Canada’s leading cargo carrier Cargojet (TSX:CJT) is expected to release its second-quarter earnings results prior to the market opening on Tuesday, August 3. The company was one of the best airline growth stocks to buy and hold at the onset of the COVID-19 pandemic. Its share price rose 108% in 2020, while the business enjoyed a sudden influx of new customer orders. But things change, and Cargojet stock is down 10% so far this year.

A near-complete absence of passenger planes from the skies in 2020 took away significant luggage-carrying capacity. Coupled with a surge in e-commerce demand last year, the company had to turn some customers away due to overbooked capacity. Investors look to the company’s upcoming earnings for clues to whether the business managed to retain some of its shine during the worst part of the pandemic.

What to look forward to in Cargojet’s Q2 earnings report

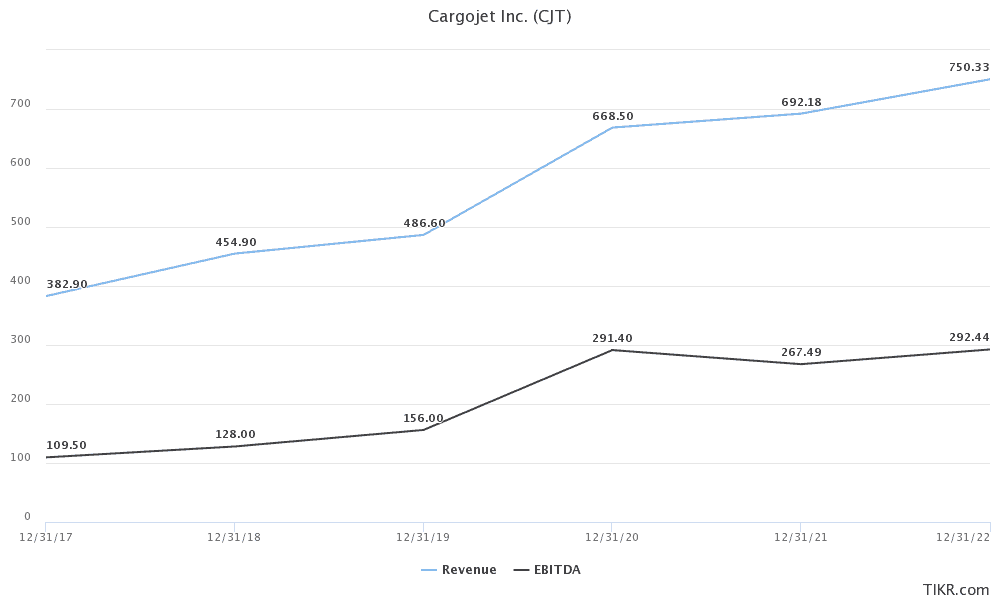

The company has reported encouraging revenue, earnings, and cash flow growth rates lately. Annual revenue grew 37% in 2020 to $668 million, and quarterly sales were up 30% to $160 million during the first quarter of this year.

However, analysts project second-quarter revenue to decline 17% year over year to about $163 million. They project second-quarter GAAP earnings per share (EPS) of $0.97, which is significantly better than an EPS loss of $2.89 during the same period last year.

That said, the revenue comparison somehow looks unfair. It’s being made against the company’s record quarterly sales of $196 million made during strict lockdowns last year. Considering that Cargojet recorded “just” $119 million revenue and an EPS of $0.32 during the second quarter of 2019 (a fair pre-pandemic level comparable quarter) the business has grown substantially. And the company is now profitable and carries much less debt on the balance sheet.

Although the market expects lower revenue in Tuesday’s report, the sales and earnings before interest, taxes, depreciation, and amortization (EBITDA) outlook for this year and for 2022 are quite bullish. Shares may rally again if such results are delivered over the next 18 months.

Let’s see if the cargo airliner will surprise the market on Tuesday.

Two critical factors that may affect CJT’s revenue

As noted earlier, the grounding of passenger planes created opportunities for higher business volumes for cargo airlines. Concerns have risen after the Government of Canada and a struggling Air Canada signed a financing support deal in April. The bailout included the resumption of passenger plane services to all suspended regional destinations.

Increased route coverage by Air Canada-linked passenger planes could take away some of the cargo airliner’s marginal volumes.

That said, a general increase in e-commerce shipments across Canada continues to support higher revenue run rates. This trend is supported by the company’s increased market clout in Canada after an extended freight deal with a huge international e-commerce retailer. Moreover, investors in Cargojet stock know that the company controls over 90% market share in the cargo space locally. Competitors have a hard time stealing the giant’s clientele.

Foolish bottom line

It’s possible that CJT stock may tumble after earnings if the company misses on earnings or provides a lukewarm outlook. This happened earlier in March 2021. Investors may better take any dips as buying opportunities. The company is capable of retaining its market-dominant position in Canada. It could even grow internationally with its e-commerce clients. Its stock looks more attractive after debt repayments during the most recent great quarters.

An analyst target price of $246 represents a potential 26% increase in CJT stock over the next 12 months. A market-beating earnings report could lift share valuation towards this target on Tuesday.