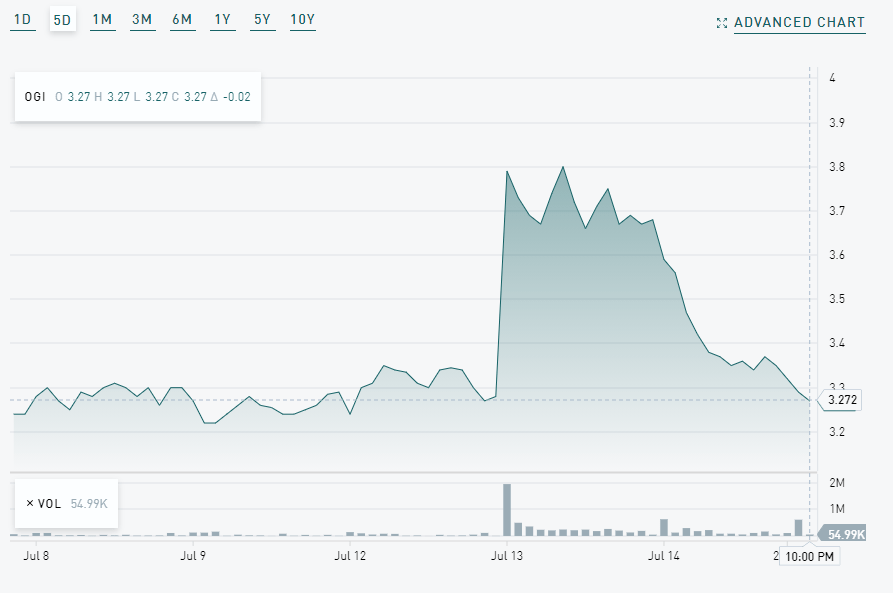

Organigram (TSX:OGI)(NASDAQ:OGI) stock price declined by more than 11.1% on Wednesday. Shares rallied more than 12% in a post-earnings bullish run on Tuesday after the cannabis firm reported stronger-than-expected quarter-over-quarter revenue growth and narrowing losses. However, Wednesday’s plunge wiped off all the post-earnings gains. This could be an opportunity to buy the dip for long-term gains.

Why did Organigram stock fall 11% on Wednesday?

Investors were overjoyed when Organigram reported a surprise 51% sequential growth in quarterly revenue in the three months to May 31, 2021. Net revenue grew by 39% quarter over quarter to $20.3 million, as recreational cannabis sales soared 40% higher sequentially. Investors in OGI stock welcomed the company’s narrowing operating losses and improvements in adjusted EBITDA. It’s evident that the company has stopped a revenue decline trend that had emerged lately. However, some significant problems still remain.

Problems at the cannabis firm

For a start, heavy excise taxes muted Organigram’s revenue growth. From the $9.8 million that the company added in gross revenue, only $5.7 million (or 58%) made its way to the net revenue line. Heavy excise taxes will remain a huge growth constraint as long as value brands dominate the company’s product portfolio — more so if average selling prices weaken further.

If a marijuana firm pays a fixed excise tax per gram of cannabis sold, volume growth accompanied by lower unit prices per unit will result in higher effective excise tax rates. Efforts should therefore focus on growing premium brands that have better economics.

Secondly, Organigram was still unable to generate positive gross profits from higher cannabis sales. Although the quarterly cost of sales declined sequentially by $7.7 million to $23.4 million, gross profit before fair-value changes was a negative $3 million. The company needs more time to rationalize its production costs before any hopes of becoming operationally profitable can be entertained.

Most noteworthy, although management’s guidance is for further revenue growth this quarter, and sequential improvements in gross margins, the company still faces growing operating costs. Selling, general, and administration (SG&A) expenses will be higher this quarter. The company is investing in research and development works at its Centre of Excellence project with a new strategic investor British American Tobacco (BAT). Moreover, the reopening of stores to foot traffic will be accompanied by increasing selling, advertising, and marketing expenses.

In my view, the net effect of revenue growth, problematic production costs, and increasing SG&A expenses on operating earnings remains highly uncertain. Such a clouded outlook weighs heavily on the company’s share price in the short term.

Time to buy the dip?

New information from the latest earnings results suggests that Organigram is a much better company. It performed better than what the market perceived before Tuesday. But traders and short-sellers have reset OGI stock back to pre-earnings valuation — as if the latest revenue beat and narrowing operating losses never happened.

This could make sense for investors who believe shares were overvalued, even before Tuesday’s earnings rally. If so, then Wednesday’s drop could be justifiable. However, the opposite is likely true that Organigram stock was undervalued due to previously weak quarterly earnings reports.

That said, the company’s shares trade at 57% below their most recent high recorded in February. Surely, the improvement in revenue and earnings should elevate the stock by some margin; it doesn’t matter how small.

Most noteworthy, the company could enjoy a windfall from cannabis exports to Israel before December this year. Organigram received its Good Agricultural Production certifications last month, and it could be permitted to supply into its 6,000-kilogram cannabis flower supply agreement with a high-flying InterCure subsidiary Canndoc any time.

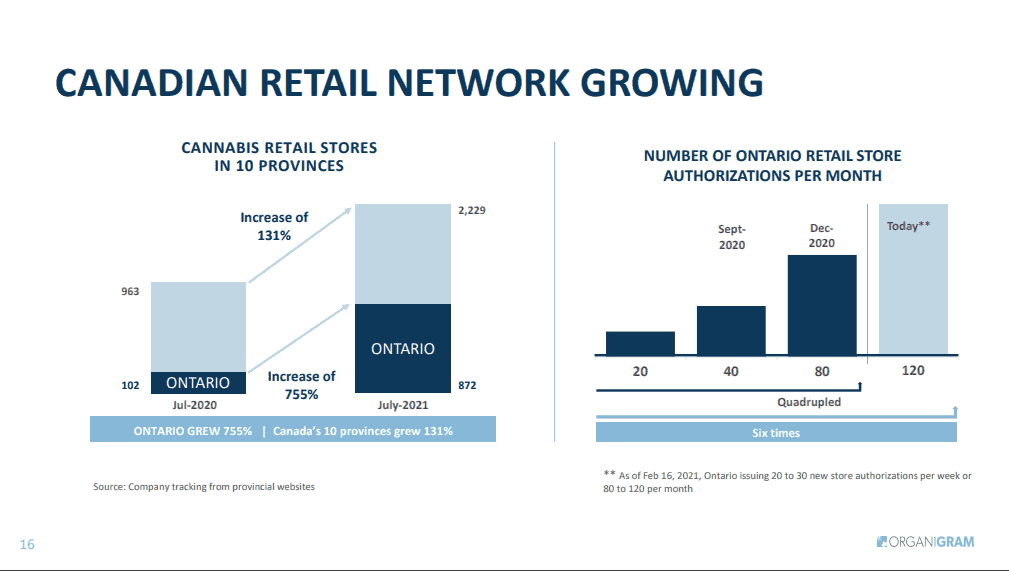

To add more, Canada’s retail store network is still expanding exponentially, led by Ontario. I would expect the growing network to generate higher sales for licensed producers, including OGI.

One more thing: the company is now virtually debt-free, which reduces its balance sheet risks in the near term.

It could make sense to buy the dip on Organigram stock today. The company is a better cannabis play than it was before the latest financial results release.