Toronto-Dominion Bank (TSX:TD)(NYSE:TD) is one of the largest Canadian banks. It’s also the fifth-largest North American bank. TD stock has a market cap of almost $160 billion and a 3.6% dividend yield. Through it all, TD Bank stands out for its strength south of the border and for its success in driving efficiencies. Many of us at the Motley Fool have liked TD Bank stock for a long time now. Today, it’s even more clear why.

TD stock rallies as Q2 earnings soar

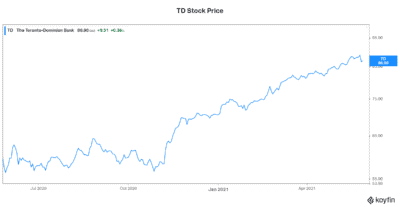

TD Bank stock has been strong all year long. In fact, in 2021, TD’s stock price has risen more than 20%.

This makes sense, given the results that TD Bank has been posting in recent quarters. The second quarter showed an acceleration of the positive trends. Trade volumes and account openings were at record levels during the quarter. Wealth assets soared more than 20%. In the U.S. retail business, the numbers were even more impressive, with the segment’s earnings up almost 300%.

The main reason for this impressive performance was lower provisions for credit losses (PCLs). We’re also seeing this at the other banks. Basically, the pandemic did not hit businesses and consumers as hard as feared. Today, they have proven to be resilient. Government support programs have supported them, as many have found new ways to survive and thrive. TD’s stock price has reacted by soaring to new heights.

Credit losses: Stabilizing and even reversing

I would like to talk a bit about the PCL situation at TD Bank. This was the biggest issue in 2020 as the pandemic hit. Consequently, TD Bank, as well as the other Canadian banks, took major PCL charges that hit earnings.

Today, vaccines are making their way to the Canadian population. The U.S. has already begun to reopen. While the economies were hit by the pandemic, it was not as bad as initially feared. So, now banks are posting PCL recoveries that are benefitting the bottom line. In the second quarter, TD Bank posted a $377 million PCL recovery. This compares to the $3.2 billion provision last year. Q2 adjusted EPS was $2.04 versus $0.85 last year. This is a 140% growth rate.

TD Bank stock poised for a huge dividend increase?

Canadian banking is thriving today for many reasons. For example, it’s benefitting from the recent stimulus that has been injected into the economy. Also, banks are benefitting from an extremely liquid consumer. Finally, a recovering economy is lifting all banks.

As a result, earnings at Canadian banks are soaring. I wrote about Bank of Montreal’s Q2 results in a Motley Fool article yesterday. BMO recorded an 80% rise in adjusted earnings. TD Bank did even better. So, the question becomes, “what will the banks do with all of this excess cash?” Payout ratios have fallen big-time, meaning there’s ample room for sizable dividend increases.

Since 1995, TD Bank has delivered an 11% annualized dividend-growth rate. The banks have been regulated to stop increasing dividends during the pandemic. But in the longer term, this dividend-growth history shows no signs of stopping. Actually booming profits would indicate that this growth rate will be accelerating.

Economic recovery = rising interest rates

Banks have been hit by low interest rates for some time now. During the pandemic, this hit net interest margins hard. With an economic recovery upon us and expected to accelerate in 2021 and 2022, banks like TD Bank can now look forward to more good news. Interest rates will likely rise to keep inflation at bay. This means that TD’s net interest margin will start to rise, bringing more money to the bottom line.

Motley Fool: The bottom line

Canadian banks are booming. TD stock has also been booming. The latest earnings result shows why. The consumer has proven to be resilient. With the help of government support, people are sitting on big sums of money. As the economic recovery gains traction, we can expect Canadian banks like TD Bank to continue to profit big.