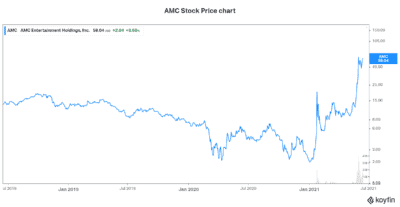

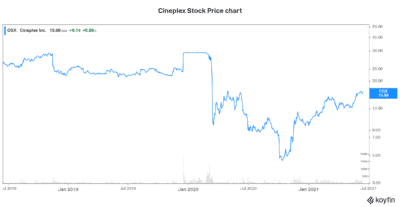

AMC Entertainment Holdings (NYSE:AMC) stock has rallied a shocking 2,500% in 2021. Cineplex (TSX:CGX) stock has rallied a more reasonable but still amazing 70%. The difference lies in the fact that AMC stock is part of the Reddit meme stock craze. At the Motley Fool, we don’t recommend participating in that high-stakes game. Cineplex stock, however, is rallying as hopes for a reopening.

Let’s take a closer look at AMC stock versus Cineplex stock. Which is the better buy?

AMC stock soars to new heights as the Reddit crowd takes hold

AMC stock seemingly has no limit to how high it will go. But certainly, its days are numbered. It cannot indefinitely be propped up on a short squeeze. Therefore, I cannot stress the importance of fundamentals enough. Investing is not gambling. Stocks need to follow company fundamentals. If these two are out of sync, it’s not sustainable. The longer they remain out of sync, the faster the stock will correct — to the upside or downside. It works both ways.

So, the answer to this question I posed in the title of this article seems obvious, but investors can easily get lost in the hype. The Reddit stock craze is big. AMC stock has reacted in an enormous way. A lot of money is being made. Despite this, it is the Motley Fool’s goal to help keep us grounded — to help investors stay focused on the long-term and on fundamentals. This is what I hope to do in this article.

I mean, gains made on speculation can be huge; there’s no denying that. But one must remember that losses made on speculation are also huge. We just don’t hear about those as much. So, we might get tempted to participate and take on these huge risks.

AMC stock is a gamble

AMC stock is trading at highs never seen before. It’s trading at a price-to-sales multiple of 64 times. Earnings at AMC have plummeted. Cash burn is high. And debt is at unmanageable levels. The stakes are high. AMC’s stock price does not reflect anything close to an accurate picture of current and future fundamentals.

Cineplex stock, however, is more of a reasonable calculation. There is risk there; that’s for sure. But Cineplex stock has not gone to new heights. It’s not being influenced by the short-squeeze Reddit trade. Cineplex’s valuation is therefore more reasonable and consistent with what we might expect given the fundamentals.

Cineplex stock trades at a price-to-sales multiple of six times. It is certainly factoring in a recovery, but it hasn’t gone overboard. The stock was trading at over $50 five years ago. So, its current trading price is not unreasonable, assuming that things go back to normal. It’s a stock that I, as well as many of us at the Motley Fool, like. By contrast, AMC stock is currently trading at $60. The highest it’s ever traded was just over $30. This is not justified by anything fundamental — today or in the future. In AMC stock, we have an artificially propped up equity that will not hold this value.

Motley Fool: The bottom line

AMC stock has become somewhat of a joke. The Reddit short squeeze has manipulated it. It has decoupled from fundamentals. The money that some have made is no joke — I get that. But at this point, buying into this craze comes with a lot of downside risk. It’s gambling. Stick with Cineplex stock for a more logical, fundamentally driven ride.