Air Canada (TSX:AC) stock continues to be at the top of investors’ watchlists. Among all the cheap companies and high-growth stocks to buy, Air Canada continues to be one of the most popular stocks across the country.

By now, though, we know what we are getting with Air Canada stock.

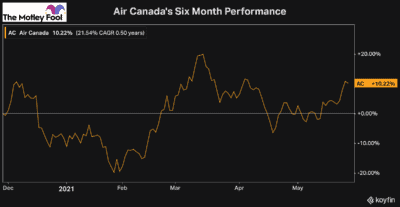

It hasn’t done much of anything since the beginning of December, and the longer it takes to recover, the lower its fair price will be given it continues to lose value every day.

There have been several stocks outperforming Air Canada over the last year, and several continue to offer a lot more growth potential.

Here are two cheap Canadian growth stocks to buy instead of Air Canada today.

Forget Air Canada: Buy this cheap growth stock

One of the top stocks in Canada to buy today that’s cheap and has plenty of growth potential is Andrew Peller (TSX:ADW.A). Andrew Peller is a Canadian alcoholic beverage company that’s perfect for long-term investors and a much better buy than Air Canada stock today.

The growth stock started out as a wine producer, which continues to be the majority of its business today. Through the years, it’s grown exceptionally by acquisition and is now one of the biggest wine companies in Canada. Lately, though, it’s ventured into other drinks that are growing in popularity, such as ciders and liqueurs.

In the past, Andrew Peller hasn’t offered massive growth as a tech stock would. However, it’s always grown with consistency. Today, though, it has the potential to grow a lot faster — especially with the new products it’s been launching over the last couple of years.

The stock has a strong market share in Canada that continues to grow and even has impressive integration with its operations, owning several of its own retail stores. Plus, it even returns cash to shareholders. Currently, its dividend yields roughly 2.1%.

So, due to the fact that the stock trades at a price-to-earnings (P/E) ratio of just 14.1 times, it’s extremely cheap and therefore definitely a top Canadian growth stock I’d be looking at buying over Air Canada.

A top real estate stock to buy today

Real estate is one of the best industries for long-term investors. Several real estate stocks offer exceptional value today and are better buys than Air Canada. One of the best, though, is Nexus Real Estate Investment Trust (TSX:NXR.UN).

The trust is always looking for prudent growth opportunities and acquisitions to grow unitholder value.

Nexus owns an attractive portfolio of office, retail, and industrial assets across Canada. The office and retail assets have been the most impacted and caused the stock to selloff during the pandemic.

Nexus’s portfolio is very high quality, though, as are its tenants. Not to mention, more than half of the 6.5 million square feet that the fund owns comes from its industrial segment, which has been of the top-performing subsectors in real estate the last year.

Nexus currently trades at a P/E ratio of just 10.1 times. Furthermore, its dividend yields roughly 6.9%, making it one of the most attractive stocks in Canada to buy today.

So, clearly, Nexus is one of the cheapest stocks in Canada, especially considering its long-term growth potential, and, therefore, it’s a much better buy than Air Canada today.