stock and a top stock to buy.

Cash flow generation has always been one of Suncor’s strengths. In the latest quarter, Suncor’s cash flows doubled — yes, doubled — to $2 billion compared to the $1 billion in Q1 of 2020. This is due to rising commodity prices. But it was also helped by Suncor’s relentless focus on cost reductions.

So, looking ahead, Suncor will continue to benefit greatly from strong oil and gas prices. In my view, the oil and gas sector will also benefit from sector rotation by investors. It’s becoming increasingly clear that oil and gas companies are making great strides in cleaning up their businesses. The progress they’re making on reducing carbon emissions can eventually bring many investors back.

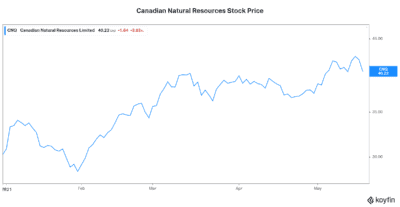

Canadian Natural Resources stock: An unbeatable resource and soaring cash flows

Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) is Canada’s best-in-class oil and gas stock. And a top stock to buy. Its long-life, low-decline assets are a gem. They require comparatively low capital expenditures and provide a high degree of predictability. Its asset base is resilient, diversified, and flexible.

So, Canadian Natural Resources’s stock price has rallied big in 2021. The company is churning out huge amounts of cash flow as oil and gas prices soar. Canadian Natural’s recent Q1 results demonstrate this. Operating cash flow rose almost 60%, and free cash flow generation was significant. In fact, 2021 free cash flow is expected to come in at almost US$8billion.

For now, this cash flow will be used to pay down debt. But be ready for an accelerated return of capital to shareholders. The company has a history of 21 years of growing its dividend at a compound annual growth rate of 20%. The company increased its dividend by another 11% this quarter. This makes it a top dividend stock and a top stock to buy.

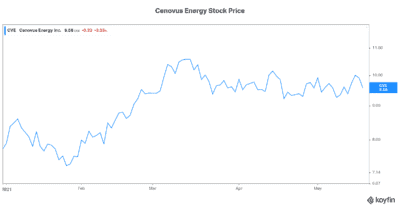

Cenovus Energy stock: Integration synergies will impress

Cenovus Energy (TSX:CVE)(NYSE:CVE) is a leading Canadian oil sands producer with additional natural gas and conventional oil assets. Cenovus is in a sweet spot of its own. After having completed the acquisition of Husky Energy at rock-bottom prices, the company now stands to gain big off of the significant amount of synergies that will result. Future cash flows will soar, making Cenovus an emerging top dividend stock. And one of the best stocks to buy right now.

Motley Fool: The bottom line

My best stocks to buy right now have many things in common. For example, they are all benefitting from strong cash flow generation. Furthermore, they are all dividend stocks. Also, they have very solid management teams and asset bases. Lastly, the difficult oil and gas sector has hit all of them — until 2021. Today, investors will not be able to ignore the earnings power of these companies any longer. They are, therefore, the best stocks to buy right now.