For a good number of years, Canopy Growth (TSX:WEED)(NASDAQ:CGC) has been the go-to cannabis stock for investors who needed a piece of the nascent industry’s pie. The Canadian marijuana giant enjoyed first-mover advantages in the product market and on stock market indexes. However, cannabis investors looking for outperforming returns have to look elsewhere right now.

It’s true that WEED still has one of the strongest balance sheets among TSX-listed marijuana stocks. The company retains over $2.3 billion in cash and short-term investments after Constellation Brands’s $5 billion injection in 2018 and a US$750 million debt raise in March. However, if phenomenal growth is what you are looking for, there’s one small, little-known, and seemingly undervalued cannabis stock you could buy over Canopy Growth stock today.

Canopy Growth has struggled to deliver

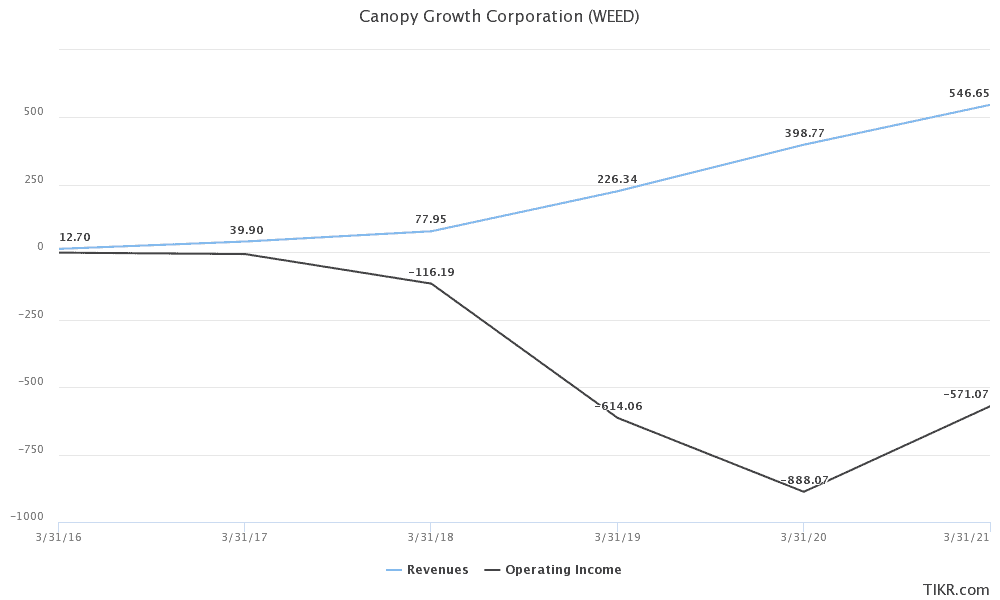

For all the $10 billion company’s efforts since 2016, Canopy Growth has grown its annual revenue run rate to nearly $547 million. But the company has generated more operating losses than what it booked as revenue in each of the past four years. The company’s historical financial performance has been horrible.

Just recently, the company reported $148.4 million in quarterly revenue during the first three months of this calendar year. Sales generated a mere 14% in adjusted gross margins, and the company printed a $616.7 million net loss. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) loss of $94 million was more than half of quarterly revenue, and $466 million cash was “burnt” in operations in three months.

In contrast, one recently listed TSX marijuana firm reported stellar results during the same period. It could deliver even better numbers later this year.

This tiny TSX marijuana stock is poised to outperform

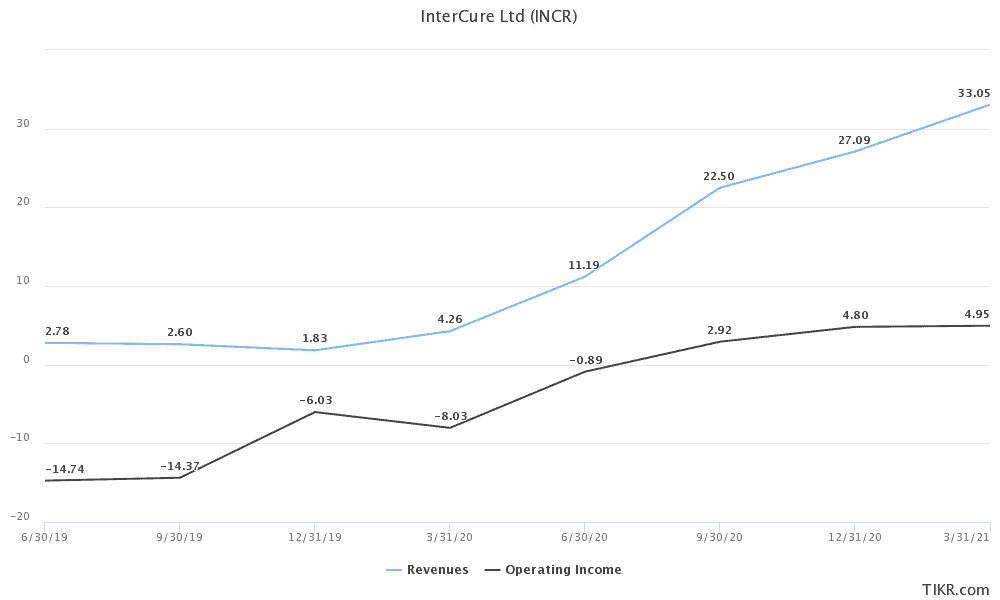

InterCure (TSX:INCR.U) is an Israeli cannabis firm that was recently listed on the TSX through a merger with a special purpose acquisition company (SPAC). The company’s subsidiary, Canndoc, is the leading marijuana player in Israel. It reports in New Israeli Shekels (NIS).

InterCure grew its quarterly revenue eight-fold in 12 months to NIS 33 million (CAD 12.2 million) by March 31, 2021. The company reported a strong 45% adjusted gross margin, and management forecasts the stellar growth trajectory to persist throughout this year.

Most noteworthy, InterCure reported a positive adjusted EBITDA of C$3.5 million (a 30% margin) and generated positive cash flow from operations of C$3.7 million from pot operations. This marked a third consecutive quarter of positive operating cash flow which was driven by revenue growth and profitability improvements.

I like the small company’s revenue and operating earnings trend.

The smaller player is evidently fairing better than its larger peer, and its story is only unfolding.

Massive growth ahead

InterCure reported an eight-fold revenue increase while it had only two operational medical marijuana pharmacies during the first quarter of 2021. Subsequent acquisitions will increase the pharmacy chain to 12 locations across the country during the year. The company’s local market has been reportedly growing at rates around 4% a month.

On one hand, analysts expect InterCure to grow its revenue by 148% over the next twelve months. New product launches, higher productive capacity, a broader market reach, and strong support from international suppliers could make this a reality. The company is generating profits and cash flows while importing significant flower supplies from Canada and Uruguay.

On the other hand, Canopy Growth could grow revenue by 41% over the next 12 months. There’s a slight hope it can turn adjusted EBITDA positive in 2022. The company has struggled to contain operating expenses after it aggressively grew its global footprint beyond market capacity over the years.

Foolish bottom line

New investors in Canopy Growth stock are paying 14 times the company’s expected next twelve months (NTM) sales per share. Yet the company continues to lose money.

On the other hand, InterCure stock is priced at just 3.1 times NTM revenue. The company is already profitable and could grow 3.6 times faster than CGC while generating positive operating cash flows.

Canopy Growth has arguably maintained its steep valuation due to wider market publicity. However, InterCure stock is a bargain buy right now. Cathie Wood’s ARK Invest is already a major shareholder.