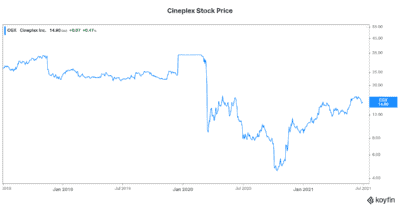

Cineplex (TSX:CGX) stock has been quite the roller-coaster ride since the COVID-19 pandemic hit us last year. Sure, it’s mostly been down. But this has been what has intrigued many of us at Motley Fool. Today, we finally have reasons for greater optimism. In fact, Cineplex stock could be the comeback stock of the year.

The country is reopening, as the pandemic is fading into the rear-view mirror. What will this mean for Cineplex stock? Could it hit $25 this summer?

Cineplex stock: A rough year coming to an end

There’s no denying that Cineplex stock has been beaten down badly. A set of unfortunate circumstances have battered the company. It was through no fault of its own. It’s been pretty sad to watch, because this Canadian company has been doing many things right.

But Cineplex was ready. I mean, this company has been tested before. For example, Cineplex management has long known that the movie exhibition industry was facing threats. The online streaming world has given us a real alternative to movie theatres. Movies have been brought to our homes. This has altered the movie-making business in general. New paths to bring movies to movie watchers have been forged. And this has impacted Cineplex.

Cineplex already set its sights on a more diversified business

In response to this, Cineplex embarked on a plan to diversify. For example, Cineplex created Cineplex Media, an advertising network with a presence that goes beyond movie theatres. In fact, Cineplex media is featured in many high-traffic destinations. For example, Cineplex media can be found in many coffee shops. It’s also found in many rest stops and shopping centres.

In 2019, the last “normal” year for Cineplex, the results of this diversification plan were evident. Revenue rose more than 3%, even though theatre attendance was down. Importantly, the media segment’s revenue rose more than 20%. While this segment only represented 12% of total revenue, it demonstrates the success in Cineplex’s strategic response.

Also, revenue from the company’s amusement and leisure segment rose more than 7%. This is Cineplex’s other area of diversification that is serving the company well. It also represents a small portion of total revenue, but it’s growing. So, Motley Fool readers, if you’re looking for a stock to buy as the economy reopens, consider Cineplex.

Here’s how Cineplex’s stock price can hit $25 this summer

Why do I think that Cineplex stock can hit $25 this summer? Firstly, Cineplex’s theatres will continue to reopen across Canada. There will be less limitations. And people will likely go back as they complete their vaccinations. Theatre revenue still represents the bulk of Cineplex’s total revenue. So, this will obviously be meaningful.

Also, many investors have understandably shunned Cineplex stock recently. But as the pandemic fades, the company will recover. It will report significant revenue increases. Demand for the stock will soar. Recall that in 2019, Cineplex’s stock price hit highs of over $34. This was a year when Cineplex was starting to show the fruits of its diversification plan. After years of uncertainty and capital investment, things were starting to fall into place.

Motley Fool: The bottom line

Cineplex stock is, in my view, likely to soar this summer. A return to normal will continue to drive the stock higher. The pandemic will fade into the background. Cineplex stock has a lot of recovering to do, as it re-emerges from the dust. It is, after all, a top Canadian entertainment company.