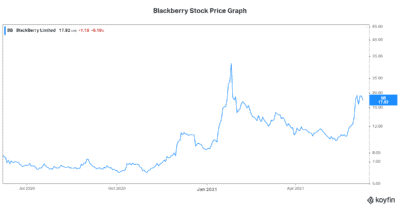

BlackBerry (TSX:BB)(NYSE:BB) stock has truly gone parabolic as part of the meme stock craze. An almost 100% gain in just over a month has many investors unsure of what to do next. Will BlackBerry’s stock price continue to surge? Or is it destined to fall just as fast as it soared?

These are really simple but good questions that many of us have. The answer, however, is not so simple.

The meme stock craze has blurred the picture for BlackBerry stock

I’ve said it many times. The meme stock craze is something I can do without. Of course, it’s really nice to benefit from it. However, it’s not a sign of a healthy, rational market. A rational market trades on fundamentals. This makes sense. It gives us a chance to figure out which stocks are good buys. It gives us a chance to make predictions.

Forecasting what will happen in the future is difficult enough. If we add emotional meme stock trading to the picture, it becomes harder. It becomes more of a speculation game rather than investing. BlackBerry stock has joined the ranks of stocks affected by the meme stock craze. It feels manipulative. Buying for any reason other than your fundamental outlook is short-lived. It’s not a sustainable move. It must be met with fundamentals or the stock price will fall. In BlackBerry’s case, it’s complicated. I think that in time, the fundamentals will back up its price move. The problem is that we don’t know how long it will take.

I’m of the opinion that BlackBerry’s stock price will fall in the short term. This is because what propped it up was not sustainable. It’s also because the market in general is due for a pullback. Finally, it’s a function of the fact that BlackBerry’s industries are still in the early stages, so it will take time for the earnings and revenue ramp up.

BlackBerry stock has tons of long-term value

In my view, the bottom line for BlackBerry stock is that it has massive upside in the long term. Award-winning technology, a strong financial position, and exposure to two of the biggest growth industries are the key themes that will take the stock higher. As an active participant in the cybersecurity industry and the machine-to-machine connectivity industry, BlackBerry has a huge growth tailwind propelling it higher.

The tricky part relates to the short-term stock price movements. If BlackBerry’s stock price will be double or triple in a few years, then the price today shouldn’t matter much. Except it kind of does. While I’m of the view that the stock will be much higher a few years from now, nothing is certain. So, if we buy at an inflated price today, then the downside risk is higher.

So, that leaves us right back where we started. What should we do now that BlackBerry is once again up big in a short period of time? I mean, BlackBerry’s stock price has rallied over 80% since the end of May. It’s now sitting pretty at just below $20. The meme stock craze continues…

Motley Fool: The bottom line

BlackBerry stock is a strong long-term buy, in my view. But today is not the time to buy it. It is, in fact, the time to take profits. We can wait for the stock to trade more in line with current fundamentals before buying back. Because the risk in the market in general is already high, since it’s trading at all-time highs. We don’t need to be buying BlackBerry stock in the midst of its meme stock craze. Patience in key here.