For the last three weeks, the S&P/TSX Composite Index has traded above 20,000 points. There could still be more upside for TSX stocks. While this is great if you are already in the market, it is more challenging if you are looking to invest new money today. Many TSX stocks are hitting new 52-weeks highs. Value stocks, in particular, are starting to look a little more expensive.

If you are looking for cheap stocks, you really have to be prudent. There are still areas of dislocation in the market, but you also have to be willing to think counter to the market. Given this, here are three cheap TSX stocks that look pretty attractive in July.

Suncor: A top TSX energy stock

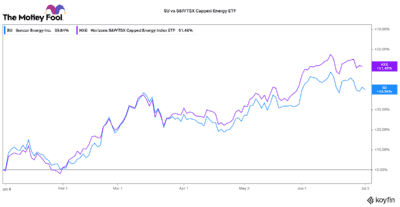

Suncor (TSX:SU)(NYSE:SU) has had a decent 38% recovery in 2021. However, it has lagged the Canadian energy sector by 115 basis points. Certainly, many investors are still hesitant since it cut its dividend by 55% last year. Yet the pandemic forced Suncor to improve its balance sheet, reduce costs, and unlock operating efficiencies.

Today, at only US$35 per barrel, Suncor can sustain its enterprise operating costs, sustaining capital, and dividend payments. Given that oil is trading above $70 per barrel right now, half of that sum is completely gravy (free cash flow).

If sustained throughout the year, Suncor should be able to significantly reduce debt, buy back stock, raise the dividend, and also think about further capital investments. This TSX stock pays a 2.8% dividend. Yet, I expect that could drastically rise if commodity prices stay stable above the $60 mark. Suncor trades just under $30 per share today.

AltaGas: A misunderstood utility and midstream business

At $26 per share, AltaGas (TSX:ALA) still looks attractive today. AltaGas has been performing an incredible turnaround over the past few years. It has divested non-core operations, simplified its strategy, and significantly reduced debt. As a result, today it has a really intriguing investment thesis.

Around 57% of its normalized EBITDA is actually derived from a very stable American natural gas utility business. Consequently, it has a very predictable baseline of earnings. Not only that, but as it rolls out an aggressive capital strategy, it expects to garner an 8-10% annual rate-base growth going forward.

In its midstream business, it is seeing very strong energy demand, particularly for propane exports in Asia. Overall, strong energy pricing should support strong volumes growth in fractionation and exports in 2021.

Despite a decent run-up, this TSX stock still trades at a meaningful discount to American utilities and Canadian midstream businesses. The stock pays a nice 3.8% dividend, but there could still be a decent upside as management rolls out its growth strategy.

BSR REIT: An undervalued TSX apartment stock

Speaking about stocks at a discount, BSR REIT (TSX:HOM.U) looks really attractive even at US$13 per share. Many Canadian’s are unfamiliar with this stock because it operates completely in the United States. Yet, often I find when U.S. businesses list on Canadian exchanges, there can be a great value arbitrage opportunity.

BSR operates a high-quality portfolio of garden-style residential apartments primarily located in Dallas, Houston, and Austin. The REIT has been transforming its portfolio to focus on regions and municipalities that are seeing nation-leading immigration and economic activity. Today, BSR is much better located with higher quality properties than prior to the COVID-19 pandemic.

It is now positioned to experience industry-leading rental rate growth, and likely cash flow growth as well. Yet, this stock still trades at a meaningful discount to its U.S. peers. Collect a great 3.8% dividend while you wait for this undervalued TSX stock to catch up to the rest of the market.