Late last year, after plenty of stocks had already started to recover, Air Canada (TSX:AC) stock was one of the few businesses that was still struggling mightily.

There was no sense of when the business could recover until the vaccine was announced. Even then, though, there was still great uncertainty about when its operations could return to normal.

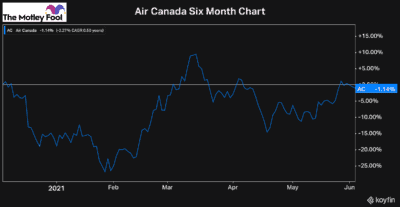

Sure enough, while the stock rallied initially due to news of the vaccine, it never had that much upside. And as we can see by the chart below, over the last six months since December 3, 2020, Air Canada stock has actually declined in price.

Air Canada stock’s struggles continue

If you told most investors six months ago that Air Canada would be flat or even slightly lower by today, most would have thought that was highly unlikely.

However, looking at Air Canada’s business and how badly the pandemic has impacted it, this was something that shouldn’t be that surprising. Last December, after the vaccines had been approved for emergency use, I still recommended investors avoid the stock.

With all the money it loses every day, it’s not surprising the stock will lag the rest of the market until investors can be absolutely sure the business is ready to open back up.

So, at close to $30 a share, where the stock trades today, this could be as high as it gets until it’s actually back up and running and reporting positive earnings.

Of course, it could see a pop when travel is expected to resume. But it doesn’t seem like it has the momentum to get anywhere near returning major sums to shareholders.

Rather than investing in Air Canada, I’d consider an undervalued stock that’s in a much more promising position today.

A top Canadian stock that’s still recovering

Many investors consider buying Air Canada, because it’s one of the few stocks left to make a decent recovery from the pandemic. One stock, though, that’s in a slightly better position than Air Canada stock and still offers recovery potential is American Hotel Income Properties REIT (TSX:HOT.UN).

As its name suggests, American Hotel Income Properties (AHIP) is a real estate investment trust that owns over 75 hotels across the United States.

AHIP was one of the hardest-hit Canadian stocks, as hotels saw a massive slowdown in business during the pandemic. Normally, AHIP’s occupancy rate fluctuates between 70% and 85% depending on the time of the year. During the pandemic, though, AHIP saw its occupancy rate fall as low as 30% at its worst point.

Today, it’s well on its way to recovery, with its occupancy rate at roughly 60%. This is not surprising, as the U.S. has had a strong recovery from the pandemic.

However, this strong recovery isn’t the only reason why AHIP is a better investment than Air Canada stock. AHIP has also been able to weather the storm better and cut more costs.

It’s still lost value through the pandemic, but nowhere near as much as Air Canada. So, not only does it have more recovery potential, but it’s a safer investment in this environment.

We aren’t completely out of the woods yet when it comes to the pandemic. And should these companies continue to be impacted for longer than expected, AHIP will be able to preserve value for investors better than Air Canada stock.