The TSX Index has been soaring in 2021. One significant reason for the TSX’s strength is the strong recovery in energy stocks this year. Talk about the difference a year makes! Last year, commodity prices were in the doldrums. Oil prices even traded negative for a short period. Commentators were saying energy stocks were simply not investable. However, the COVID-19 pandemic turned out to be beneficial for energy companies.

TSX energy stocks are better positioned than prior the pandemic

TSX energy producers have had to cut back production and focus on only the most efficient projects. Likewise, many producers have cut back operating expenses significantly. Now, many of these businesses are lean operating machines.

With West Texas Intermediate oil trading over US$70, TSX energy stocks can generate a tonne of free cash flow. Given this dynamic, there could still be some decent upside in the sector. Here are two beaten-down stocks that still look pretty attractive today.

Enbridge: A North American pipeline leader

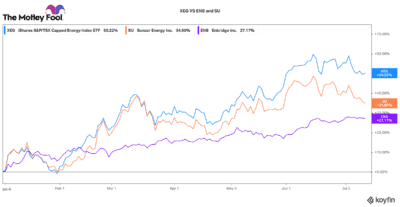

Pipelines these days get no love. Yet they are still absolutely essential to the economy. That is why Enbridge (TSX:ENB)(NYSE:ENB) is still a pretty attractive stock today. This TSX stock is up 23% this year, but it still has not regained its pre-COVID-19 trading levels. Not to mention, Enbridge pays one of the highest dividend yields on the TSX at 6.7%.

Despite a lot of negative press regarding its Line 5 pipeline in Michigan, this company has a large, diversified business. Its pipeline network spreads across North America. In fact, 20% of North America’s oil runs through its network. Likewise, 25% of America’s natural gas passes through it pipe.

The point here is that its network is vital to the North American economy. With it nearly impossible to build new pipelines anymore, its current infrastructure is irreplaceable. Strong oil prices mean strong transport volumes. That all bodes well for this stock.

Likewise, Enbridge is looking to assist in the energy transition. This includes looking at opportunities in hydrogen, co-generation, renewable natural gas, and renewable power generation. This TSX stock should still have a relevant future ahead. Collect a great dividend while that story unfolds.

Suncor: A top TSX energy stock

Suncor Energy (TSX:SU)(NYSE:SU) has likewise lagged behind other TSX energy stocks this year. It is up 33% this year versus the S&P/TSX Capped Energy Index, which is up 49%. It appears that some of this underperformance may be due to a number of large institutional investors avoiding the stock over ESG concerns (especially surrounding its oil sands operations).

Yet investors fail to recognize that Suncor is a very diverse company. Only 10% of its total cash flows are derived from bitumen operations. In fact, the largest share of profits come from its refined products business (about 50%). The remainder come from processing/logistics and offshore oil operations.

Through the pandemic, Suncor drastically reduced its cost structure. Its operations have near factory-like productivity. For only US$35 per barrel, it can cover its operating costs, sustaining capital, and dividend. Any price earned above that is pure free cash flow. That can be used for debt reduction, share buybacks, dividend increases, or investments into diversifying projects like renewables.

In addition, over the next four years, Suncor is hoping to generate an additional $2 billion in free cash flow returns through plant optimization, cost reductions, and growth projects. Should oil prices remain relatively stable, this company will be oozing free cash flow. This business has lots of catalysts for strong operational and financial performance going forward. You have to be a contrarian and be prepared for volatility. However, value investors could be rewarded by this TSX stock over time.