Do you have $1,000 to invest? While this is not a big amount of money, you could easily double it in less than two years by buying high-growth stocks like Spin Master (TSX:TOY) and Canada Goose Holdings (TSX:GOOS)(NYSE:GOOS). Let’s look at each of these two growth stocks in more detail.

Spin Master

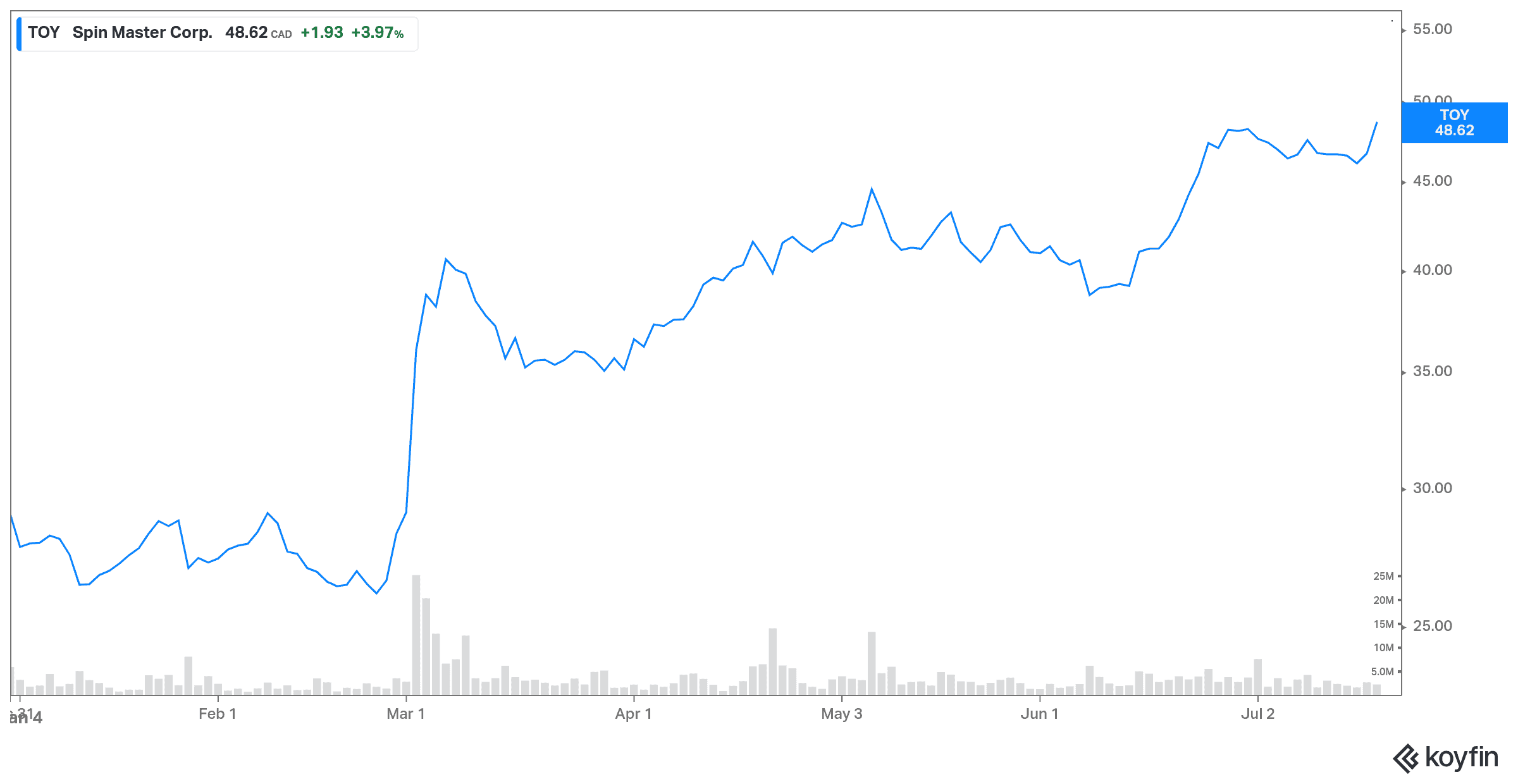

Spin Master is an innovative Toronto-based children’s toy manufacturer with a $5 billion market cap. The company also has a studio and internal partners with other studios to create compelling contents, stories, and toy characters. Spin Master stock price has increased by 75% since the start of 2021.

This toymaker has been among the beneficiaries of the pandemic.

In addition to physical toys, Spin Master has made a big move in the digital game segment. Indeed, it is the segment that has had the highest growth over the past year. Spin Master’s digital game segment saw a growth of 400% year over year due to the pandemic.

In the first quarter, Spin Master reported a 39% increase in revenue to US$317 million year over year — in part due to a huge 394% increase in its digital game segment revenue year over year. The company’s management is currently focused on increasing its international market sales by developing persistent global entertainment franchises and strategic acquisitions.

Due to its strong first-quarter performance, the company’s management has raised its outlook for fiscal 2021. Revenues are expected to increase by 13.3% to $1.78 billion for the current fiscal year, while earnings per share are estimated to grow by 186.3% to $1.46.

Spin Master’s track record bodes well for investors betting the company’s management team to continue to innovate towards future growth.

Canada Goose

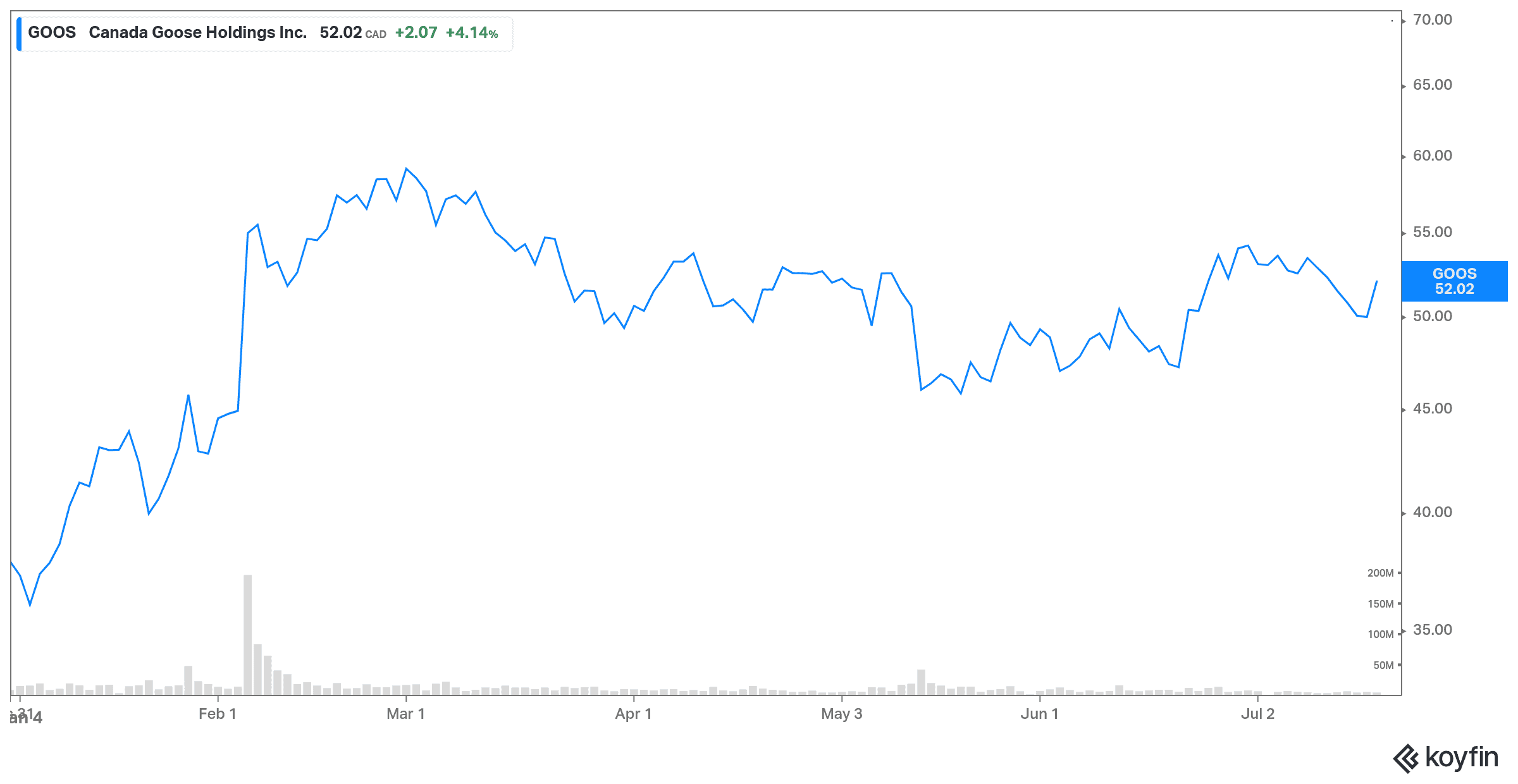

Canada Goose is a Toronto-based designer, manufacturer, and seller of luxury clothes. The growth stock has gained approximately 40% since the beginning of the year.

In the fourth quarter of 2021, total revenues increased by 33% to $208 million from the prior-year quarter. In addition, wholesale revenues came in at $33.3 million, compared with $25 million in the fourth quarter of fiscal 2020. Net profit was reported at $2.9 million, or $0.03 per diluted share, compared with $2.5 million, or $0.02 per diluted share, a year ago.

President and CEO Dani Reiss said that Canada Goose has shifted from recovery to growth beyond pre-pandemic levels, with the company achieving its largest ever fourth quarter by revenue.

Canada Goose is on track for strong profits growth in the coming years. Indeed, the company has established a strong brand in luxury winter clothing. The upcoming Olympic Games in China are a privileged opportunity to strengthen the brand. Chinese consumers account for about one-third of global luxury demand. This means that the points of sale in China are essential to the growth of Canada Goose. In 2021, the company plans to double the number of stores it operates in the country.

Canada Goose is also adding new lighter coats to its collection. These products should be more attractive in areas that have milder winters.

Revenues are expected to increase by 22.6% to $1.11 billion for the current fiscal year, while earnings per share are estimated to grow by 55.8% to $1.20.

This growth stock is always worth to possess long term for its durable competitive advantages.

2-for1 Sale

2-for1 Sale