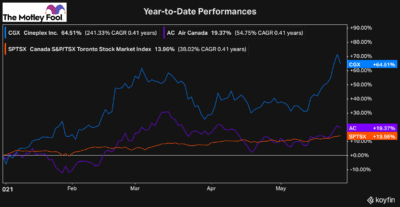

Cineplex (TSX:CGX) stock has been rallying rapidly this year, as it’s been a top performer in 2021. Air Canada (TSX:AC) stock, though, which has arguably been more impacted and has been more popular among investors, hasn’t fared quite so well.

So far this year, the stock market in general has had a strong performance.

As you can see, through just the first five months of the year, the TSX has gained just under 14%. So, although Air Canada stock is up nearly 20%, that’s considerably less than Cineplex and only slightly edging out the broader market, which has been recovering for over a year.

Air Canada continues to trade well off its pre-pandemic price, and anytime it’s looked like it might rally, the stock has once again sold off. This has many investors wondering what’s going on. Will this continue? Which is the better stock to buy now?

Cineplex stock

Cineplex stock, despite its impressive rally so far this year, still has a tonne of upside. Although its business isn’t anywhere close to being similar to Air Canada, the two companies have been impacted almost identically by the pandemic.

The difference is that Cineplex has had the opportunity to cut a lot more costs than Air Canada and consequently save a lot more value.

In fact, because it hasn’t lost nearly as much value as Air Canada stock through the pandemic, it looks in a lot better shape today. Not only are its movie theatres primed for a big recovery, but so are its entertainment venues and its digital ad business.

In my view, there is still lots of upside with Cineplex stock, especially if you’re willing to hold it for a couple of years. There’s no telling how it may perform in the short term.

However, over the next few years, as it can recover and the pandemic is fully in the rearview, Cineplex stock offers investors a substantial opportunity.

Air Canada stock

Air Canada stock is a lot more difficult to consider, because there is so much more uncertainty. For Air Canada, its business doesn’t solely rely on the state of the pandemic domestically but also around the world.

This makes it a lot more complicated, because it adds more uncertainty to an investment than Cineplex stock, for example. And as I’ve said since the beginning of the pandemic, taking a long-term position in Air Canada stock doesn’t make sense, because it continues to lose massive amounts of value every single day.

The stock was worth a little more than $50 a share when the COVID-19 market crash took place. Since then, the stock has lost a tonne of value.

Simple math shows that if you take the company’s negative earnings per share (EPS) since the pandemic began (all the money it’s lost) and subtract it from its pre-pandemic share price, it’s lost between $15 and $20 in EPS. If you subtract that from its $52 pre-pandemic high, you get a share price today around $32-$37.

That’s spot on with the target price I gave the stock when I did a little more in-depth math a few weeks ago. And keep in mind, that’s the price of Air Canada stock would be worth if things went back to normal today.

Analysts seem to think the stock is worth around that price, too. According to the average target price, the stock is worth just over $30. That’s not much upside from today’s market price of roughly $27.

Because there looks to be little upside and so much uncertainty, rather than Air Canada, I’d either stick with a long-term investment in Cineplex stock or choose any number of other Canadian stocks that offer much better potential today.

Don't Miss AI's Third Wave

Don't Miss AI's Third Wave