This summer, it will become increasingly clear that Canadians have a lot to look forward to. For example, the virus is fading into the background. Also, the Canadian economy has held up impressively through it all. This Motley Fool Canada article lists the three Canadian stocks to buy in July. They are all pretty defensive stocks. The list includes utility giant Fortis (TSX:FTS)(NYSE:FORTIS) and Enbridge (TSX:ENB)(NYSE:ENB). Enbridge is an essential part of the Canadian energy infrastructure. It has staying power.

I think defensive is the way to go right now. Because valuations, in general, seem stretched. And the risk of a market pull-back is real.

Without further ado, here are the 3 Canadian stocks to buy.

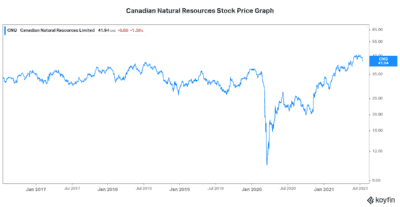

Canadian Natural Resources stock: A Canadian oil and gas leader

As a leading Canadian oil and gas company Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) doesn’t have a lot to prove. This company has been excelling operationally for many years now. Also, it has been raking in strong cash flows. And it has been returning a lot of these cash flows to its shareholders.

It’s not as defensive as Enbridge stock, but it is the most defensive within the energy producer category. Just take a look at the following graph depicting Canadian Natural Resources stock price over the last five years. It’s remarkably stable.

For example, the company’s latest quarterly result was once again exceptional. Operating cash flow rose almost 60%. Its free cash flow generation was significant. And the outlook is just as bright. In fact, 2021 free cash flow is expected to come in at almost US $8billion. This is nothing new, really.

Canadian Natural Resources has been outperforming for years now. The only difference is that today, oil and gas prices are cooperating. The price of oil has rallied 75% in the last year.

These are all things we at Motley Fool Canada like to see in a stock. It’s a high-quality company that’s benefiting from momentum in its industry.

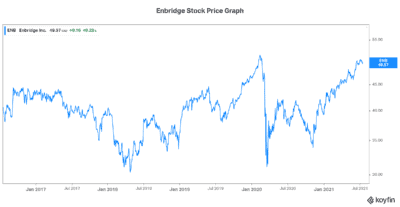

Enbridge stock: A healthy dividend yield with big upside

Enbridge is another Canadian energy stock that’s benefitting from booming oil and gas prices. But it’s an energy infrastructure company. This means that it’s got a little more predictability and stability on its side. These are very attractive qualities to be exposed to, especially this summer.

I mean, the next few months are very uncertain. For example, stock market valuations are high. Also, the risk of inflation is looming in the background. Finally, there’s a high probability that the economic comeback after the pandemic will disappoint.

So this defensive stock is a top Canadian stock to buy for many reasons. First of all, Enbridge is a reliable dividend payor. Today, its dividend yield is a very generous 6.76%.

And the company’s history of dividend growth is nothing short of impressive. In the last five years, Enbridge’s dividend has grown at a compound annual growth rate of 8.85%. Let me remind you, this was a period when the price of oil was extremely volatile. But Enbridge continued to chug along. The company was happily growing its cash flow and increasing its dividend.

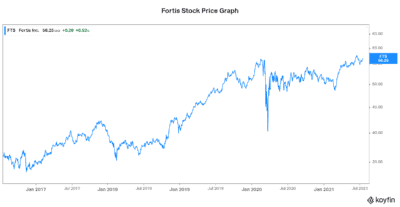

Fortis stock: The top defensive Canadian stock to buy

Lastly, Fortis (TSX:FTS)(NYSE:FTS) stock is the most defensive of all. Fortis is a leading North American regulated gas and electric utility company. It’s also a leading dividend stock that’s yielding 3.6%. In addition, Fortis has 47 years of dividend growth under its belt.

Fortis is certainly a Canadian stock that has stood the test of time. It’s made shareholders happy time and time again. Being in the utility business, we can see how its revenue and dividend payments would be steady, predictable, and resilient. I think Fortis is a great Canadian stock to buy in July for these reasons.

Motley Fool Canada: The bottom line

So the bottom line here is that for July, I’m recommending the more defensive names like Enbridge stock. While some of them are not cheap, they offer predictability and downside protection. I think this will be needed. So let’s use July to set ourselves up with these defensive Canadian stocks.