Canadian copper, steelmaking coal, and zinc miner Teck Resources (TSX:TECK.B)(NYSE:TECK) released its second-quarter (Q2 2021) earnings results on Tuesday. The $14 billion company’s latest financial results cover the three-month period to June 30, 2021. Company CEO Don Lindsay described the results as a “solid performance.” However, Teck Resources’ stock price dropped by 3.3% in pre-market trading in New York. Are shares still a buy post-Tuesday’s earnings?

Teck Resources misses analyst projections, is the stock a buy?

Teck Resources reported a 49% year-over-year increase in second-quarter revenue to $2.56 billion. This was a good performance but it missed analyst projections for $2.685 billion sales for the quarter.

Quarterly GAAP earnings per share (EPS) of 48 cents were far below market expectations of 66 cents per diluted share. However, normalized diluted EPS at 63 cents were not very far off from a 67 cents projection by analysts closely following the company’s business.

As highlighted in a recent article, analyst estimates have been off the mark on Teck Resources’s quarterly performance for the seventh quarter in a roll. Investors may not want to let earnings misses distort the amazing performance that this commodity producer has managed to pull off so far in 2021.

Although analyst expectations were too bullish, the business did well to grow quarterly adjusted EBITDA by 104% year over year to $989 million. The company is significantly profitable now.

What’s driving the company’s earnings improvements in 2021?

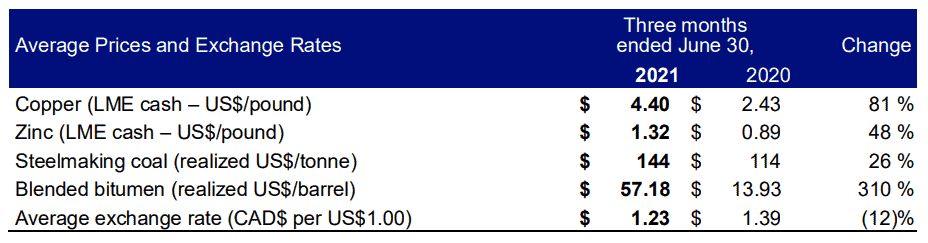

Higher demand for steelmaking coal, copper, and zinc, higher realized market prices across all business segments, and the achievement of higher production plan targets have resulted in improved earnings results for the mining giant.

Strong commodity prices and higher productivity combine to boost the company’s revenues and earnings profile this year. Steelmaking coal sales volumes in the second quarter were 24% higher than the same period last year, while copper sales volumes increased by 21% higher than the same period last year.

Bitumen is also in a strong show this year. However, a 36% reduction in sales volumes of zinc and a stronger Canadian dollar offset some of the gains.

Should you buy Teck.B stock after the recent quarterly earnings results?

TECK.B stock price has traded up by 82% in the past 12 months despite missing analyst estimates during the entire time. Shares continue to be volatile, but the stock has managed to pull off an 18% gain since January this year.

Given improved productivity post the Elkview Plant Expansions, the Neptune bulk terminal upgrades, and recent improvements in zinc concentrate production, there is more upside to the company’s stock price if the company continues to execute so well, more so if the commodities markets continue to support increased prices seen so far in 2021.

Most noteworthy, the company increased its 2021 annual zinc in concentrate production guidance on Tuesday. Management reported that steelmaking coal price assessments in Australia and China increased sharply in the latter half of the second quarter, “…the impact of which will be reflected in (the company’s) Q3 financial performance.”

The company’s copper-focused growth strategy is already underway, with construction at the Chile copper project expected to be 60% complete by early August. If the first production in Chile rolls out in 2022 as planned, investors may love the business more as it participates in supplying copper into an already thriving electric vehicle (EV) global market.

Now that the company’s liquidity remains good at $6.1 billion, and given a much better business cash flow outlook for the next year, shares could outperform over the next 12 months.

Foolish bottom line

Even though there is inflation pressure in the price of production inputs like tires, mining equipment, fuel, and explosives due to commodity price increases, the company should still do well during the second half of 2021.

Shares still look cheap at a forward price to earnings ratio of 8.3 right now. The average analyst price target of $34.66 gives shares a potential 27% gain over the next 12 months.