Analysts play a key role in the investment industry. It’s good to have a lot of analysts to get different opinions and views of a company. So, it’s not often that you find Canadian stocks that every analyst agrees are worth a buy.

Analysts’ recommendations, of course, aren’t the end all, be all. There are plenty of cases of companies defying the odds and rallying when analysts are bearish or underperforming when they are bullish.

For the most part, though, not only can they help investors find Canadian stocks that are in an appealing position today, they can also be crucial for understanding how companies work and what to look for when considering an investment.

So, with that in mind, here are three Canadian stocks that are unanimous buys from analysts.

A top healthcare tech stock

One of the top Canadian stocks to buy for the long term that analysts all seem to be bullish on is WELL Health Technologies (TSX:WELL).

WELL Health is not just a top healthcare stock. It’s also a promising tech stock. The company owns a mixed portfolio of assets ranging from medical clinics to digital healthcare services. It also has the third-largest electronic medical record business in Canada.

In the past, WELL has grown rapidly by acquisition and is now positioned perfectly for the future. Digital healthcare and innovation in the sector will only continue to pick up, making WELL a great company to own long term.

Plus, since it’s fallen out of favour after its rally in 2020, investors can buy the Canadian stock at a significant discount today.

Of the 10 analysts that cover the stock, all have it rated a buy. Furthermore, the average target price from analysts is more than $11.50. That means the stock has the potential to gain over 40% over the next 12 months. And if it continues to find high-quality acquisitions, its potential could actually be a lot higher than that.

A top Canadian tech stock that analysts are bullish on

Another high-quality Canadian tech stock that analysts are bullish on is AcuityAds Holdings (TSX:AT)(NASDAQ:ATY).

AcuityAds is an Adtech stock, another company with tremendous long-term growth potential. It’s also a stock that’s trading pretty cheap, making it the perfect Canadian stock to buy as a long-term investment.

AdTech businesses have been around for some time. However, the industry has gotten a lot more promising these days, with artificial intelligence and computers continuing to get more powerful and process more data.

So, these days, there is a lot of hype around AdTech businesses. For AcuityAds, its proprietary machine learning technology is expected to help advertisers reach more consumers and boost sales.

And while it could ultimately take years for AcuityAds to reach its full potential, it’s one of the top Canadian stocks to buy today for long-term growth.

Don’t just take my word for it, though. All five analysts who cover the stock have it rated a buy, with an average target price of roughly $25. That means AcutiyAds currently has over 75% upside potential, as it continues to trade extremely cheap.

A top Canadian growth stock

The last Canadian growth stock to consider buying today is the specialty finance company goeasy (TSX:GSY). goeasy’s primary business is a loan provider to below prime borrowers. These loans are riskier than typical loans. So, goeasy can charge a higher interest rate to offset the risk.

However, if goeasy can still manage to find quality borrowers and limit the loans it has to charge off, it has the potential to make a lot of money and fast. That’s exactly what it’s done in recent years, which is why it’s grown so fast, up more than 800% over the last five years.

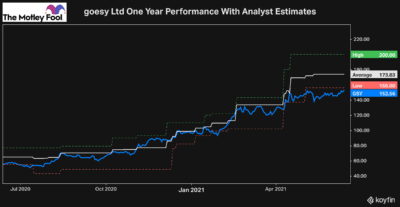

goeasy’s business model continues to be impressive, and there’s no reason it can’t continue to grow. And clearly, analysts don’t think it’s anywhere near done growing either.

The five analysts who cover goeasy all have it rated a buy. And while their target price of roughly $170 only offers about 15% growth potential today, goeasy is a stock that continues to grow rapidly.

So, I’d expect analysts to continue to move their estimates higher, as you can see, has been the case over the last year.