Cheap stocks to buy are hard to come by these days. The S&P/TSX Index is trading at all-time highs. The market is rallying, as the COVID-19 pandemic nears its end. And investors have saved up big amounts of cash after being locked down for so long. This has caused a challenged for those of us looking for cheap stocks. But I have a solution: energy stocks.

These stocks are dirt cheap after being in the doghouse for so long. I have, in fact, written quite a few Motley Fool articles on the improving outlook for energy stocks lately. Oil and gas prices are rallying, as supply has fallen, and demand is set to skyrocket.

Without further ado, here are the two cheap stocks to buy now.

Cenovus Energy stock: A dog who’s day has come

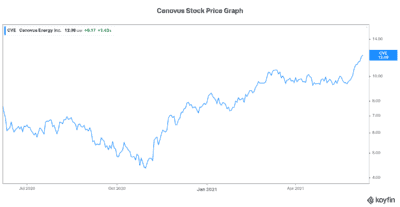

Cenovus Energy (TSX:CVE)(NYSE:CVE) was always applauded for its operational excellence. Yet Cenovus stock could never get any traction. First, it was a political environment that was heavily focused on environmental concerns. Then it was pipeline constraints. And finally, the COVID-19 pandemic hit. This was the final blow. Oil and gas demand plummeted. There was little hope.

But today, this energy stock is finally seeing better days. It’s now a top stock to buy, in my view. Cenovus Energy is the third-largest Canadian oil and gas producer and the second-largest Canadian-based refiner and upgrader. Its recently completed acquisition of Husky Energy was a perfectly timed deal that will generate massive value over the years to come. Cost and revenue synergies from the deal, along with Cenovus’s operational excellence will take this stock to the next level. On top of all this, oil and gas prices are rallying hard. Cenovus stock has soared 60% in 2021, but this is just the beginning. Cenovus Energy stock remains a top value stock to buy now.

Canadian Natural Resources stock: A cheap stock to buy as continues to pump out impressive cash flows

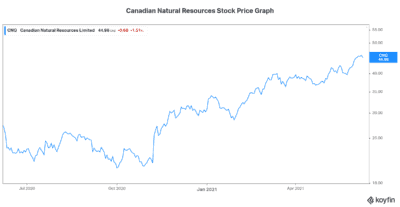

Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) is an oil and gas stock like no other. Canadian Natural’s assets are long-life, low decline assets. This means lower spending on them, higher predictability, and greater and more consistent cash flows. This drives right down to the bottom line.

Although Canadian Natural stock has also rallied big this year, it remains a very attractive, cheap stock to buy. Its more than 40% increase so far in 2021 has done nothing to change this fact. This is because oil and gas prices are rising so dramatically, and the company’s earnings and cash flow are following suit.

Take a look at Canadian Natural Resources’s stock price graph.

We can see the momentum building technically, but also fundamentally. The end of the pandemic is driving up demand for oil and gas. This comes after the pandemic affected supply so much that today it remains down year over year. This is the perfect storm for these cheap energy stocks to buy now.

Motley Fool: The bottom line

Investors who are looking to find cheap stocks to buy now on the TSX are having a hard time — that is, until we start looking more closely at energy stocks. This industry is coming out of a multi-year struggle that has left them trading at rock-bottom, cheap stock valuations. Yet today, many of them are churning out massive amounts of cash flow amid a recovering industry that is firing on all cylinders.