Investing in TSX dividend-paying stocks is one tried and tested strategy used to steadily grow a retirement portfolio. If executed consistently through future-proof companies, the strategy produces a portfolio with massive amounts of reliable and growing dividend cash flows, with stable capital gains affording individual investors to sleep well at night.

With $3,000 available to invest, there’s one top TSX dividend stock I’d buy in June. Without any doubts, Algonquin Power and Utilities (TSX:AQN)(NYSE:AQN) is a fast-growing, green energy producer whose current yield and dividend-growth policy is inviting. Yet it has a price set-up that makes it a good dividend-growth stock to buy in June 2021.

Let’s have a look.

Algonquin Power and Utilities: A dividend-growth play with capital gains potential

Algonquin Power and Utilities owns and operates a multi-billion portfolio of regulated clean energy generation, distribution, and transmission utility assets in the United States, Canada, Chile, and Bermuda. The company is investing heavily in its renewable energy generation projects and remains a dividend-growth play for several years to come.

A power outage at Algonquin’s wind power-generation assets in Texas was responsible for short-term cash flow and profitability setbacks in 2020. Repairs are underway, and the company has recovered well. However, the market has punished the otherwise stable growth stock, with a 12% decline in AQN stock so far this year. I see this as a temporary setback.

Interestingly, Algonquin Power and Utilities’s stock price seems to have consolidated above $18 a share over the past two weeks, giving long-term investors a chance to buy the dip before the valuation recovers.

Why buy Algonquin Power & Utilities stock in June?

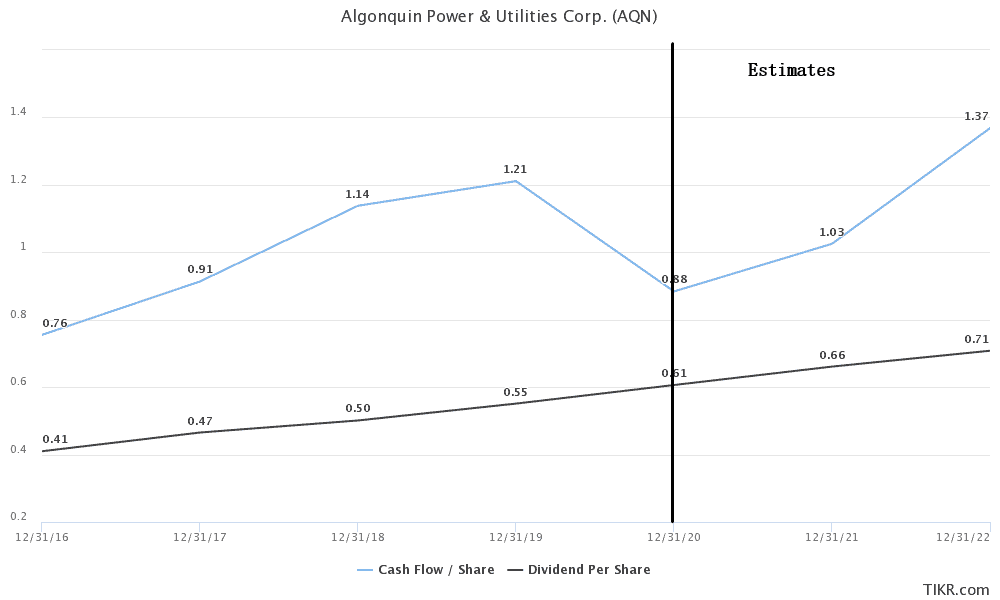

Algonquin Power is a dividend-growth stock of promise. The company recently increased its quarterly dividend by 10% in 2021. The latest dividend increase marked the 11th consecutive year of dividend increases at an average rate of 10% per year. More dividend increases are on the way, as the company grows its business and distributable cash flows over the next five years.

The company’s current US$0.171-a-share quarterly dividend yields a nice 4.5%. annually. This is true at the ongoing exchange rate of USD/CAD $1.21. However, if the American dollar recovers back to prior trading levels near CA$1.36 last seen in 2020, the current yield would rise to over 5%. I wouldn’t want to speculate too much on currencies though. That said, long-term-focused, dividend-growth, Canadian stock investors could do well if they buy local USD dividend payers when the U.S. dollar is still subdued.

According to data from the TIKR Terminal, analysts expect AQN to grow its revenue by 28% year over year to a record US$2.16 billion in 2021. Revenue could grow by a further 15% in 2022 as the company executes its US$9.6 billion five-year growth plan until 2025. However, I like the per-share dividend and cash flow metrics better.

Most noteworthy, the company’s cash flow per share is seen recovering in 2021 and could print record levels by 2022. Not only should the dividend keep growing, but the share price could also steadily creep back up over the next 12 months, as AQN completes repairs to its Texas wind plant and reports better cash flows in 2021.